Technology

Discover how our proprietary technology streamlines every part of the savings experience.

Get in touch

Some legacy providers use outdated systems. Our platform runs on our proprietary, intuitive technology stack—backed by dedicated support.

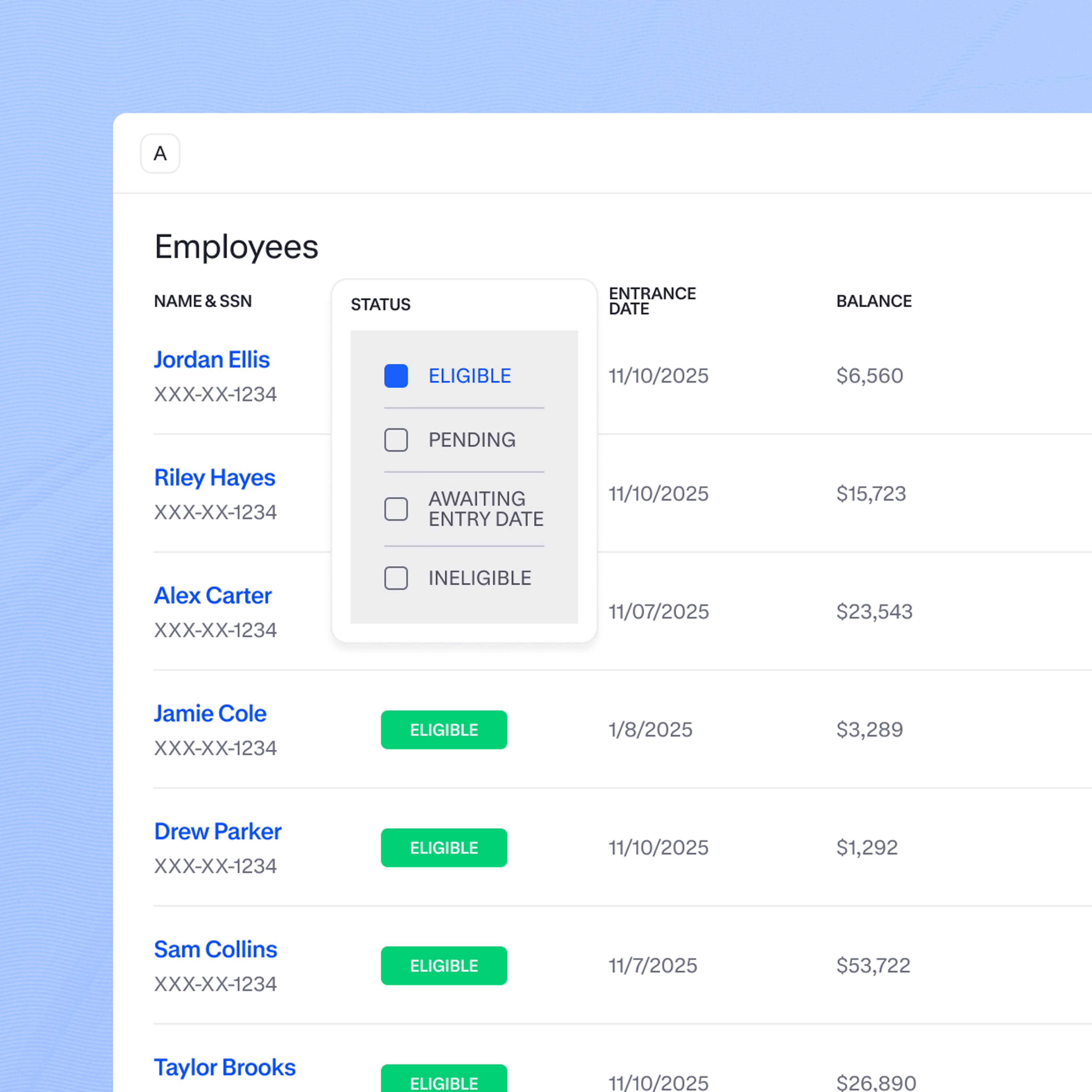

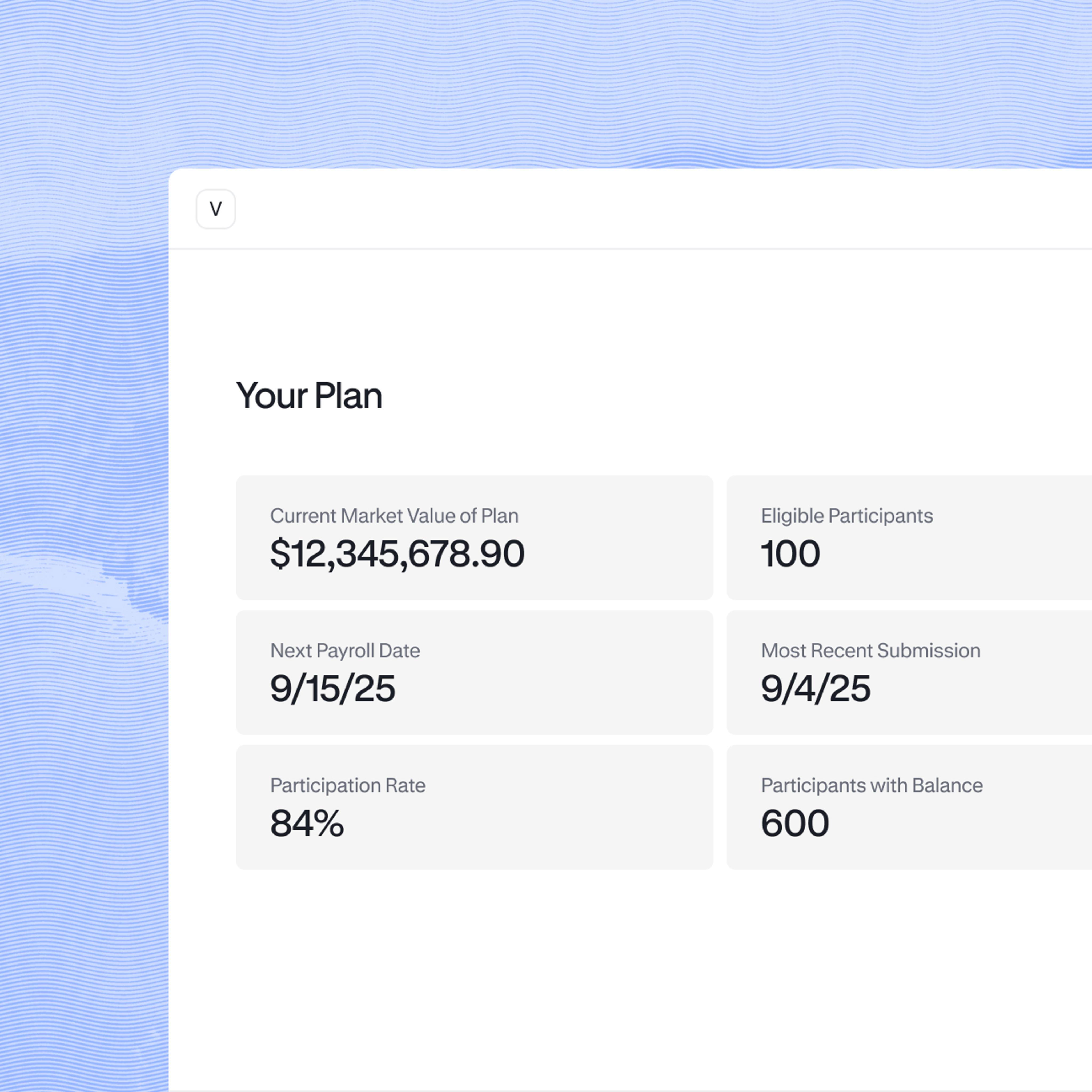

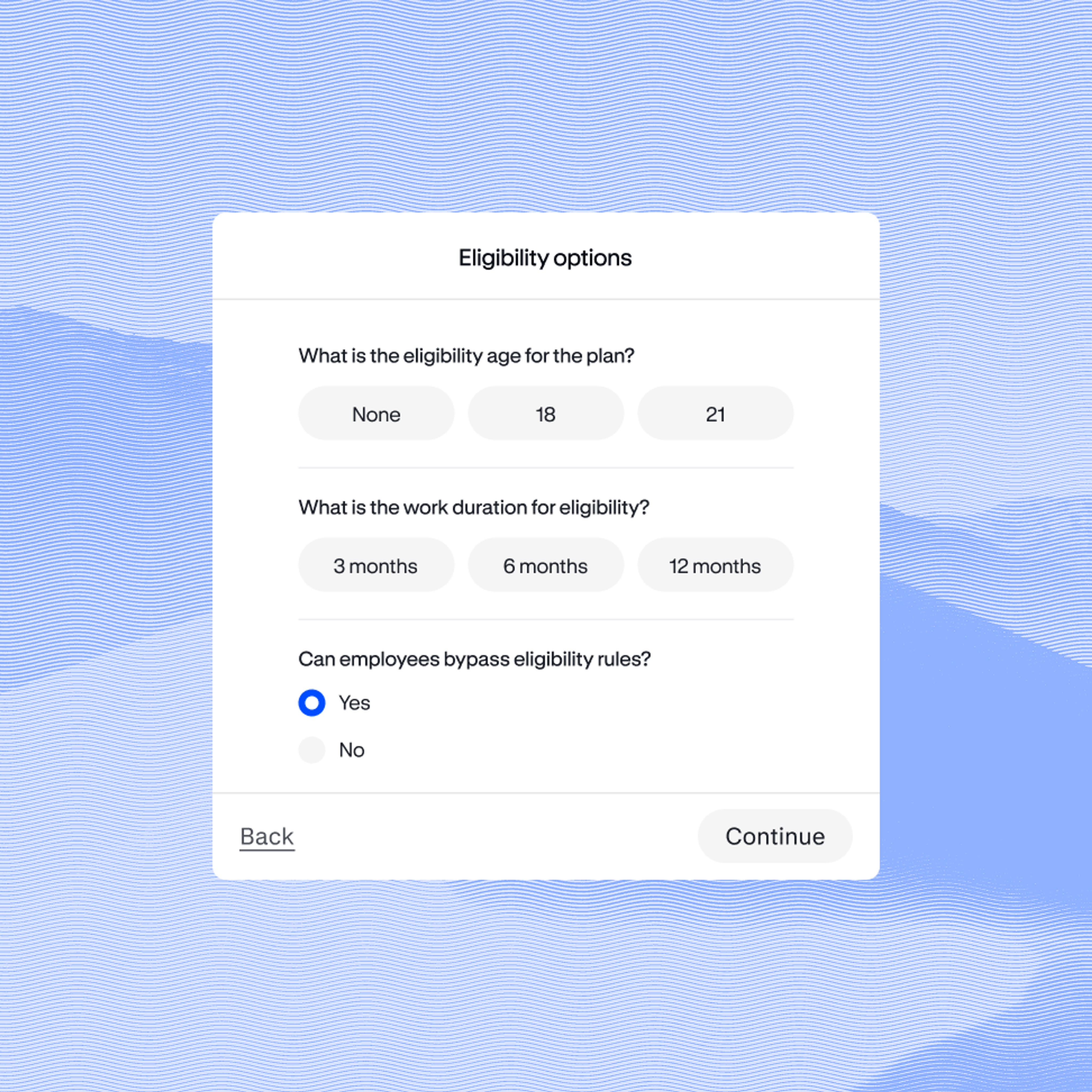

An intuitive portal makes it simple to get started and manage your benefits programs. Self-service and streamlined digital onboarding lets you get started in minutes without paperwork alongside 1:1 onboarding support. Real-time dashboards keep track of program health, compliance tools keep plans up to date, and API-based payroll integrations keep data connected between systems.

As your business needs change, our dynamic, cloud-based platform is designed to evolve alongside your company. Our flexible solutions were built to support your long-term growth.

A modern, configurable platform lets you custom-build your offering to best fit your workforce’s needs—from specific tuition reimbursement expense requirements to part-time employee eligibility for retirement plans to incentives for emergency savings.

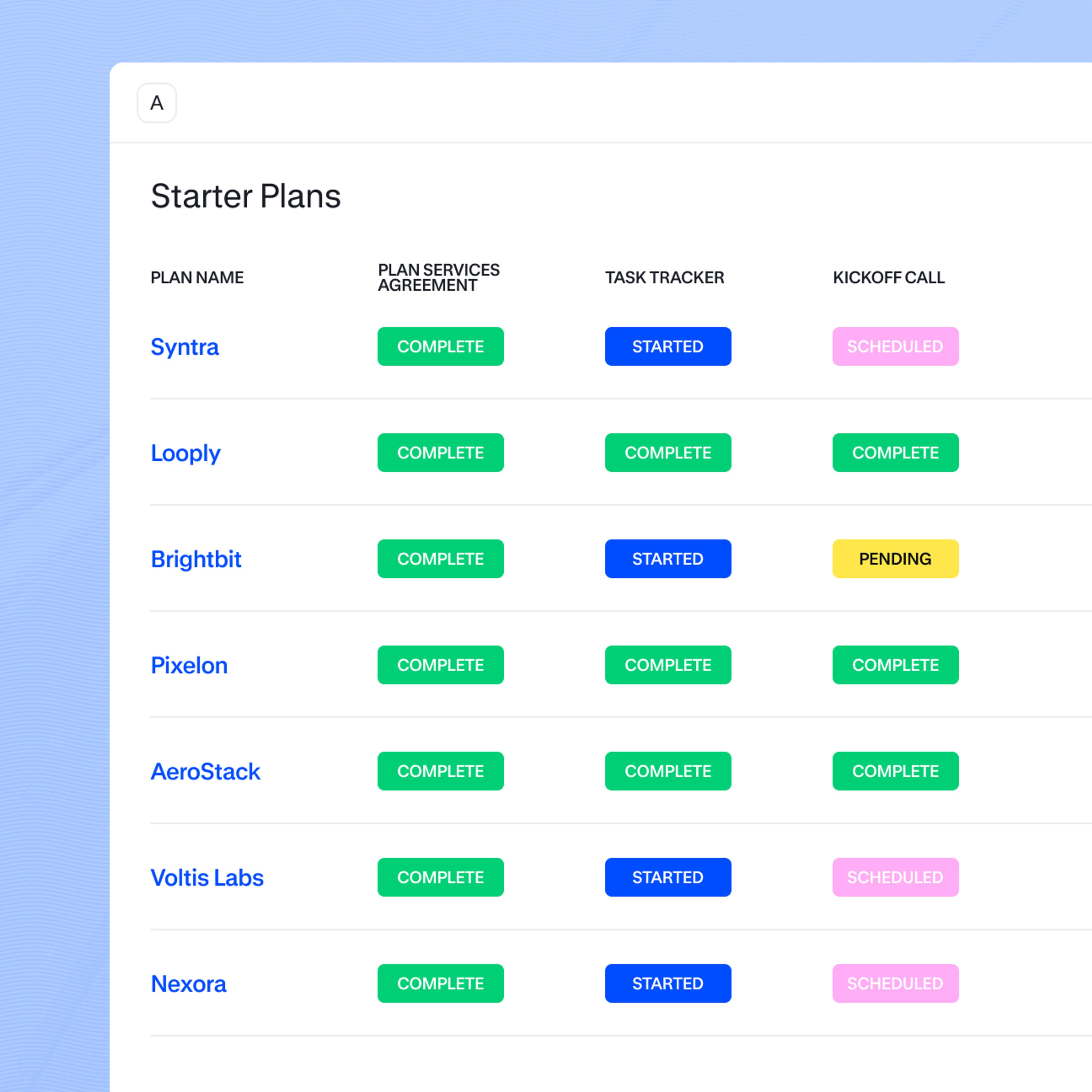

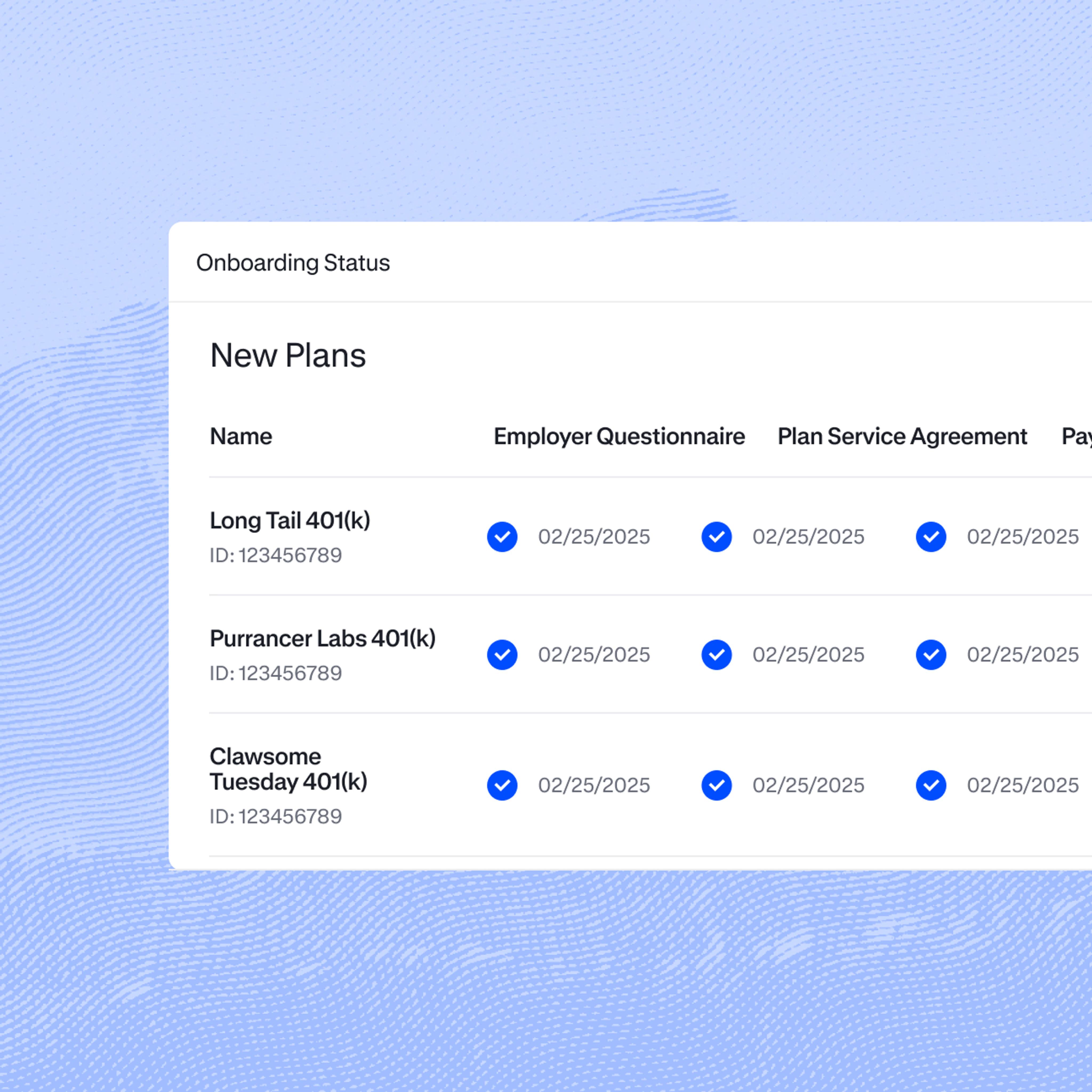

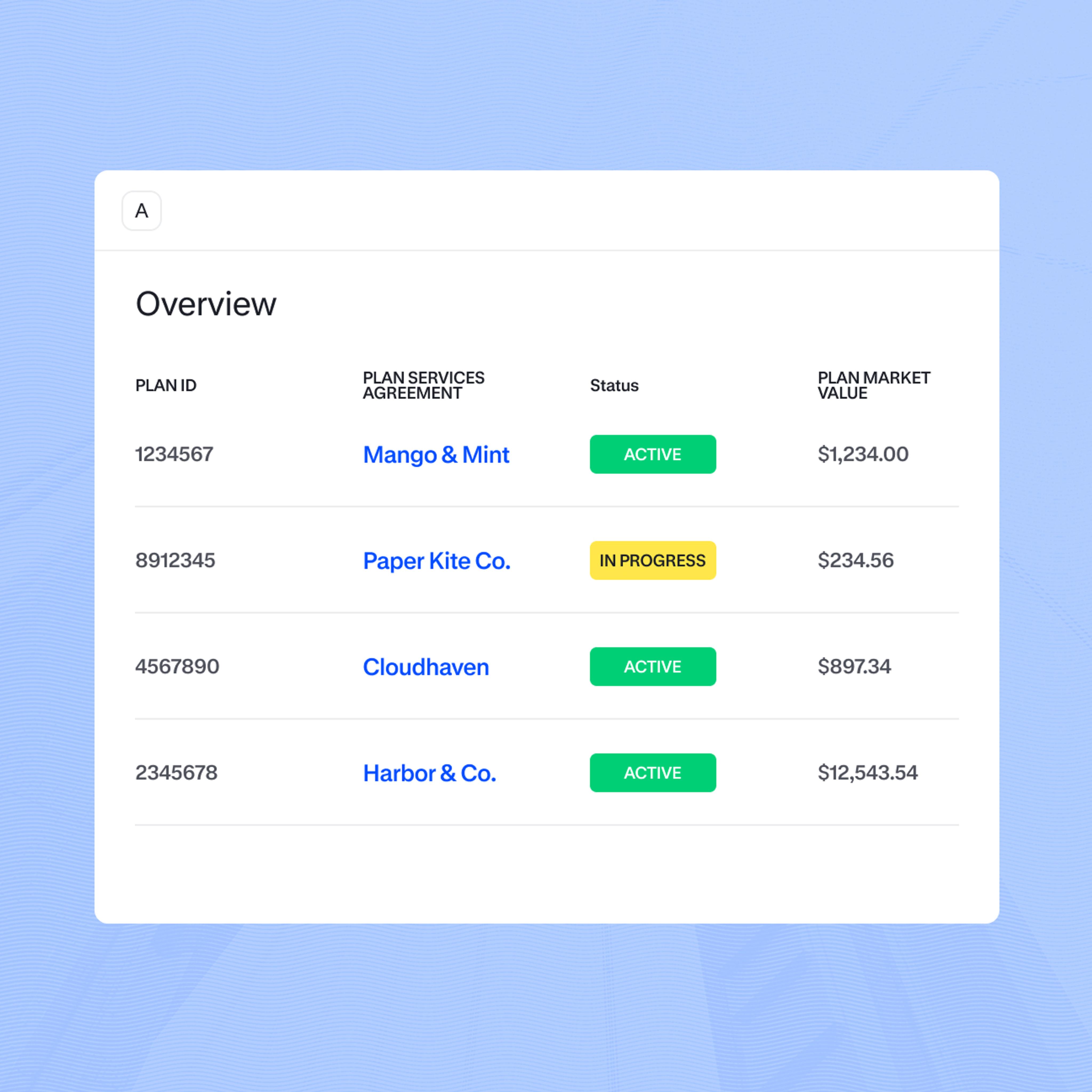

Track all plans in one place, from onboarding status to real-time compliance testing results. Access rich data for a complete view of activity across your book of business while drilling down into plan and participant details—arming you with insights to strengthen client relationships and drive your firm’s growth.

Our proprietary technology means clients benefit from up to 10x¹ more efficiency than legacy providers—from real-time data to automation of plan administrative tasks to daily system releases, keeping you and your clients seamlessly running on the latest.

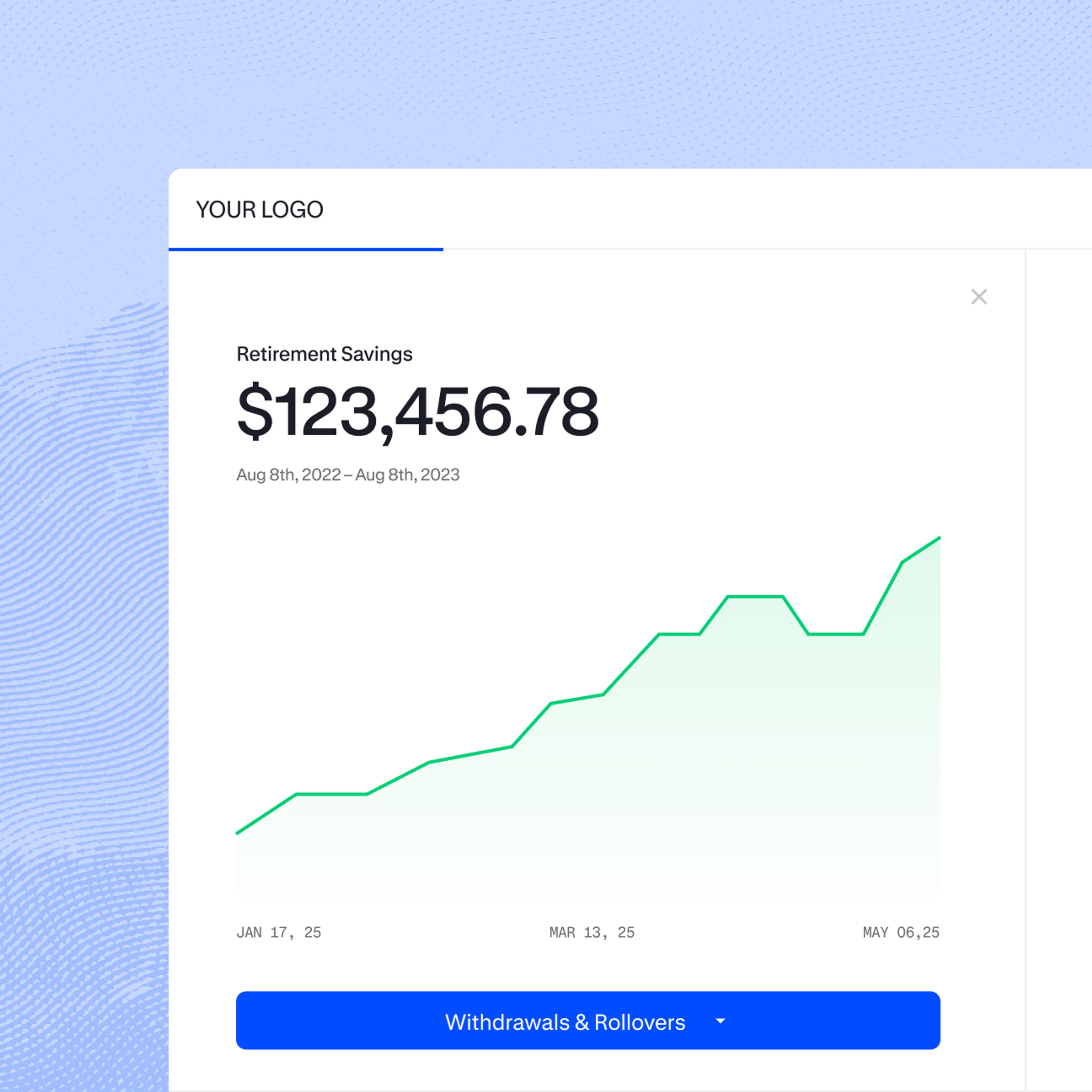

An open-architecture platform lets you custom-build your investment offering without proprietary constraints—from turnkey lineups to asset allocation models and goal-based advisor-managed accounts. Plus, portal white labeling options can keep your brand front and center.

With our mobile app, you can track savings progress, manage contributions, and access your account—anywhere, anytime. With portal accessibility in 18 languages and call support in 240+ languages, you can save confidently in the language you know best.

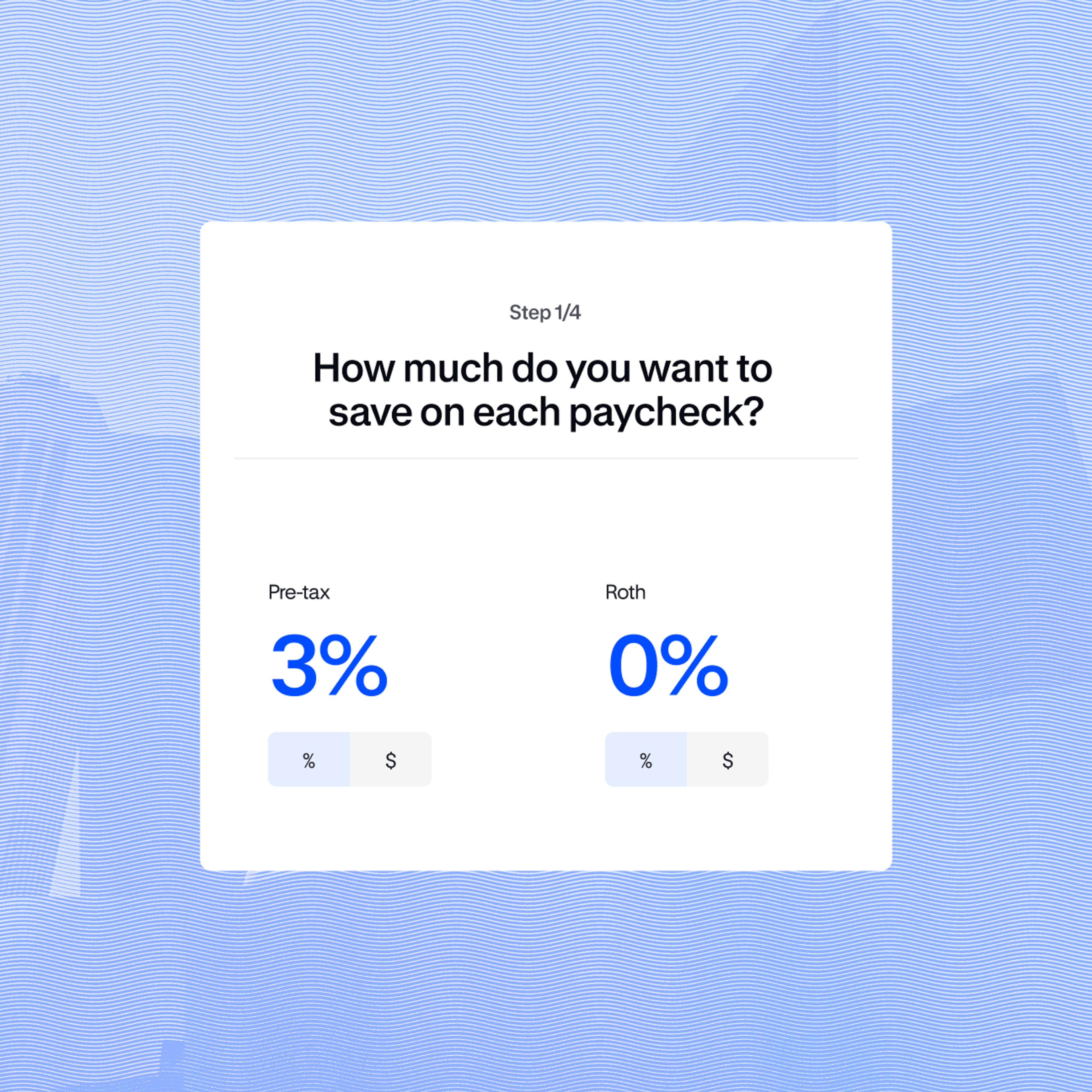

A guided onboarding process makes it easy to enroll, set savings goals, and begin contributing in minutes—no paperwork, no complexity. Robust financial education resources and interactive learning modules within your portal make it simple to save towards life’s most important milestones.

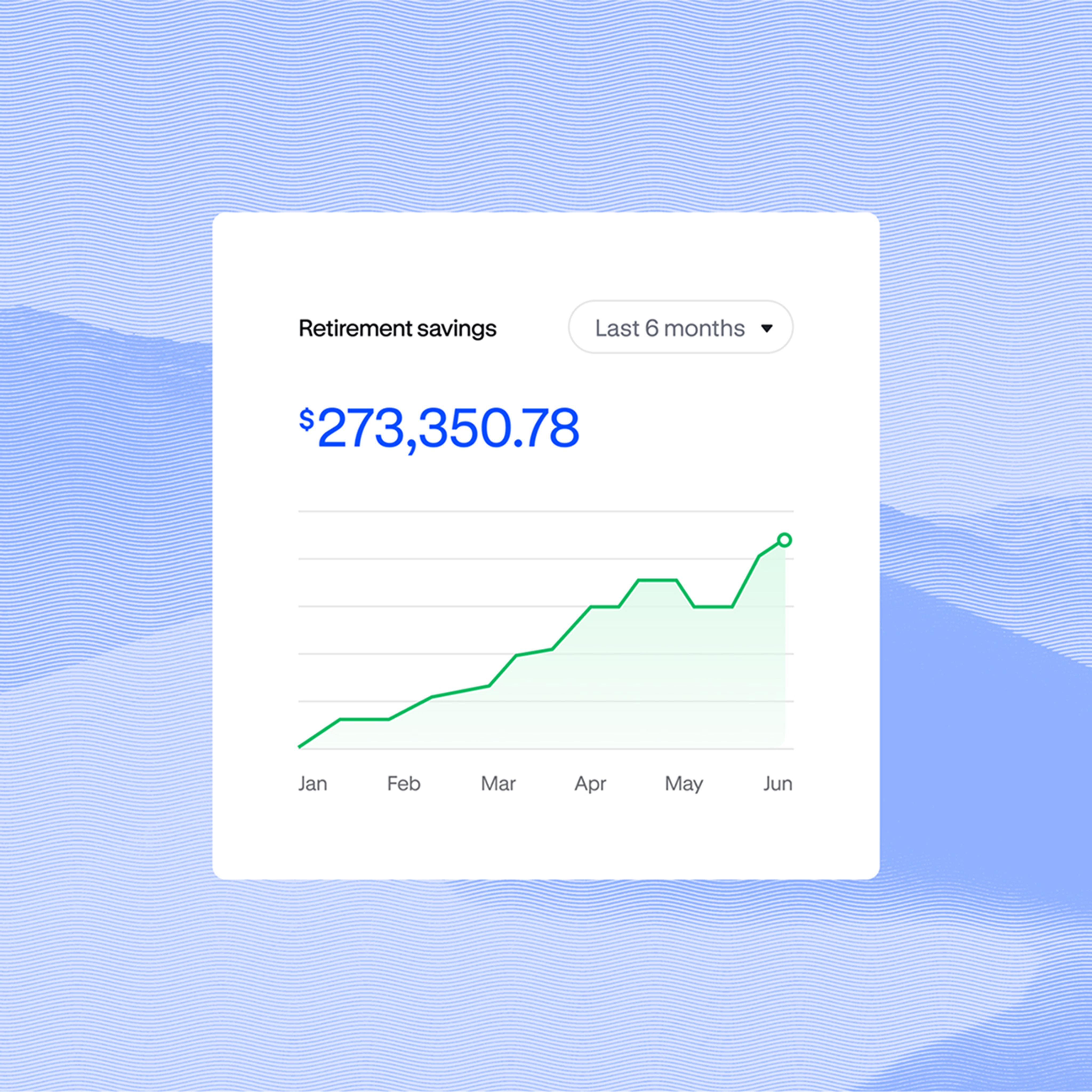

From your retirement plan performance to emergency savings goals to tools for visualizing student loan repayment progress, your portal gives a clear snapshot of your financial journey. See balances, contributions, account growth, and more.

Deliver a seamless extension of your brand with a customizable co-branded or whitelabeled portal experience. Keep your trusted brand front and center for advisors, clients, and employees—while we power the technology behind it.

Our partner portal gives you centralized access to real-time client and sales data, reporting, and program oversight tools—so you can manage relationships, monitor performance across your book of business, and scale your distribution.

We can share detailed, customizable data feeds directly with your team—at the frequency and in the format you prefer—or through the data aggregators you already use. Gain a complete view of your book of business activity to power your internal systems and inform your benefits strategy.

Explore how our modern dashboards, intuitive portal tools, and guided digital onboarding experience streamline the savings experience.

“Vestwell has innovated and used technology to make things straightforward and simple. That's how it should be.”

“The portals are very user-friendly. On the plan sponsor side, we just walked a client through an end-of-the-year contribution and profit share. It was intuitive and easy to do in Vestwell’s portal. It took you through the whole process in less than five minutes. Our folks who use Vestwell’s employer and saver portals have all loved it.”

“I'm much closer to retirement than our newest associate, so we needed a wide range of offerings. I was pleasantly surprised at the quality and quantity of options Vestwell had available.”

“Clients and advisors have told us how much they appreciate the ease of the platform.”

“It was really easy compared to onboarding with the company I had before. I didn't have hours of work to do or a bunch of reports to compile. It was very simple.”

Vestwell can integrate with 190+ leading payroll providers to automate contributions, deferral changes, and employee eligibility tracking. Even without an integration, our payroll engine streamlines payroll file upload, tracks real-time contributions, and offers proactive prompts for file corrections before processing—saving time, minimizing risk, and reducing potential costs.

Discover how our proprietary technology streamlines every part of the savings experience.

Get in touchExplore how Vestwell protects user data and enforces rigorous compliance standards for secure savings.

Learn moreSee how we offer personalized, end-to-end support and expertise.

Learn more

Vestwell internal data, 2025