Profit Sharing

A flexible option for employers to share company success by making additional contributions toward retirement accounts after the plan year ends.

Read the case study

Vestwell’s Safe Harbor 401(k) helps you offer a smarter retirement plan with less admin, automatic compliance, and value for retaining and recruiting talent.

Vestwell’s Safe Harbor 401(k) helps you offer a smarter retirement plan with less admin, streamlined compliance, and value for retaining and recruiting talent.

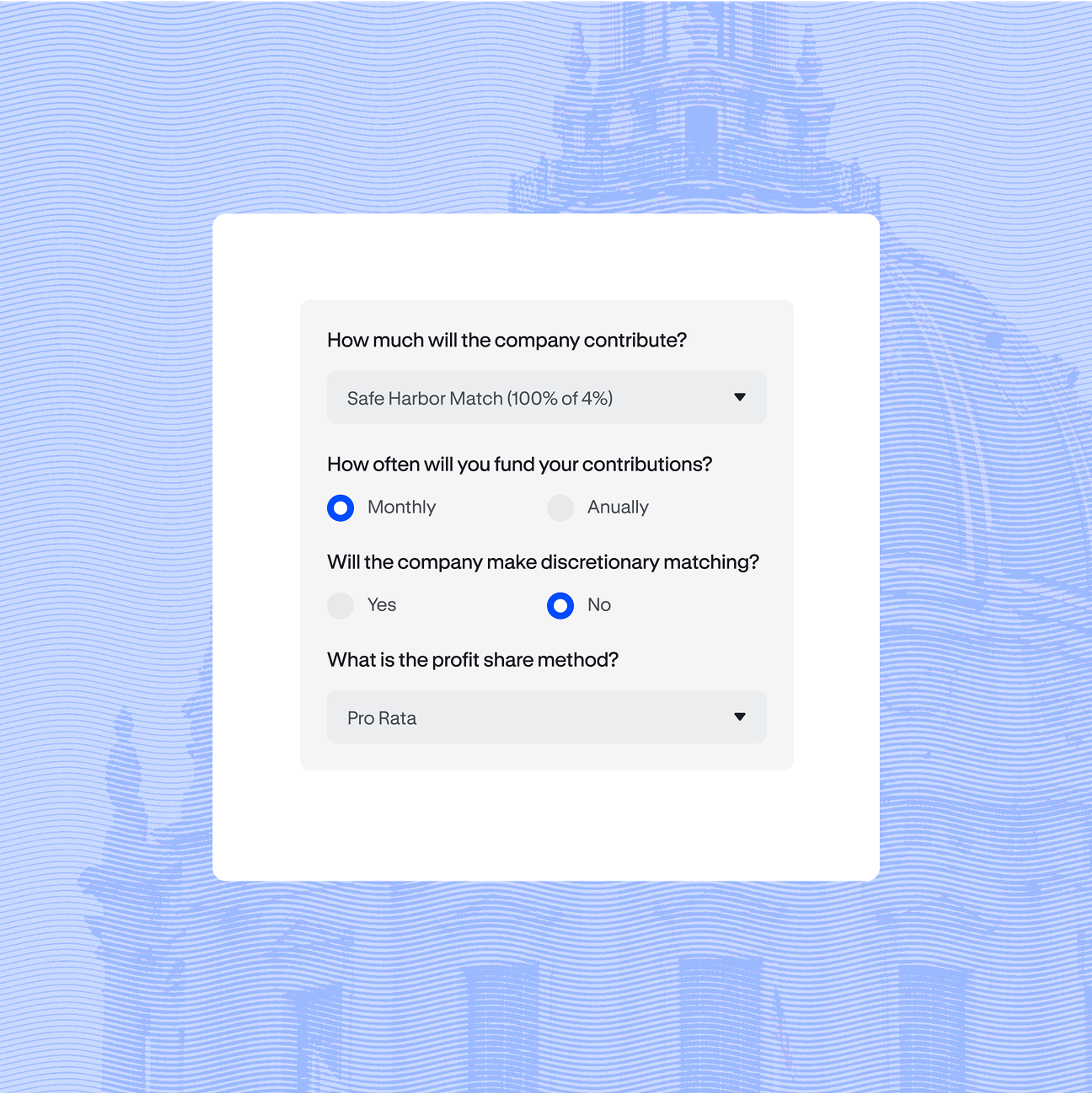

Choose from approved match formulas that fit your budget and offer employees a generous benefit.

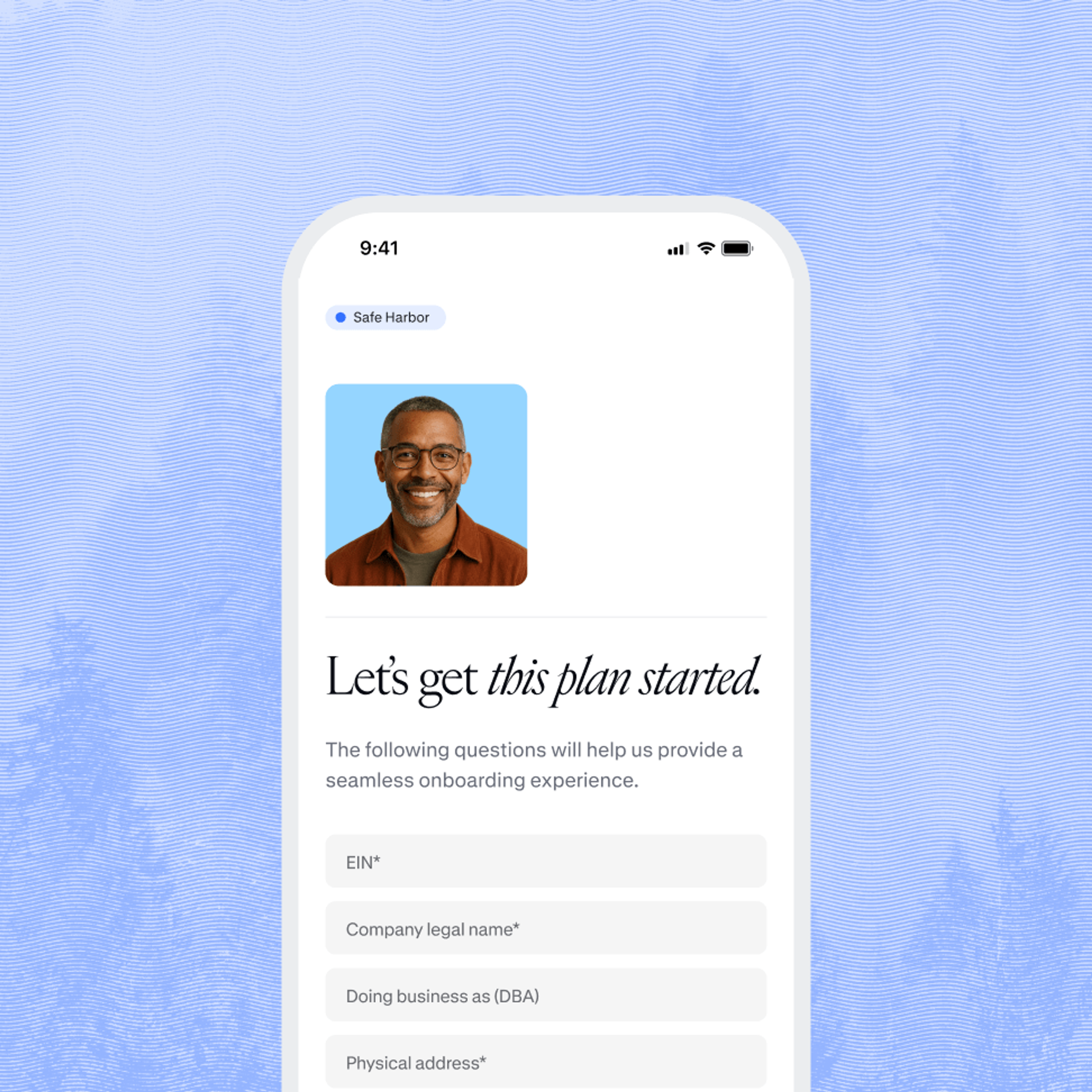

Get your plan up and running fast in less than 30 minutes with support from a 1:1 onboarding contact.

Owners can contribute up to the full limit while still passing IRS non-discrimination tests.

A flexible option for employers to share company success by making additional contributions toward retirement accounts after the plan year ends.

Read the case studyA feature that allows employees to move funds from their retirement plan into a brokerage account, providing the flexibility to invest in a broader range of assets.

Learn moreAn investment option that offers guaranteed monthly payments during retirement via lifetime annuities, providing a layer of income protection.

Learn moreA tool that provides a more personalized asset allocation into portfolios based on retirement and investment goals.

A benefit to pay back student debt while saving for retirement, with employer matching contributions of student loan payments towards employee retirement accounts.

Learn moreA complimentary, integrated library of financial wellness resources and interactive learning modules on foundational topics, from budgeting to saving for a home to planning for milestones.

Explore

A Safe Harbor 401(k) is one of the easiest ways to offer meaningful retirement benefits. With automatic compliance satisfaction and predictable contribution costs, it’s ideal for businesses that want to attract talent, earn tax credits, and streamline testing typically required for retirement plans Vestwell makes it even easier with modern tech and hands-on support every step of the way.

Enhance your Safe Harbor plan with advanced investment options—from professionally managed accounts and guaranteed lifetime income to the flexibility of Self-Directed Brokerage Accounts. Tailored solutions for long-term confidence and individual choice.

“The Safe Harbor program makes it so that I don't have to worry about compliance. It’s a generous plan that keeps things simple for us.”

Get an inside look at how Vestwell simplifies setup, strengthens employee engagement, and delivers dedicated support from onboarding to ongoing plan management.

Take a guided tour through Vestwell’s core capabilities, including onboarding, contributions, compliance workflows, and participant engagement.