Mobile App

Employees can manage their account and savings on the go with the Vestwell mobile app. They can set contributions, adjust account details, and track progress anytime, anywhere.

Download on the App Store

From Pooled Employer Plans (PEPs) to Multiple Employer Plans (MEPs) and Group of Plans (GOPs), Vestwell’s aggregated plan solutions streamline plan management across multiple plans—helping you add more clients to your book of business without adding work to your plate.

Vestwell’s pooled retirement plans enable advisors like you to serve multiple businesses through a single or grouped plan structure. This simplifies administration and compliance, lowers client costs, and allows you to expand your book of business with ease.

Streamlined plan administration, such as a single Form 5500 filing for MEPs, PEPs, and GOPs, and combined compliance tests and audits for MEPs and PEPs, takes care of the heavy lifting for lean teams and lets you focus on building client relationships—not paperwork.

Partner with Vestwell, Third Party Administrators (TPAs), and other providers to take on or delegate fiduciary oversight—like 3(16) administration and 3(38) investment responsibilities—in the way that works best for your practice. You take the reins on the client relationship, while Vestwell and our partners can handle the time-consuming day-to-day operations.

Depending on the pooled plan type, employers choose features such as eligibility, contributions, and Safe Harbor provisions based on a flexible menu of compliant, pre-approved plan design options—enabling you to tailor features towards plan goals while streamlining plan adoption and accelerating scale.

Cost-sharing across multiple employers in the plan substantially drives down investment, plan document, audit, and administrative fees that clients couldn’t access on their own. This makes retirement benefits in reach for more clients and boosts funds for where they’ll have more impact: within retirement accounts.

Employees can manage their account and savings on the go with the Vestwell mobile app. They can set contributions, adjust account details, and track progress anytime, anywhere.

Download on the App StoreA tool that provides a more personalized asset allocation into portfolios based on retirement and investment goals. Funds can be selected by a third-party investment fiduciary or the plan’s advisor acting as 3(38) or 3(21) fiduciary.

Learn moreA flexible option for employers to share company success by making additional contributions toward retirement accounts after the plan year ends.

Read the case studyA benefit to pay back student debt while saving for retirement, with employer matching contributions of student loan payments towards employee retirement accounts.

Learn moreA complimentary, integrated library of financial wellness resources and interactive learning modules on foundational topics, from budgeting to saving for a home to planning for milestones.

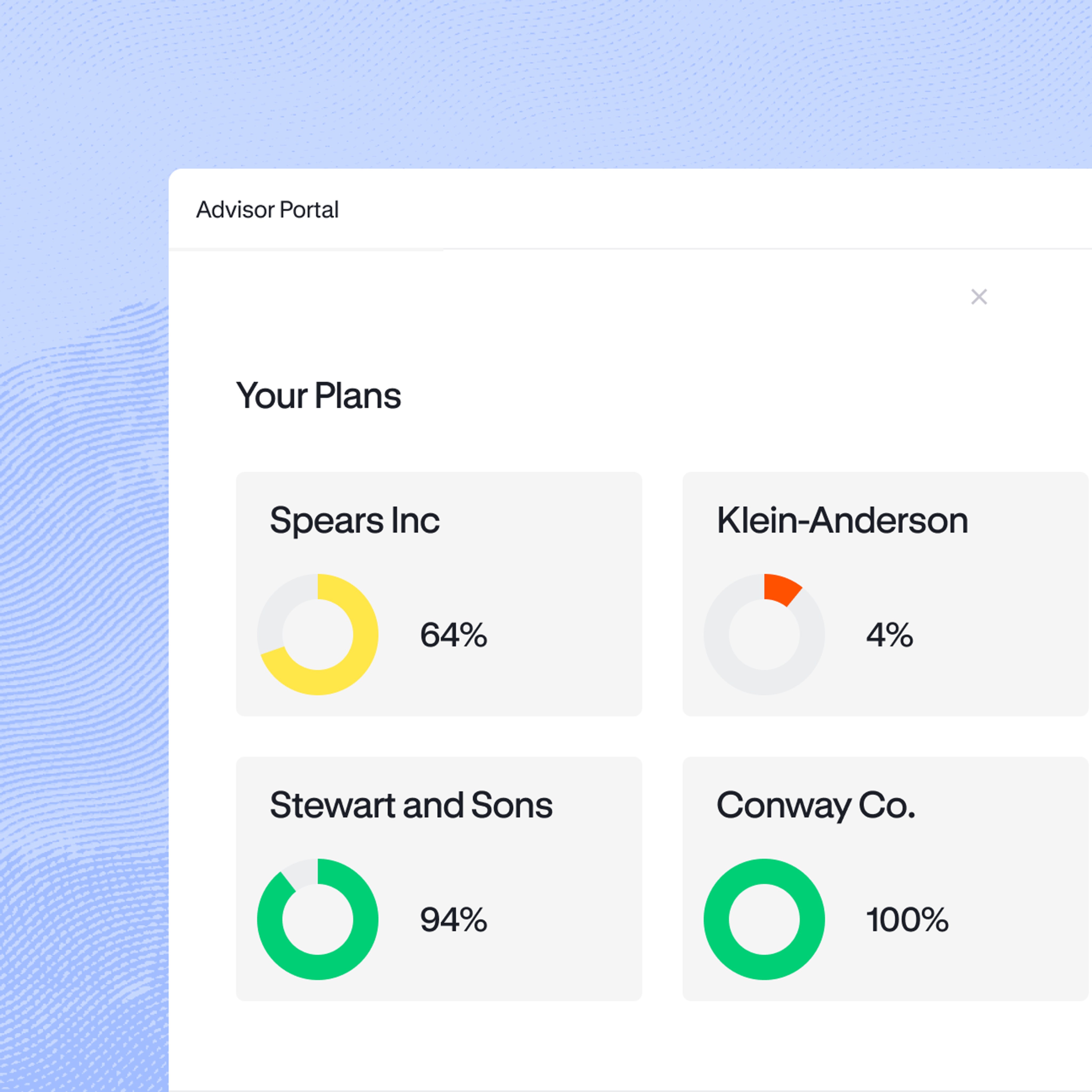

A robust advisor portal gives you full visibility into the pooled plans you manage, including onboarding status, detailed and on-demand reporting, annual testing, compliance tracking, and more.

Whether you're managing a small business starting its first plan or a larger, multi-location enterprise transitioning an existing 401(k), Vestwell guides you and your clients through a seamless, digital-first setup—backed by personalized, human support, a 1:1 relationship manager, and specialized expertise at every step.

“When we're working with Vestwell, we have a system down, and I think that efficiency allows us to serve more clients and at a lower cost.”

By offering a qualified retirement plan with auto-enrollment, your clients may be eligible to earn $16,500 or more in tax credits over a three-year period.¹

If you start a qualified retirement plan with auto-enrollment, you may qualify to earn more than $150,000 in tax credits over a three-year period.

Deliver cost-effective, compliant retirement solutions for clients that save time, reduce complexity, and offer a powerful benefit for all.

MEP (Multiple Employer Plan) - A MEP is a single retirement plan shared by multiple employers who are typically related by a common industry, association, or region. It offers pooled administration, but requires participating employers to have a common connection.

PEP (Pooled Employer Plan) - A retirement plan created under the SECURE Act that allows unrelated employers to join a single, professionally managed plan. No common relationship is needed, and a registered Pooled Plan Provider (PPP) such as Vestwell oversees all plan administration and compliance.

GOP (Group of Plans) - A GOP is a reporting structure that allows multiple employers to maintain separate 401(k) plans in a group while sharing common providers—such as a recordkeeper, TPA, and/or investment advisor. While each employer keeps their own plan, plan documents, and fiduciary responsibility, eligible GOPs can file one combined Form 5500 for efficiency.

Vestwell and our provider partners can manage both administrative 3(16) and, optionally, investment 3(38) fiduciary responsibilities for pooled retirement plan clients. Alternatively, a trusted advisory firm like yours may be designated as the 3(38) if desired. Fiduciary responsibilities include managing audits, notices, loan requests, and plan filings on your client’s behalf and making investment lineup decisions in your clients’ best interests.

Yes, but with differences depending on the structure:

MEP (Multiple Employer Plan) - MEPs with Vestwell generally allow for a moderate to high level of plan design customization. The lead sponsor, which is often an association, PEO, or employer group, sets plan features, but participating employers may have some flexibility, like employer contributions or eligibility features, depending on the lead plan sponsor.

PEP (Pooled Employer Plan) - With Vestwell's PEP options, employers choose from a diverse range of pre-approved designs, from Safe Harbor contributions to discretionary match, and variations in eligibility, vesting, auto-enrollment savings rate, and more. Clients get a plan that feels personalized with the efficiency benefits of a single PEP plan document, which makes joining the plan a breeze.

GOP (Group of Plans) - GOPs offer the greatest customization, since each employer maintains a separate plan with its own rules, features, and investment selections. The GOP structure consolidates reporting—not plan design.

For all pooled structures, investment menu selection is typically standardized, especially in PEPs, for regulatory simplicity.

Yes. Vestwell has the ability to integrate with 190+ payroll providers, and a dedicated service team collaborates with clients to ensure smooth setup and sync.

Our team of retirement specialists can help you evaluate based on business type, size, goals, and compliance needs.

The tax credit calculator is meant to be an estimate and it is provided for informational purposes only. It is based on credits that may be available to your business based on the current version of the Internal Revenue Code in effect and does not take into account potential changes to the tax credits that may be available to you that are currently under consideration. This calculator also does not take into account any other aspect of your business that may entitle your business to greater or fewer tax credits from starting or offering a new or existing retirement plan nor does it reflect any other fees or expenses associated with your plan. The tax credits that the Internal Revenue Service determines are available to your business could be materially different from the output of the tax credit calculator.