Profit Sharing

A flexible option for employers to share company success by making additional contributions toward retirement accounts after the plan year ends.

Read the case study

When you Vestwell, you can bring compliant, flexible 401(k) solutions to the table that help scale your practice and deepen client value.

Vestwell’s Safe Harbor 401(k) helps you offer a retirement plan without getting buried in complexity or compliance paperwork.

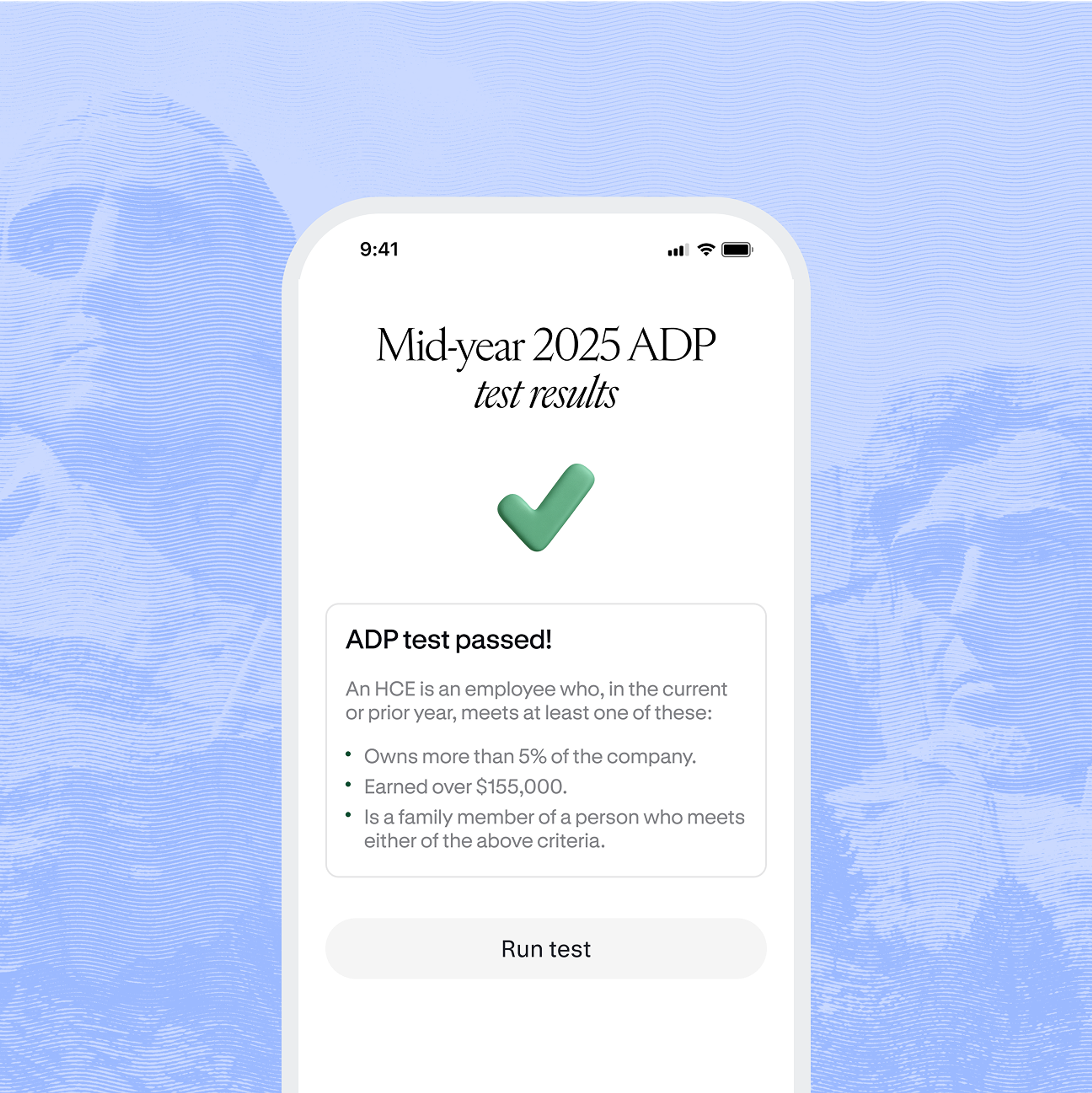

Plans are structured to satisfy nondiscrimination testing automatically.

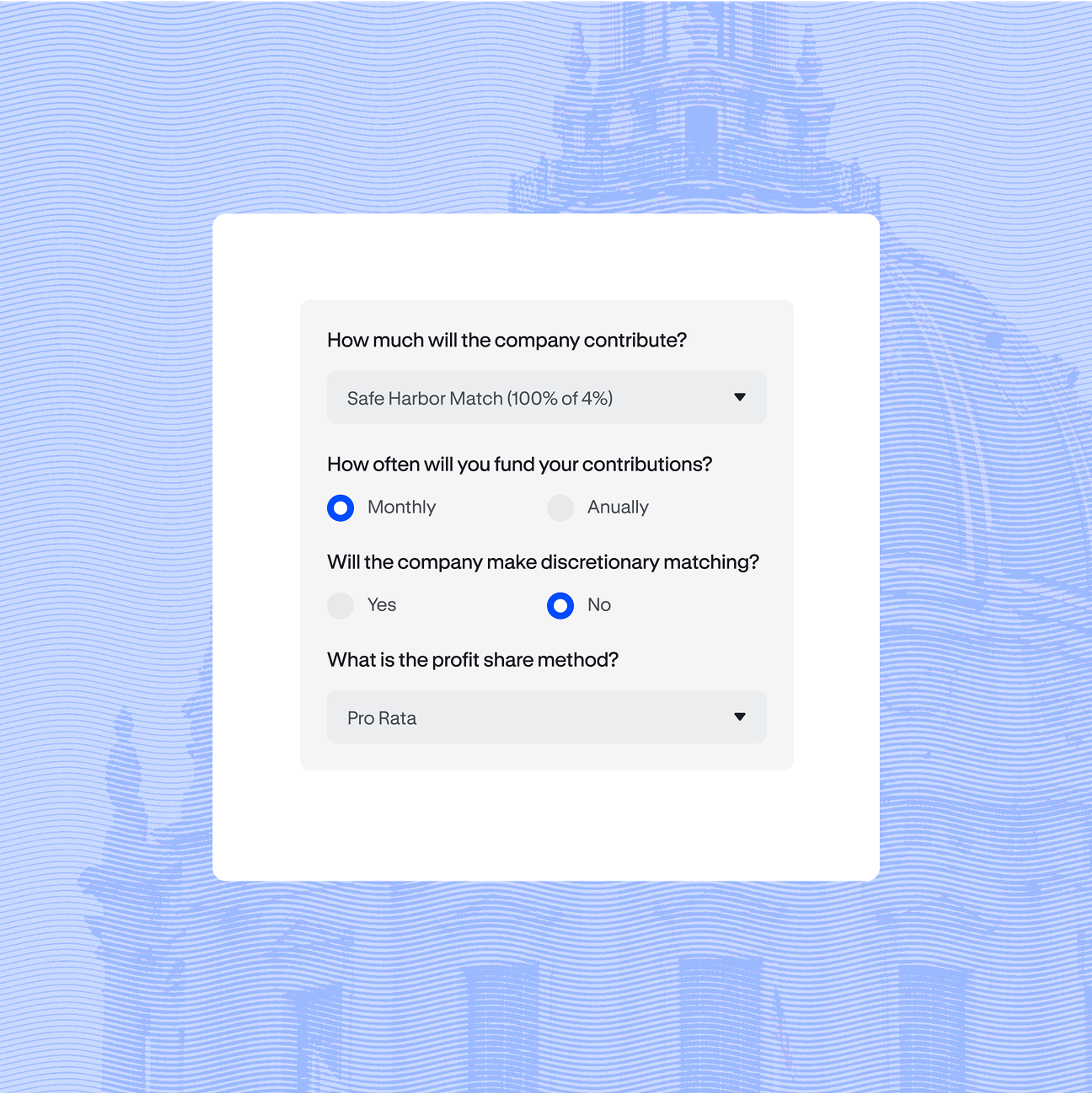

Help clients select from pre-approved formulas that work for their budget and objectives.

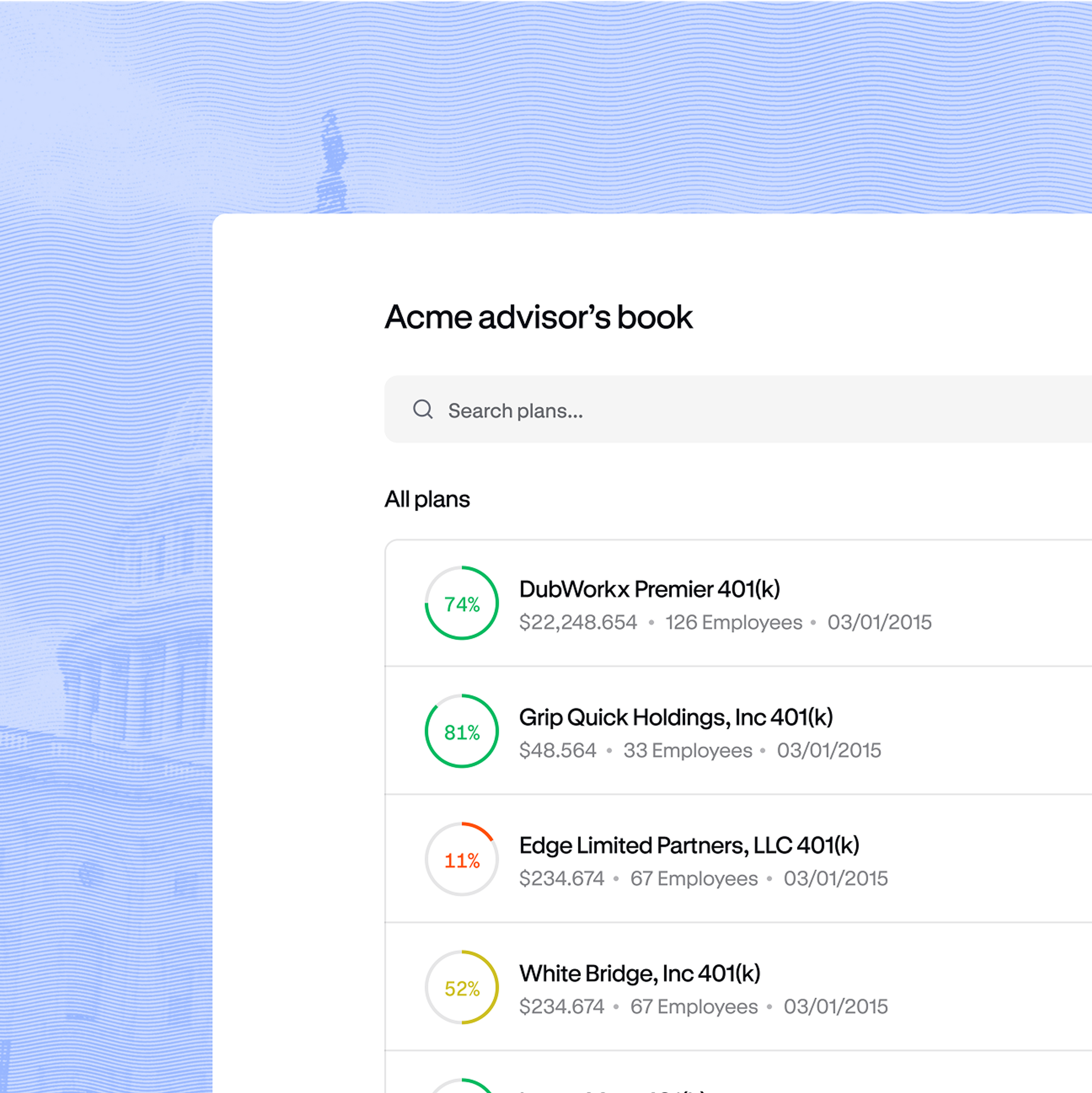

Easily manage onboarding, investment lineups, and plan health across your book from a single dashboard.

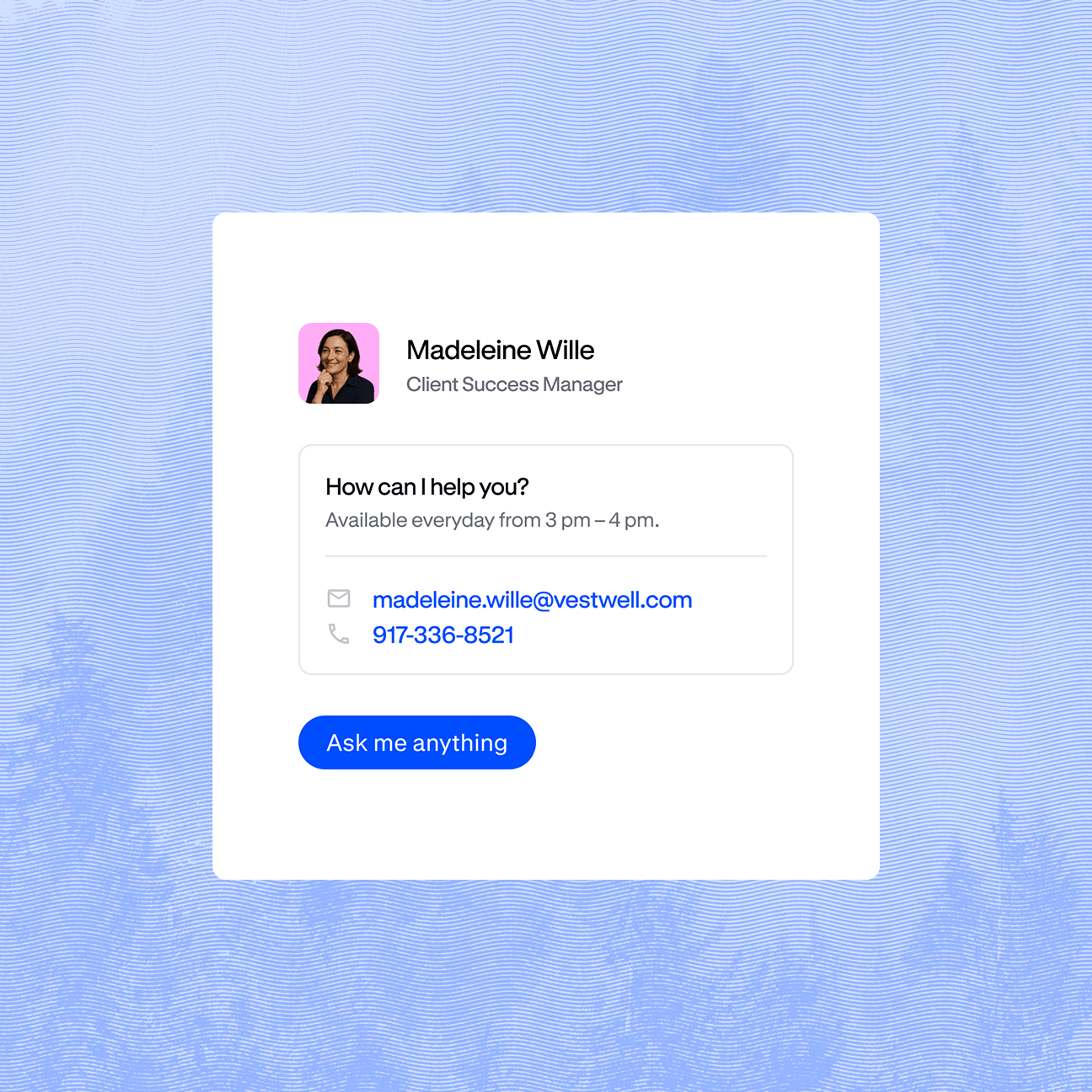

We handle the heavy lifting, so you stay focused on advising—not admin.

A flexible option for employers to share company success by making additional contributions toward retirement accounts after the plan year ends.

Read the case studyA feature that allows employees to move funds from their retirement plan into a brokerage account, providing the flexibility to invest in a broader range of assets.

An investment option that offers guaranteed monthly payments during retirement via lifetime annuities, providing a layer of income protection.

Learn moreA tool that provides a more personalized asset allocation into portfolios based on retirement and investment goals. Funds can be selected by a third-party investment fiduciary or the plan’s advisor acting as 3(38) or 3(21) fiduciary.

Learn moreA benefit to pay back student debt while saving for retirement, with employer matching contributions of student loan payments towards employee retirement accounts.

A complimentary, integrated library of financial wellness resources and interactive learning modules on foundational topics, from budgeting to saving for a home to planning for milestones.

Explore

Vestwell integrates with over 100 payroll providers to make plan setup and administration effortless. Explore our full list of payroll partners to identify the right solution for your clients and streamline their experience from day one.

Enhance your Safe Harbor plan with advanced investment options—from professionally managed accounts and guaranteed lifetime income to the flexibility of Self-Directed Brokerage Accounts. Tailored solutions for long-term confidence and individual choice.

“The Safe Harbor program makes it so that I don't have to worry about compliance. It’s a generous plan that keeps things simple for us.”

Take a guided tour through Vestwell’s core capabilities, including onboarding, contributions, compliance workflows, and participant engagement.