Neurodiverse Individuals

Empowering individuals to save without affecting essential benefits.

ABLE (Achieving a Better Life Experience) accounts are tax-advantaged savings plans that help people with disabilities save for the future. With Vestwell, it's simple to open, manage, and grow your account—without impacting SSI, Medicaid, or other important benefits.

Answer a few simple questions to see if you qualify for an ABLE account under the updated 2026 criteria.

Getting started is simple. Find your state's ABLE program and open your account today. We'll help you every step of the way.

Empowering individuals to save without affecting essential benefits.

Tools to help families save for care, education, and everyday expenses.

Support for veterans managing service-connected (or other) disabilities and savings for the future.

Custom support for organizations that serve as a financial guardian, conservator, or Representative Payee.

Vestwell is trusted by over 100,000+ people and families nationwide. As one of the top ABLE providers, we know what matters most to savers like you. Our platform helps you take control of your savings with a simple, secure experience built for real life.

Your ABLE investments grow tax free. That's extra money in your pocket. And if you receive public assistance, ABLE lets you save without putting Medicaid or other benefits at risk.

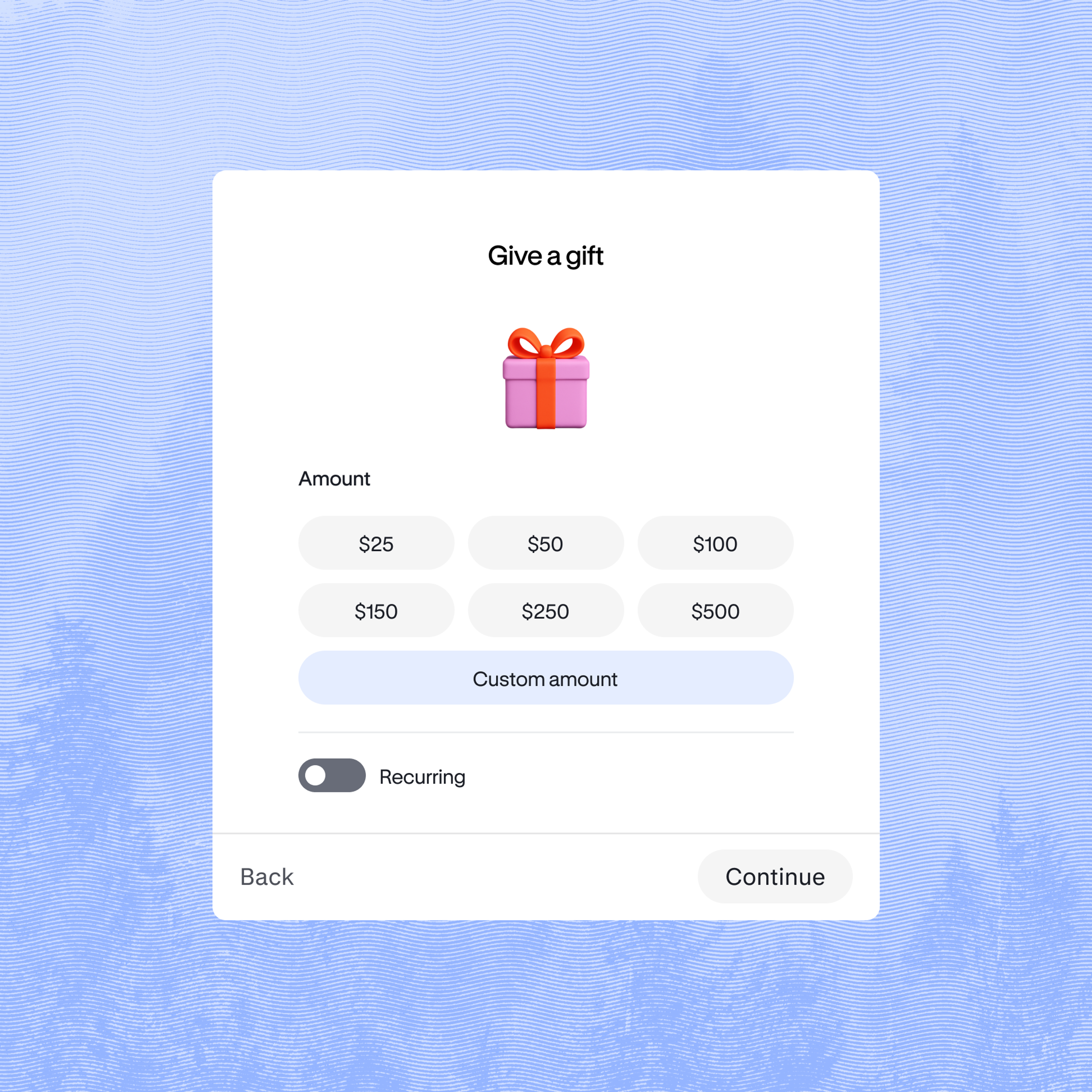

Fund your account with direct deposit, personal contributions, or gifts from friends and family.

Use your savings whenever it matters most—for housing, healthcare, education, retirement, emergencies, and more.

With an ABLE account, you don't have to choose between saving for tomorrow and protecting the support you rely on today. Vestwell makes it simple to manage your account with modern tools, helpful resources, and accessible features so you can focus on what matters most.

ABLE accounts offer people with disabilities a way to invest tax-free for the future, spend on everyday expenses, and still keep the public benefits they rely on every day. A few key benefits of an ABLE account include:

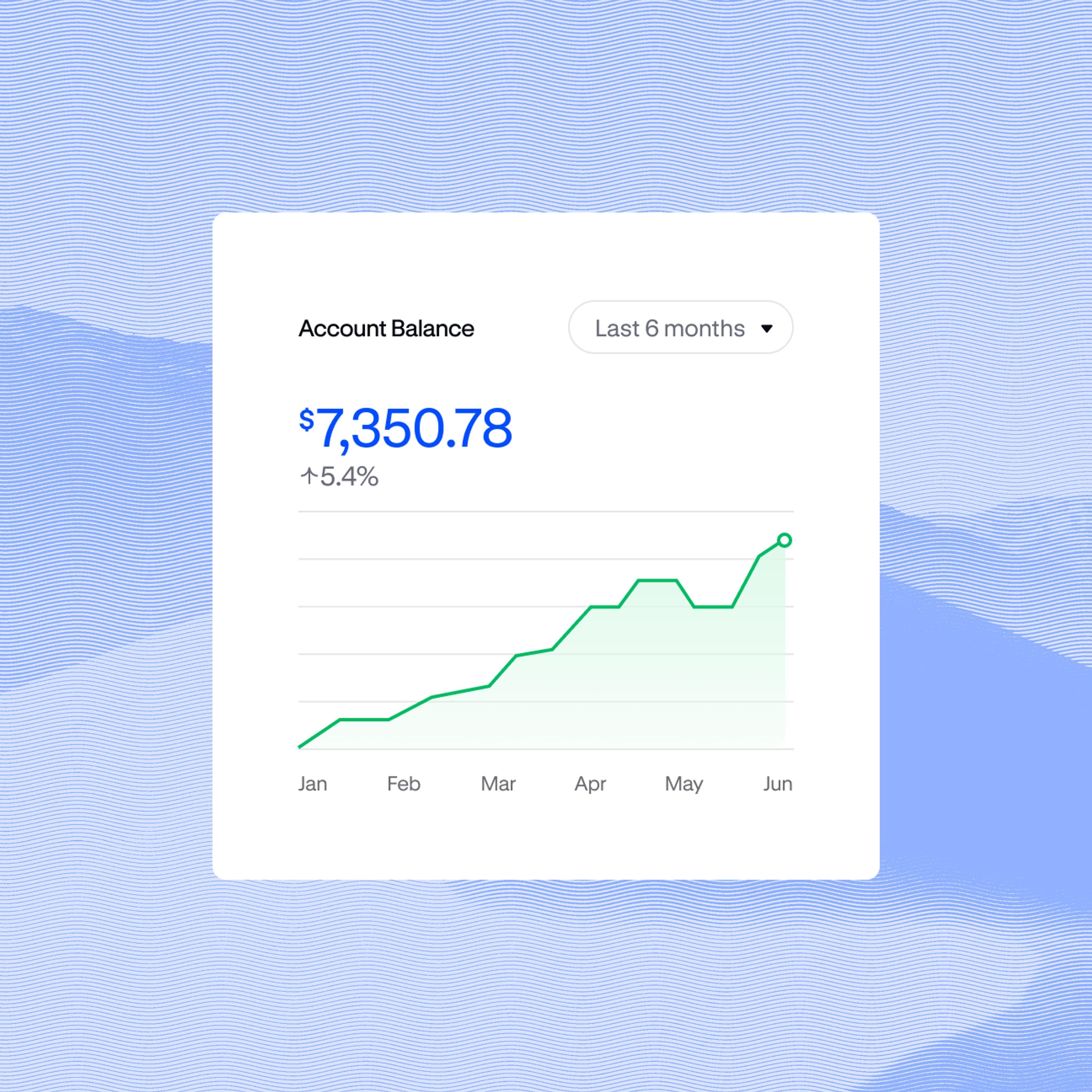

When you make contributions to an ABLE account, you can choose to put your money in savings options or in investment portfolios. Your contributions then have the chance to grow tax-free. And unlike many other investment options, when you withdraw your savings to use for qualified expenses, those withdrawals are tax-free, too.

Finally, managing the account is a snap with access to Vestwell's simple and intuitive online platform.

Millions of people with disabilities rely on public benefits and federal programs such as Supplemental Security Income (SSI) and Medicaid for their basic needs, but this assistance can be limiting. Those receiving much needed benefits, like SSI, are restricted to having only around $2,000 in assets, essentially forcing them to live in poverty. The Stephen Beck, Jr. Achieving a Better Life Experience Act, known as the ABLE Act, was passed by Congress in 2014 and allows states to create tax-advantaged savings programs for people with disabilities. After the ABLE Act was passed, people with eligible disabilities could finally save for their everyday needs, invest in a tax-free account, and prepare for the future without losing critical public benefits.

No. When saving with an ABLE account, you can keep your federal benefits (SSI, SSDI, Medicaid, SNAP, TANF, HUD Assistance, Section 8, etc.). If you receive SSI, you can save up to $100,000 before ABLE funds start counting against your benefits asset limits. If you choose to go over the $100,000 limit, your SSI benefits will be suspended, but you’ll still be eligible for all other federal benefits (such as Medicaid). Once your balance drops below the limit, your SSI benefits will resume as normal.

People with disabilities can save and invest at least $19,000 a year for a wide range of eligible expenses. Those who are employed can save even more. Workers with disabilities who do not already participate in a workplace retirement plan can save up to an additional $15,060 a year (or more in some states), depending on their annual income.

No. If the money in your ABLE account is used to pay for qualified expenses, it won’t be counted as income for your state or federal taxes. That means your investments grow tax-free, putting extra money in your pocket.

Most expenses related to the costs associated with living with a disability qualify as an eligible expense. The expense must help maintain or improve the health, independence, or quality of life of the person living with a disability. Some of the most common qualified expenses as defined by the IRS include: