Learning Center

A complimentary, integrated library of financial wellness resources and interactive learning modules on foundational topics, from budgeting to saving for a home to planning for milestones.

Help employees handle today’s surprises and build tomorrow’s security by adding Vestwell’s emergency savings account (ESA) to your benefits package.

Competitive interest rates¹, flexible employer contribution options, and penalty-free access to ESA funds equip you to offer a powerful financial wellness benefit for your workforce.

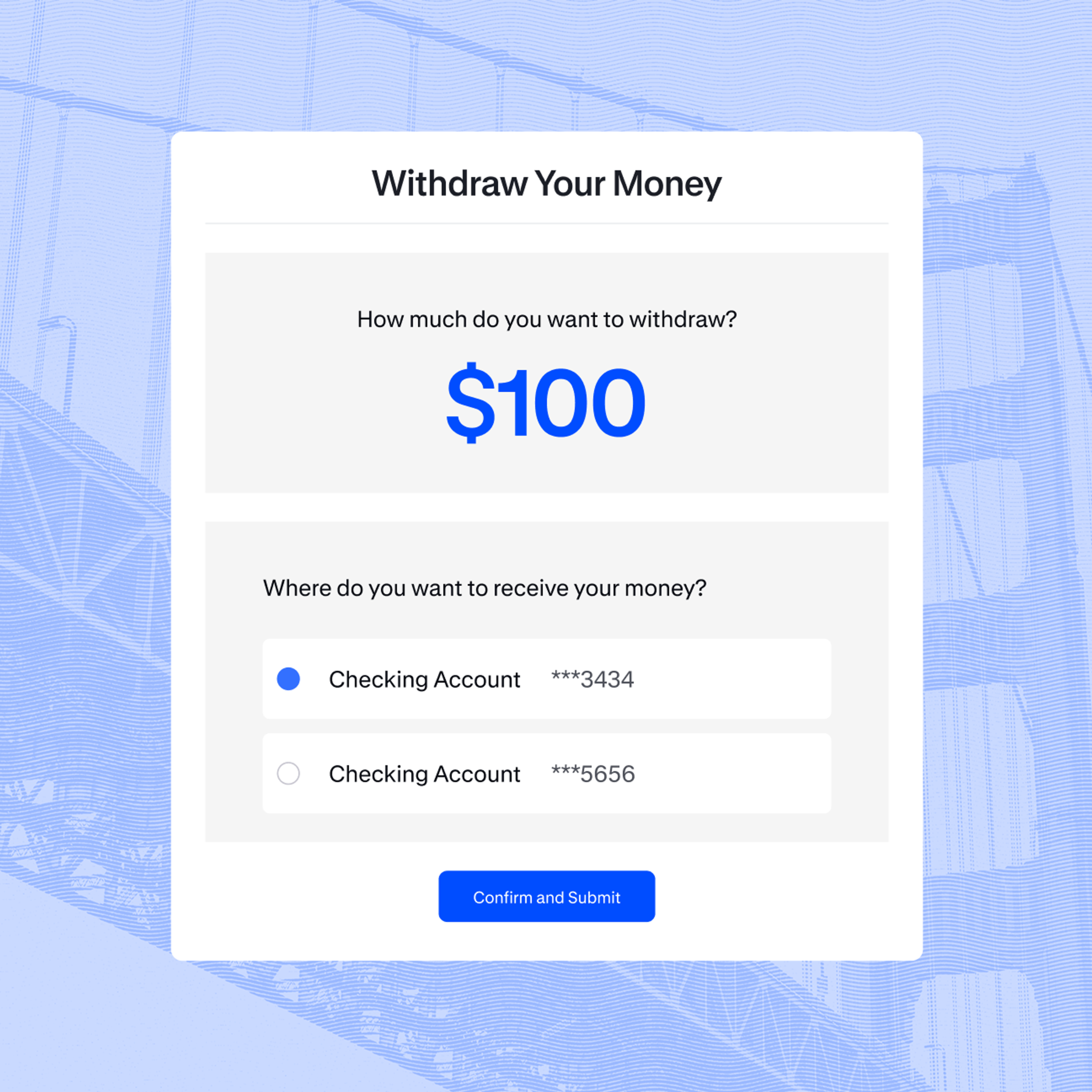

Employees get as fast as next-day access to funds without dipping into long-term savings or costly debt. They can save seamlessly—either automatically via their paycheck or via a linked bank account—and with the Vestwell mobile app and multilingual support, their savings are always within reach whenever they need.

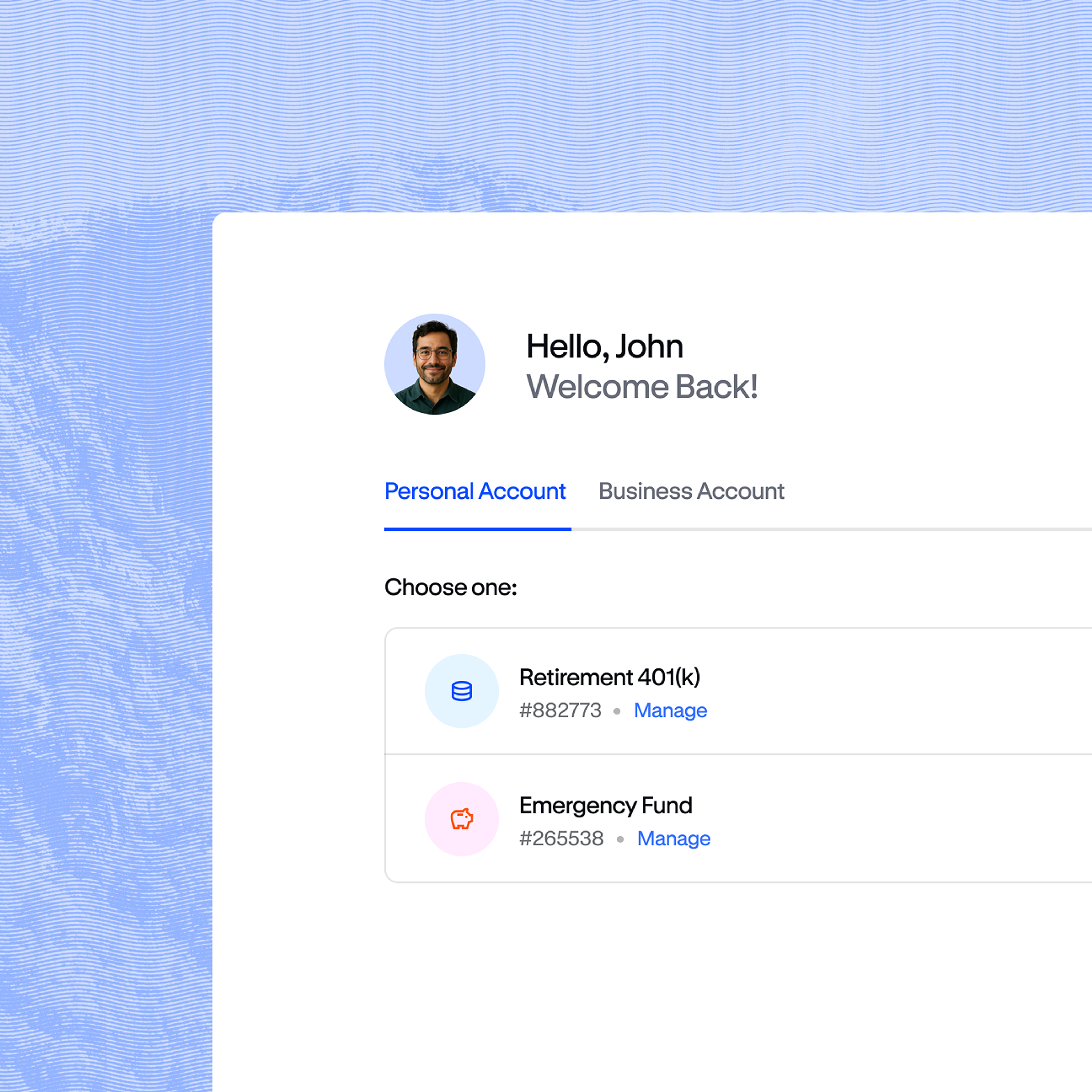

Vestwell’s platform is built to manage an ESA alongside retirement, education, and other Vestwell benefits—in one place, on one unified portal. Help employees save for every stage of their financial journey.

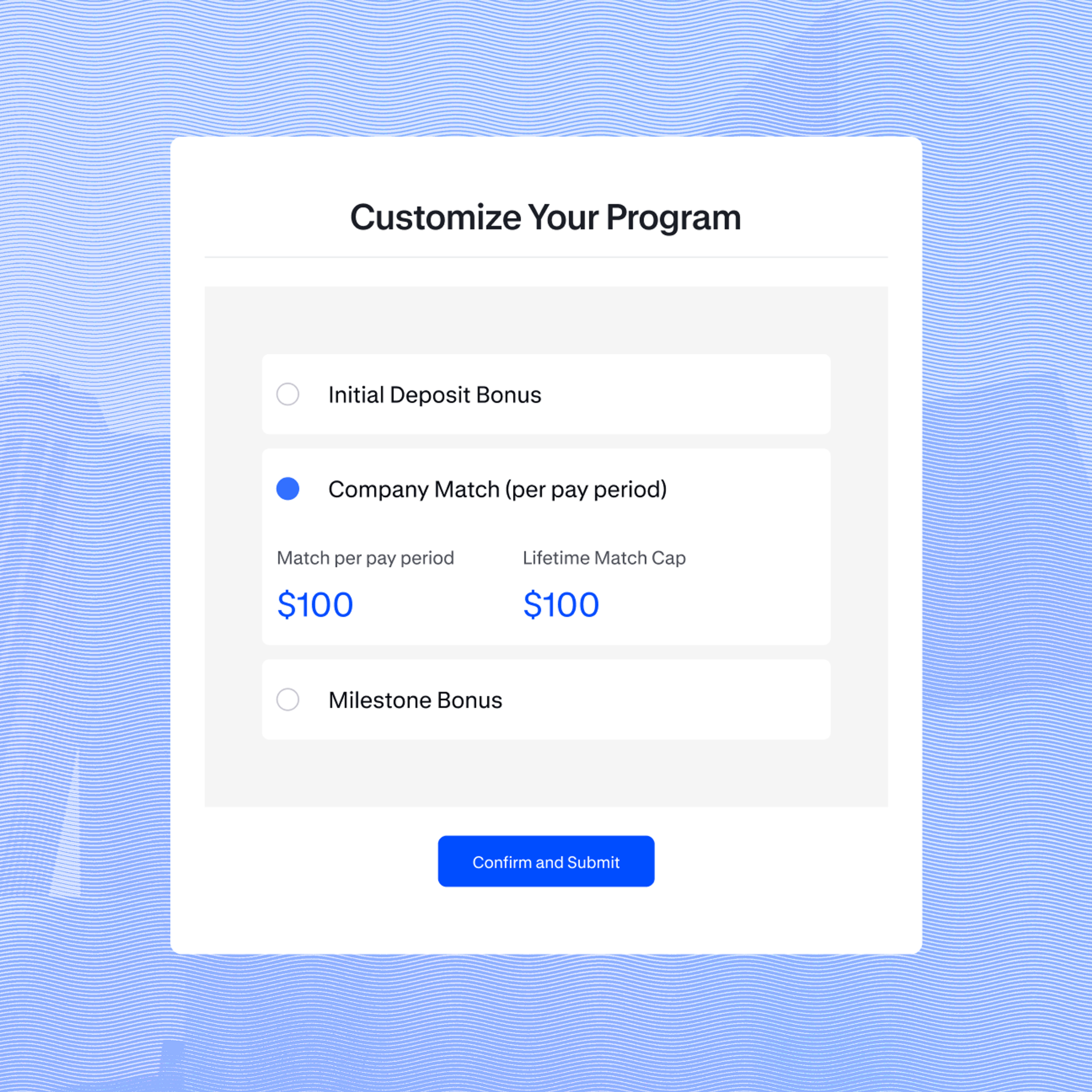

You can enhance your ESA program with optional incentives like sign-up bonuses, matching contributions, or milestone rewards. Tailor the ESA to your business needs and budget, and give your employees an extra savings boost—even a small amount can have a big impact.

A complimentary, integrated library of financial wellness resources and interactive learning modules on foundational topics, from budgeting to saving for a home to planning for milestones.

Employees can manage their account and savings on the go with the Vestwell mobile app. They can set contributions, adjust account details, and track progress anytime, anywhere.

Download on the App Store

Recruit, retain, and reward top talent in a competitive job market with a unique benefit to tackle employees’ most pressing financial needs. As financial stress continues to rise, an emergency savings benefit builds financial security and gives back to your business by promoting a more engaged, productive, and loyal workforce.

Set employees up for short-term financial needs today and long-term financial security tomorrow—while giving your business a powerful edge in today’s competitive market.

No. Employer contributions and incentives are optional, and you can decide what structure works best for your business. A dedicated onboarding manager is available to guide you through setup if you choose to offer contributions.

There are multiple ways employees can save into their ESA accounts, depending on your ESA program details. This includes via recurring or one-time deposit from an employee's bank account or via deductions from their paycheck. Paycheck deductions and any employer contributions are submitted to Vestwell via payroll file upload or entered directly within your employer portal. Our service team is available to guide you through the submission process if needed.

Yes. If you already use Vestwell for a retirement plan or other benefit, your ESA program will live within the same platform.

We send employee welcome emails, have an employee help center available, can provide you with onboarding materials, and offer in-portal guidance to help employees understand and use their ESA program.

Yes. You’ll be able to view engagement and participation metrics and contribution data through your employer portal.

The interest rate on Vestwell's ESA fluctuates. The exact rate will always be available in the ESA account portal, but it is generally higher than interest rates at traditional financial institutions.