Public Service Student Loan Forgiveness

Centralized resources and tools to navigate federal student loan forgiveness options, confirm eligibility, and track payment progress for employees in public service roles.

Learn more

Support employee growth, attract top talent, and unlock tax advantages with a customizable tuition reimbursement program—built to work for your business.

From helping employees prepare for future education expenses with 529 benefits, to paying back current continuing education costs with tuition reimbursement, you can offer a comprehensive education benefits suite on one platform—developing top talent, enhancing employee engagement, and increasing business productivity.

62% of employees would be likely to change jobs if recruited by an employer offering better tuition benefits.¹ Stand out with a benefit that shows long-term investment in your workforce.

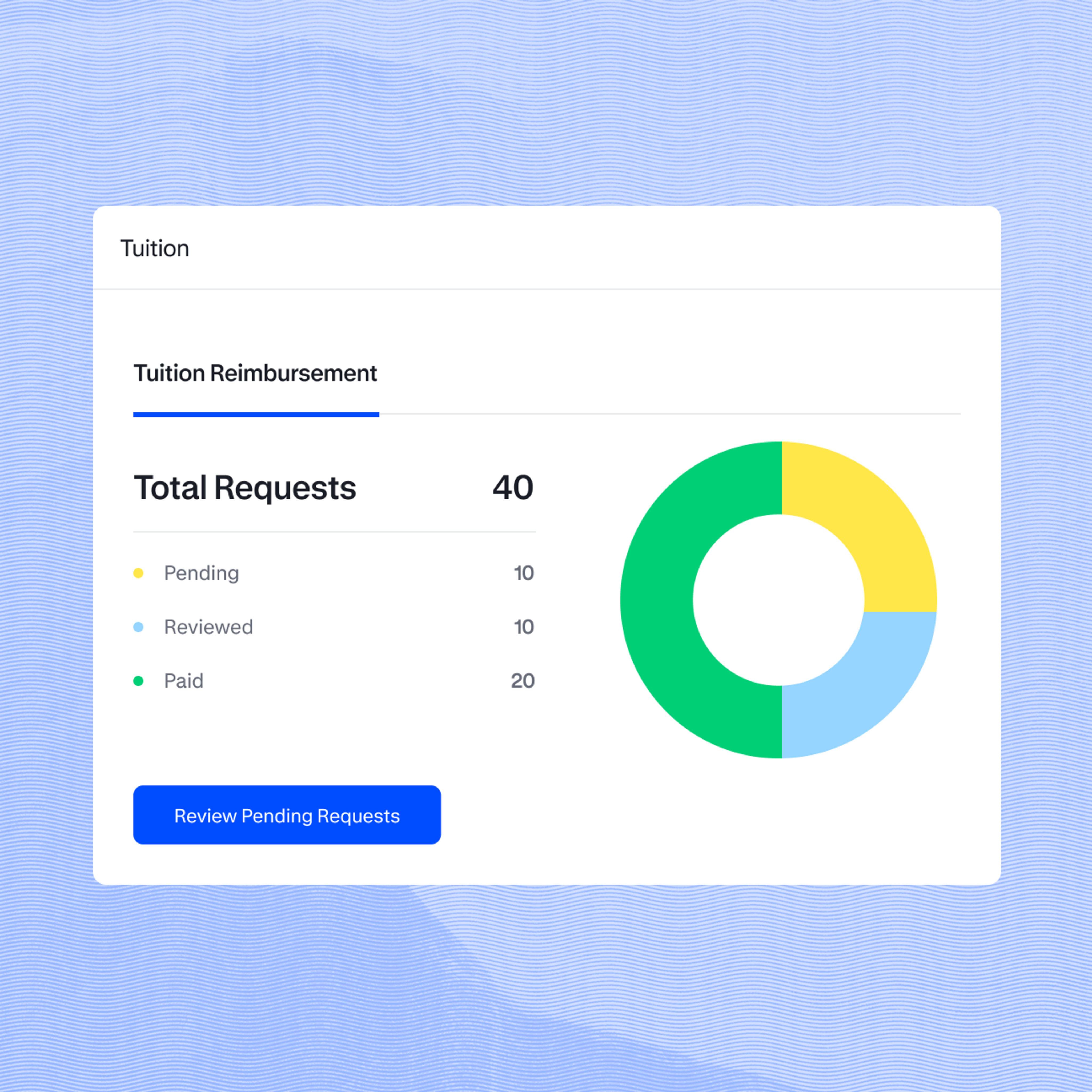

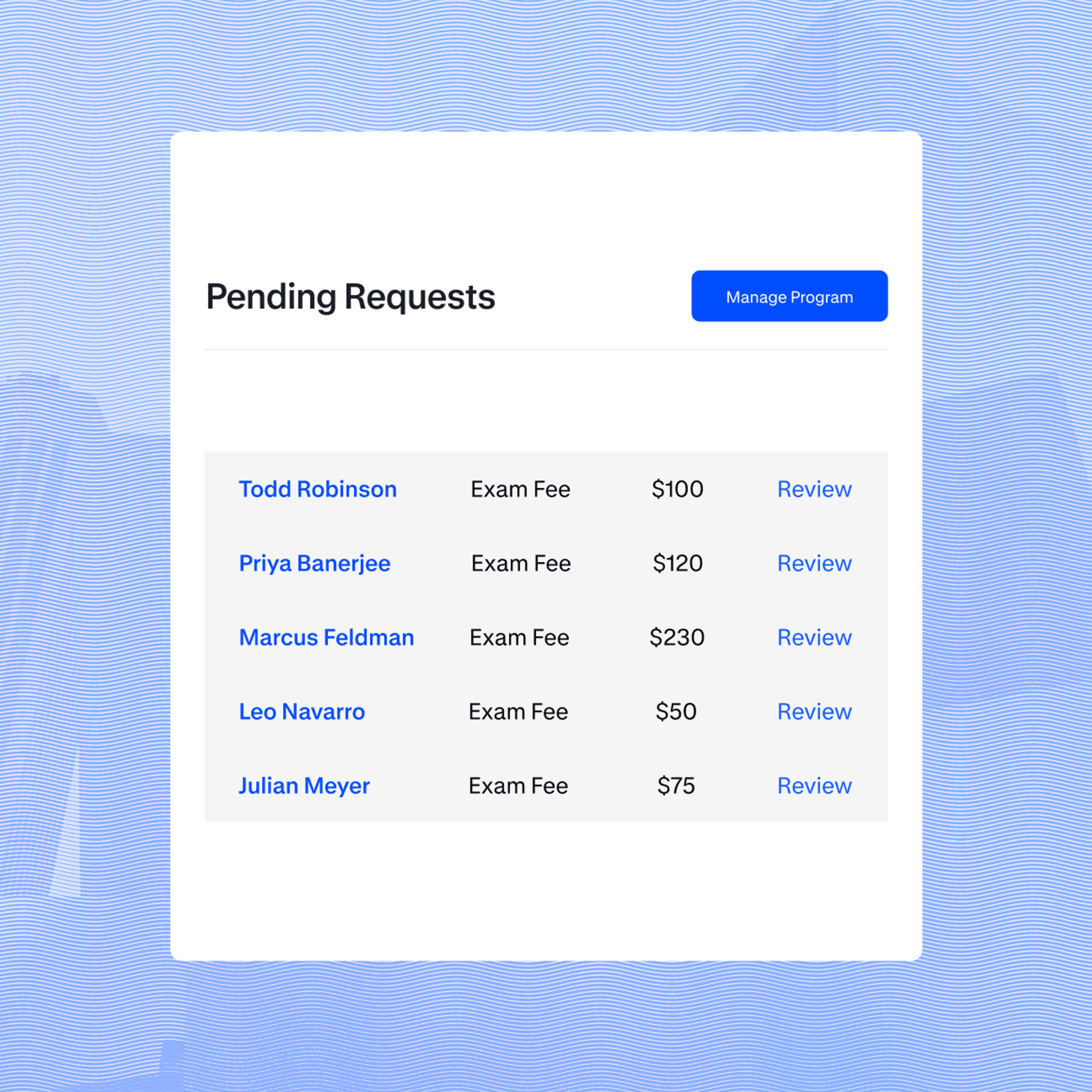

Streamline previously manual processes, like reimbursement review and approval, freeing up time to focus on the priorities that drive your business forward.

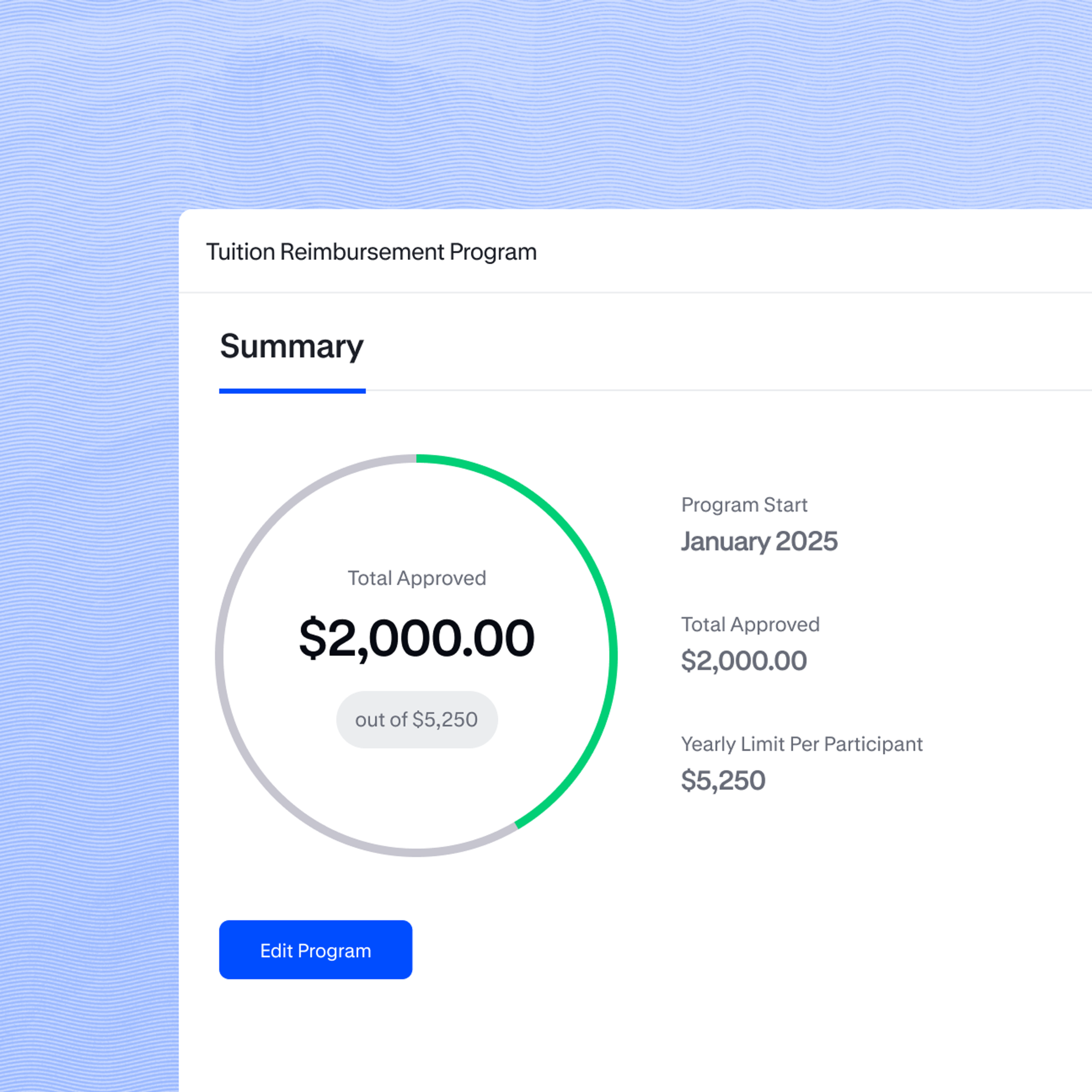

Deduct up to $5,250/employee/year, with future increases for inflation, as tax-free across education benefits, supporting employee growth while strengthening your bottom line.

Centralized resources and tools to navigate federal student loan forgiveness options, confirm eligibility, and track payment progress for employees in public service roles.

Learn moreA complimentary, integrated library of financial wellness resources and interactive learning modules on foundational topics, from budgeting to saving for a home to planning for milestones.

Customize eligibility criteria, covered expenses, documentation rules, and other details. A configurable platform makes it easy to design your tuition benefits to best fit your priorities—and access comprehensive tracking tools and reports to stay on top of program status.

Elevate your education benefits package with a flexible, streamlined, and powerful benefit that shows your team you’re invested in their future—and your own.

Yes. You can define employee eligibility, covered expense categories, required documentation, annual reimbursement limits, and other program details.

Vestwell offers an intuitive portal to upload all documents required by your company, track approvals, and view their reimbursement history.

Yes. Tuition reimbursement is available on one unified portal alongside 529 account contributions, student loan repayment, student loan retirement plan matching, and other savings benefits.

Across eligible education expenses, including tuition reimbursement, you can deduct up to $5,250 per employee per year as tax-free. This $5,250 amount increases with inflation.