Helps attract and retain employees

Retirement benefits are a valuable benefit to gain and keep talented employees, showing that you support their financial goals and future financial wellness.

A state-sponsored retirement program for employees without a workplace plan.

Retirement benefits are a valuable benefit to gain and keep talented employees, showing that you support their financial goals and future financial wellness.

These programs are designed to let you focus on your business with minimal ongoing responsibilities and a low time investment.

The employer portal allows easy integrations with many popular payroll providers for automatic, on-time payroll contribution submissions.

Government-sponsored retirement plans cost nothing for employers to participate while helping them stay competitive in the job market.

Experienced service providers select and oversee the program's investments so you don’t have to.

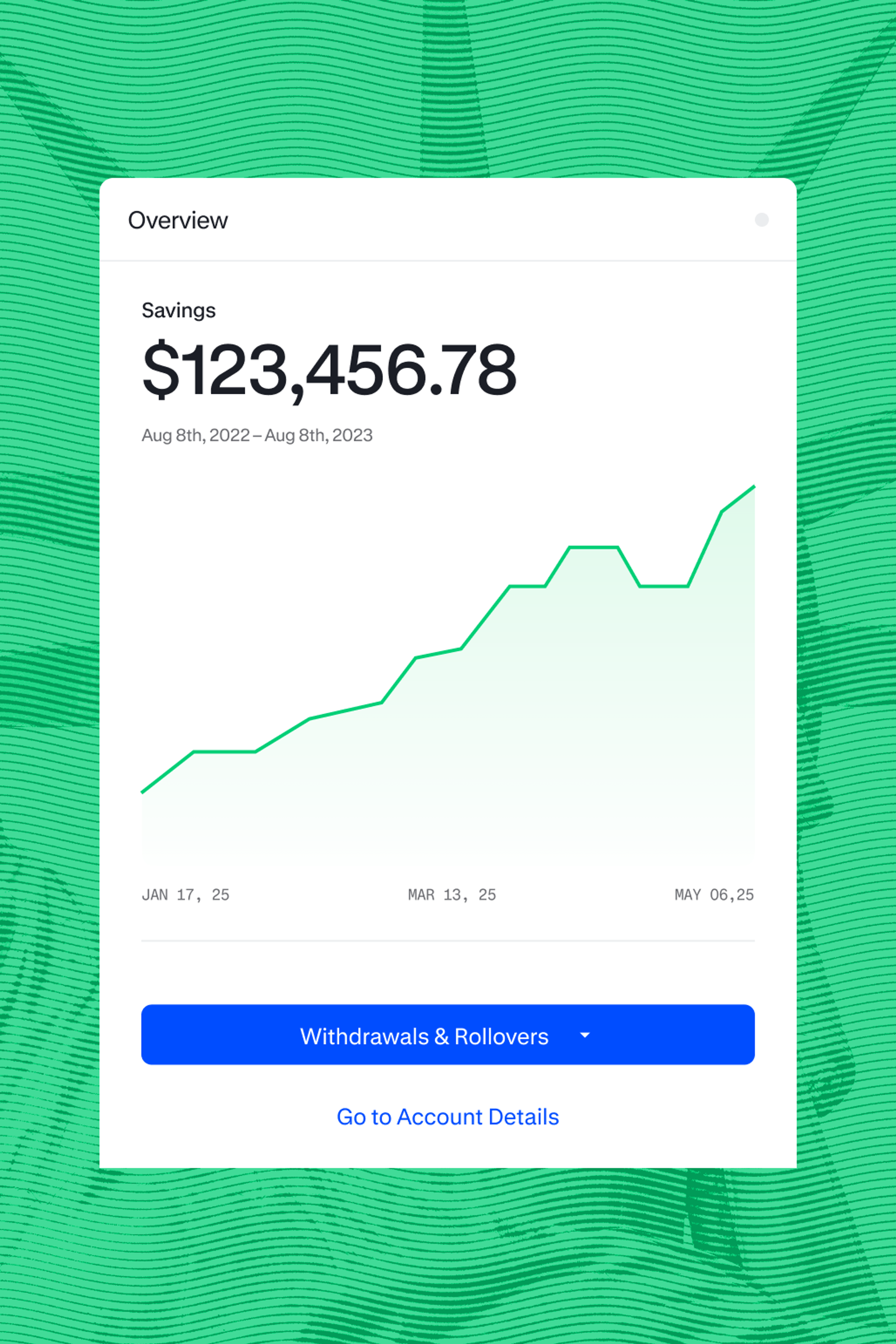

Employees can manage their account and savings on the go with the Vestwell mobile app. They can set contributions, adjust account details, and track progress anytime, anywhere.

Download on the App Store

Government-facilitated retirement savings programs require employers to participate in the program if they have a certain number of employees, have been in business for a specific amount of time, and do not currently offer a qualified retirement plan. These eligibility requirements vary by state. Use our helpful online resource to determine your state’s mandates.

“OregonSaves is I think a very positive addition to my business and to any small business because now we are actually able to offer something we were not previously able to do. Now, I’m able to compete on a level playing field.”

Employers that offer a qualified retirement plan are not required to participate in the program, but they need to certify their exemption if required by the State. Simply start the process by providing your EIN and your Access Code. Then, in the space provided, certify that you offer a plan.

Employers may also offer government-sponsored savings programs in addition to traditional retirement plans.

To register, you just need your EIN and the Access Code we provide to you via email or letter. After that, you’ll provide your preferred contact information, a list of your employees, and your payroll information. And 30 days later, you’ll need to update your participating employees’ contribution rates within your payroll. From that point on, you’ll just need to keep your employees’ payroll contributions and staff list up to date.

You should not provide any advice about the program or investments. Your responsibility is to facilitate the program only. Instead, advise the employee to visit the program’s website. You could also suggest that the employee speak to a competent financial or tax advisor.

Your employees will receive information directly from the Vermont Saves program and can choose to stay automatically enrolled in Vermont Saves or opt out; they have 30 days to decide after you add them to the program. If they stay enrolled, the payroll deductions that they elect and that you set up for them in your employer portal will start as soon as your next payroll. If they choose to opt out, they will be removed automatically from the program and can always rejoin later.

There are no employer fees. Also, employers are neither required, nor permitted, to match employee contributions to the program.