Profit Sharing

A flexible option for employers to share company success by making additional contributions toward retirement accounts after the plan year ends.

Read the case study

Vestwell helps you scale your retirement business with flexible plans, intuitive technology, and the support you need to build high-value client relationships.

Vestwell’s 401(k) plan helps you serve clients of all sizes with flexible plan design, integrated technology, and white-glove support—so you can focus on growth, not administration.

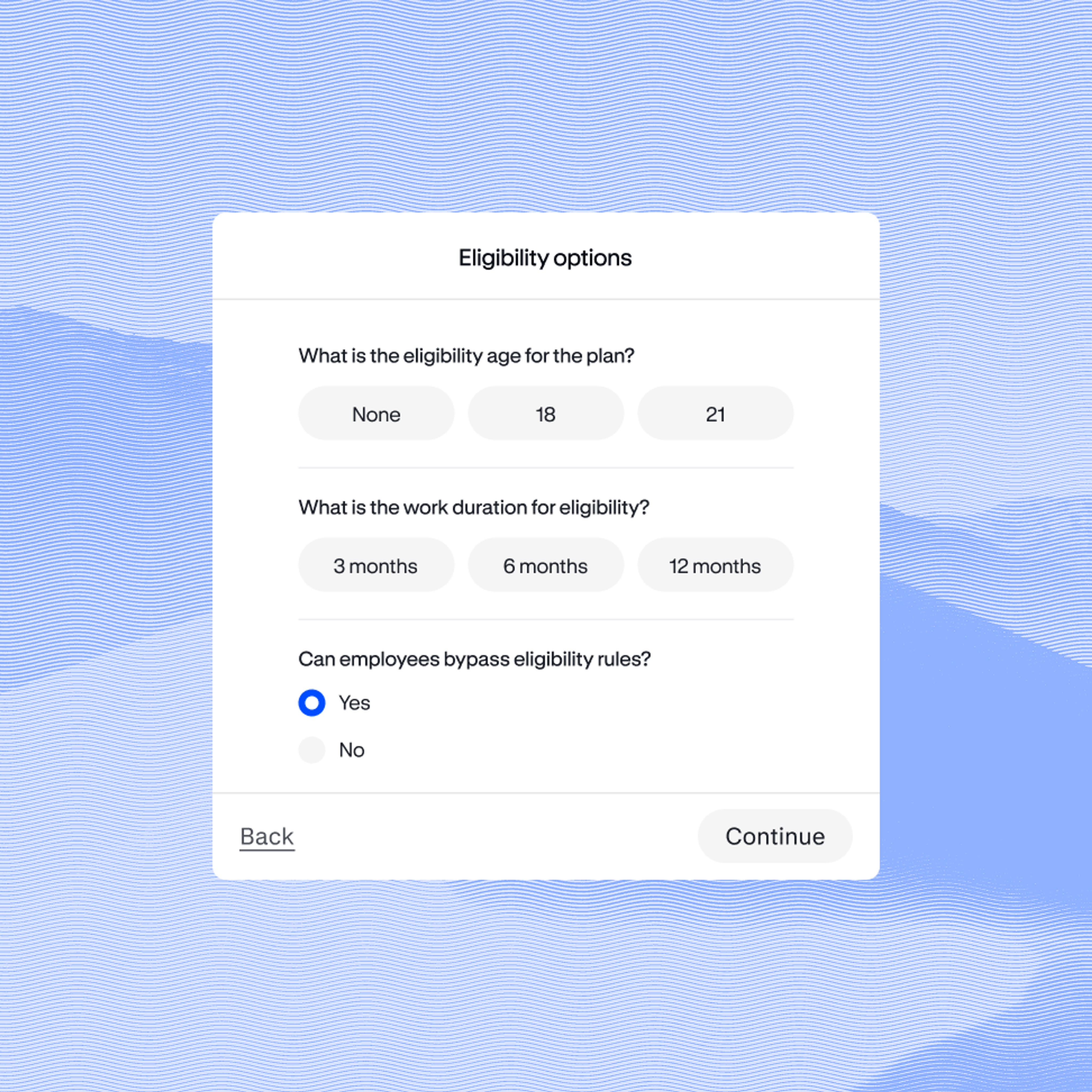

From startups to multi-location businesses, Vestwell enables custom plan design, including eligibility options ranging from eligibility by source to long-term part-time rules, vesting, Safe Harbor, profit-sharing contribution options, and more.

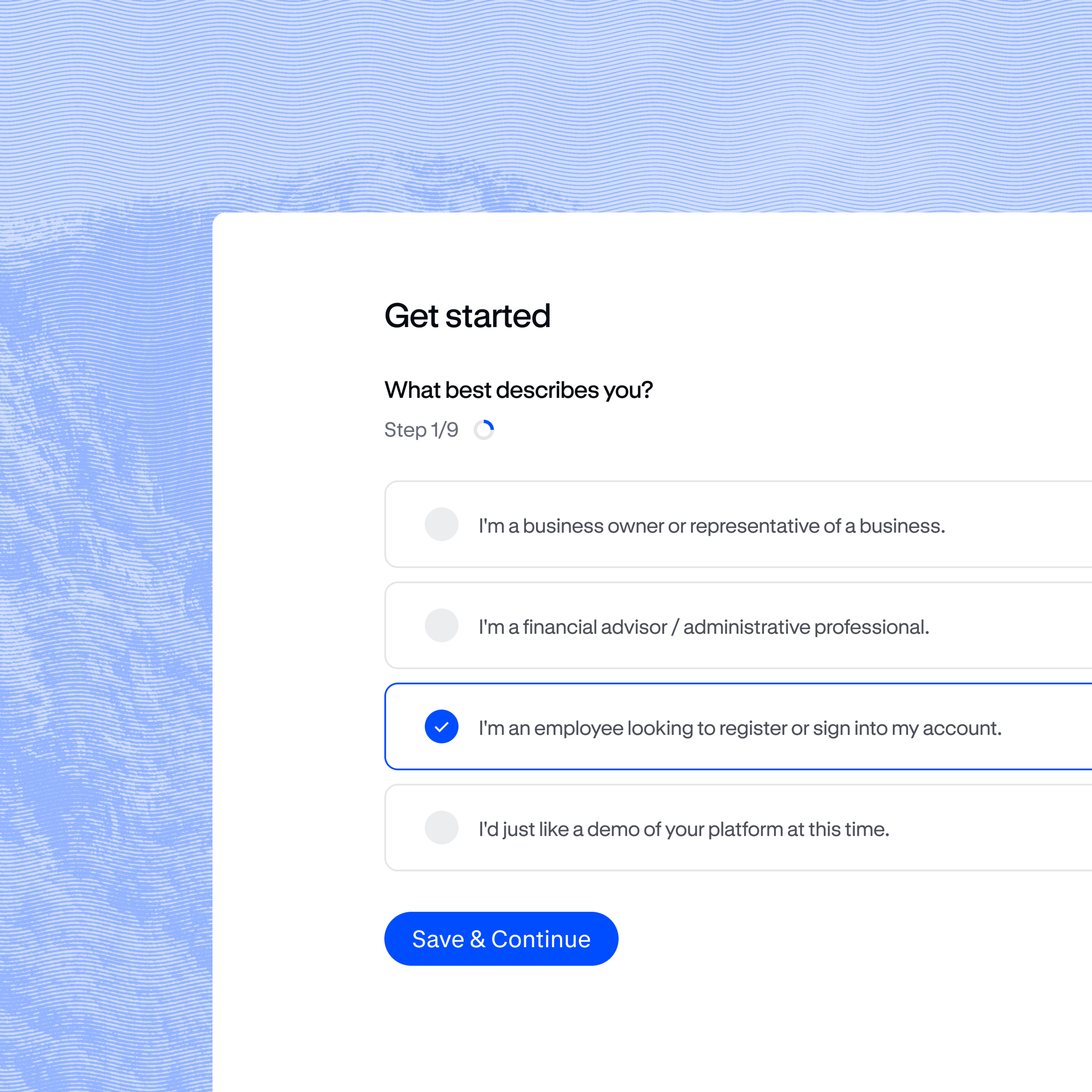

Guided digital onboarding, bi-directional payroll sync, and Vestwell’s 3(16) fiduciary administration responsibilities save you time and let you focus on deepening relationships and sourcing new ones.

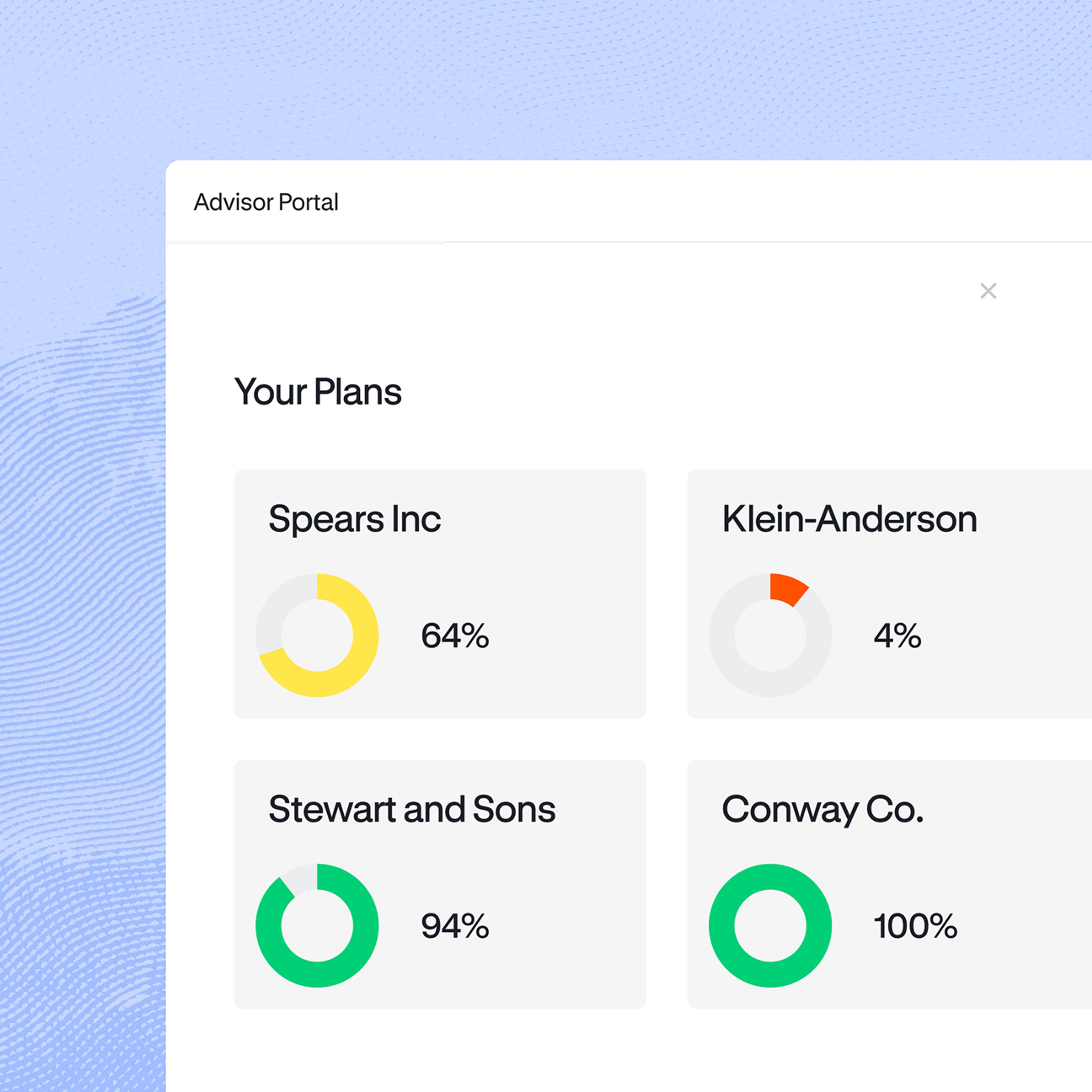

An intuitive advisor dashboard gives you real-time insights into plan performance, participation, and contributions across your book of business—helping you monitor plan health and identify new opportunities.

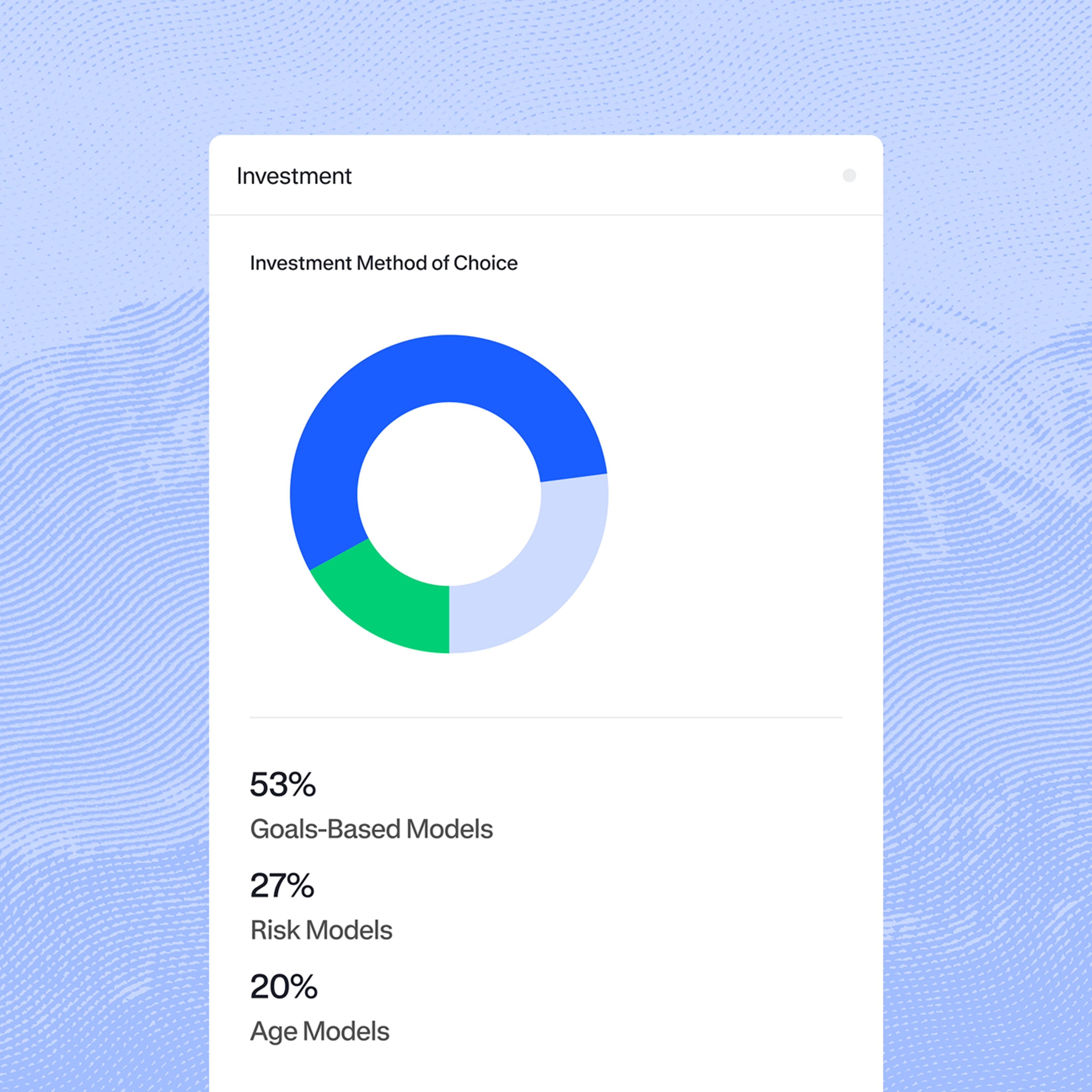

Build each plan’s investment lineup—from goal-based advisor-managed accounts to curated fund menus, target date funds, and guaranteed lifetime income options—giving you the flexibility to meet diverse client and saver needs.

A flexible option for employers to share company success by making additional contributions toward retirement accounts after the plan year ends.

Read the case studyA feature that allows employees to move funds from their retirement plan into a brokerage account, providing the flexibility to invest in a broader range of assets.

An investment option that offers guaranteed monthly payments during retirement via lifetime annuities, providing a layer of income protection.

Learn moreA tool that provides a more personalized asset allocation into portfolios based on retirement and investment goals. Funds can be selected by a third-party investment fiduciary or the plan’s advisor acting as 3(38) or 3(21) fiduciary.

Learn moreA benefit to pay back student debt while saving for retirement, with employer matching contributions of student loan payments towards employee retirement accounts.

A complimentary, integrated library of financial wellness resources and interactive learning modules on foundational topics, from budgeting to saving for a home to planning for milestones.

Our 401(k) solutions are built to work the way you do—offering plan transparency, an intuitive advisor dashboard, and the flexibility to take on as much or as little as you choose. Whether you’re serving as the plan design consultant, the investment fiduciary, or anything in between, Vestwell makes it easy to scale your business without scaling your workload.

“When we were evaluating our options, we interviewed multiple fintech solutions. Without a doubt, Vestwell was the most advisor-friendly in the marketplace.”

By offering a qualified retirement plan with auto-enrollment, your clients may be eligible to earn $16,500 or more in tax credits over a three-year period.¹

If you start a qualified retirement plan with auto-enrollment, you may qualify to earn more than $150,000 in tax credits over a three-year period.

Vestwell’s Safe Harbor 401(k) lets you deliver plans that meet IRS requirements—reducing compliance risk, streamlining plan management, and helping your clients attract and retain top talent.

Grow your book with 401(k) plans that save you time, simplify administration, and give you the tools to deliver better client outcomes.

Yes. Your advisor dashboard gives you full visibility across every Vestwell plan you manage.

Absolutely. We support flexible designs tailored to your client’s goals—from safe harbor to profit-sharing and more.

No. Vestwell’s team supports every step of onboarding and handles ongoing compliance requirements for your clients.

We offer a range of educational and sales enablement resources to help you streamline onboarding, guide client decisions, and communicate value.

Yes. We have the ability to integrate with 190+ payroll providers and can collaborate with your preferred partners to create a seamless client experience.

The tax credit calculator is meant to be an estimate and it is provided for informational purposes only. It is based on credits that may be available to your business based on the current version of the Internal Revenue Code in effect and does not take into account potential changes to the tax credits that may be available to you that are currently under consideration. This calculator also does not take into account any other aspect of your business that may entitle your business to greater or fewer tax credits from starting or offering a new or existing retirement plan nor does it reflect any other fees or expenses associated with your plan. The tax credits that the Internal Revenue Service determines are available to your business could be materially different from the output of the tax credit calculator.