Learning Center

A complimentary, integrated library of financial wellness resources and interactive learning modules on foundational topics, from budgeting to saving for a home to planning for milestones.

Vestwell enables businesses to address the most pressing financial stressors for their employees and create a strong, happy work culture.

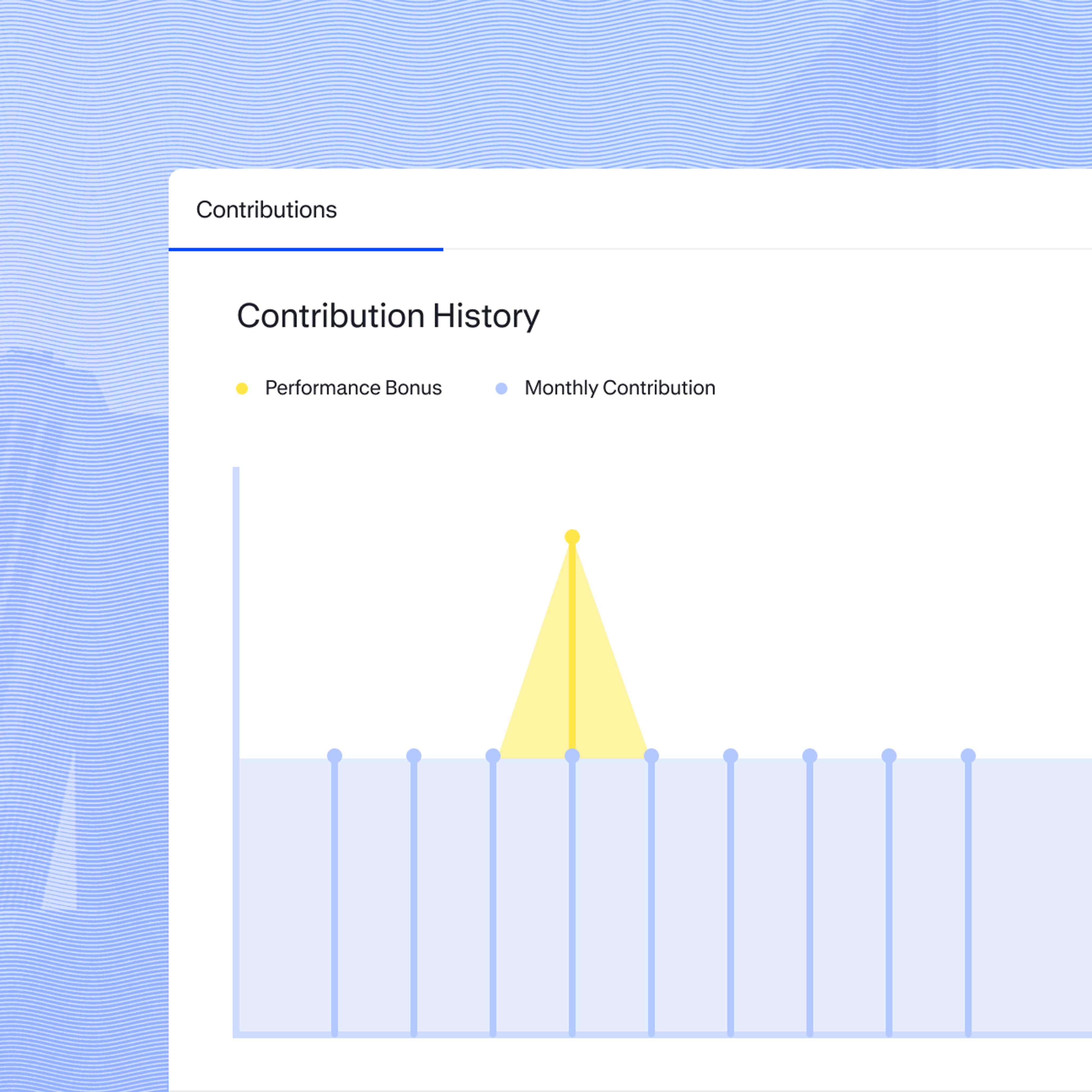

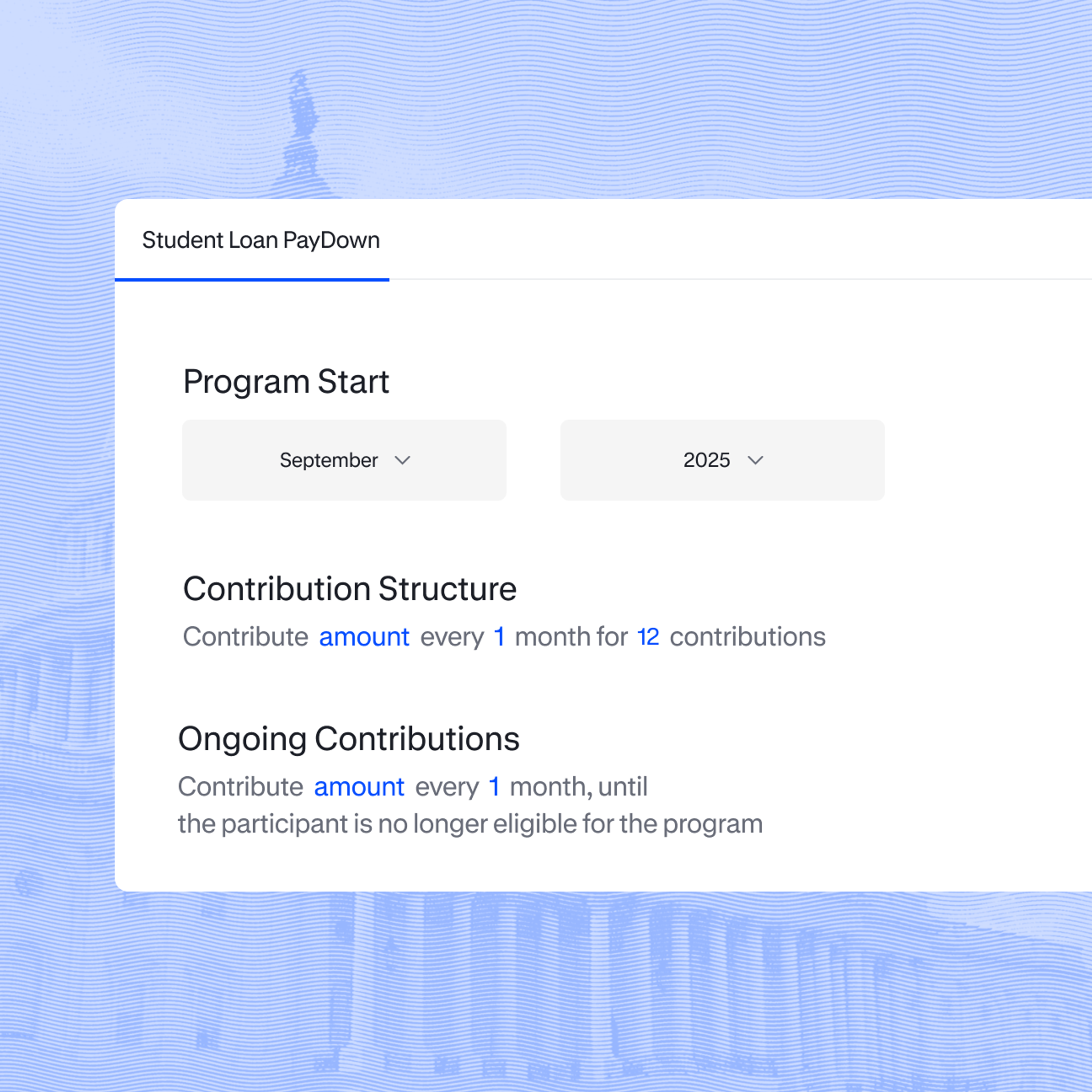

Help employees pay back student debt faster and start saving for the future sooner via direct student loan contributions up to $5,250 per year per employee tax-free.

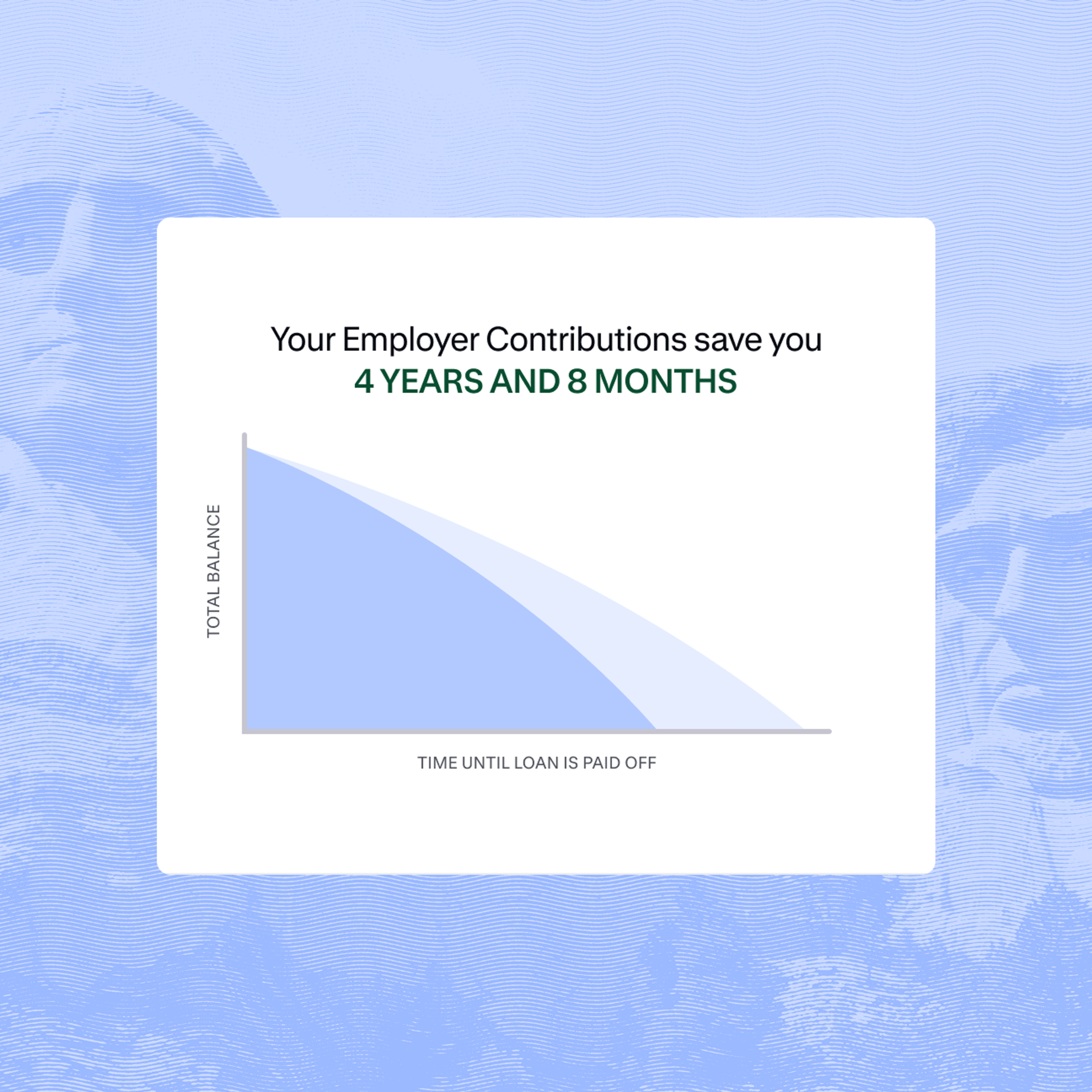

Empower faster progress towards a debt-free future. Your contributions can help eliminate student debt years earlier and save employees thousands in interest.

Employer Student Loan PayDown contributions are tax-free for employees and tax deductible for you, increasing impact for your employees and your bottom line.

Attract and retain talent by showing your lasting commitment and enabling employees to tackle their most pressing financial needs.

Alleviate financial stress and promote a more productive, loyal workforce by enabling employees to tackle one of their most pressing concerns—financial security.

A complimentary, integrated library of financial wellness resources and interactive learning modules on foundational topics, from budgeting to saving for a home to planning for milestones.

A benefit to pay back student debt while saving for retirement, with employer matching contributions of student loan payments towards employee retirement accounts.

Learn moreAccess to a curated marketplace of student loan refinancing lenders that can help lower interest rates and monthly payments, along with a student loan credit when refinanced.¹

Centralized resources and tools to navigate federal student loan forgiveness options, confirm eligibility, and track payment progress for employees in public service roles.

Learn more

“This has been a great benefit, not just financially, but also mentally, knowing that I'm finally making progress on my loans.”

93% of employees with student loans say student debt has affected their ability to save for retirement.¹ Our Student Loan Retirement Match lets you match employees’ student loan payments with contributions towards their retirement account. With a student loan matching solution, your employees have an opportunity to lower their debt today while still saving towards tomorrow.

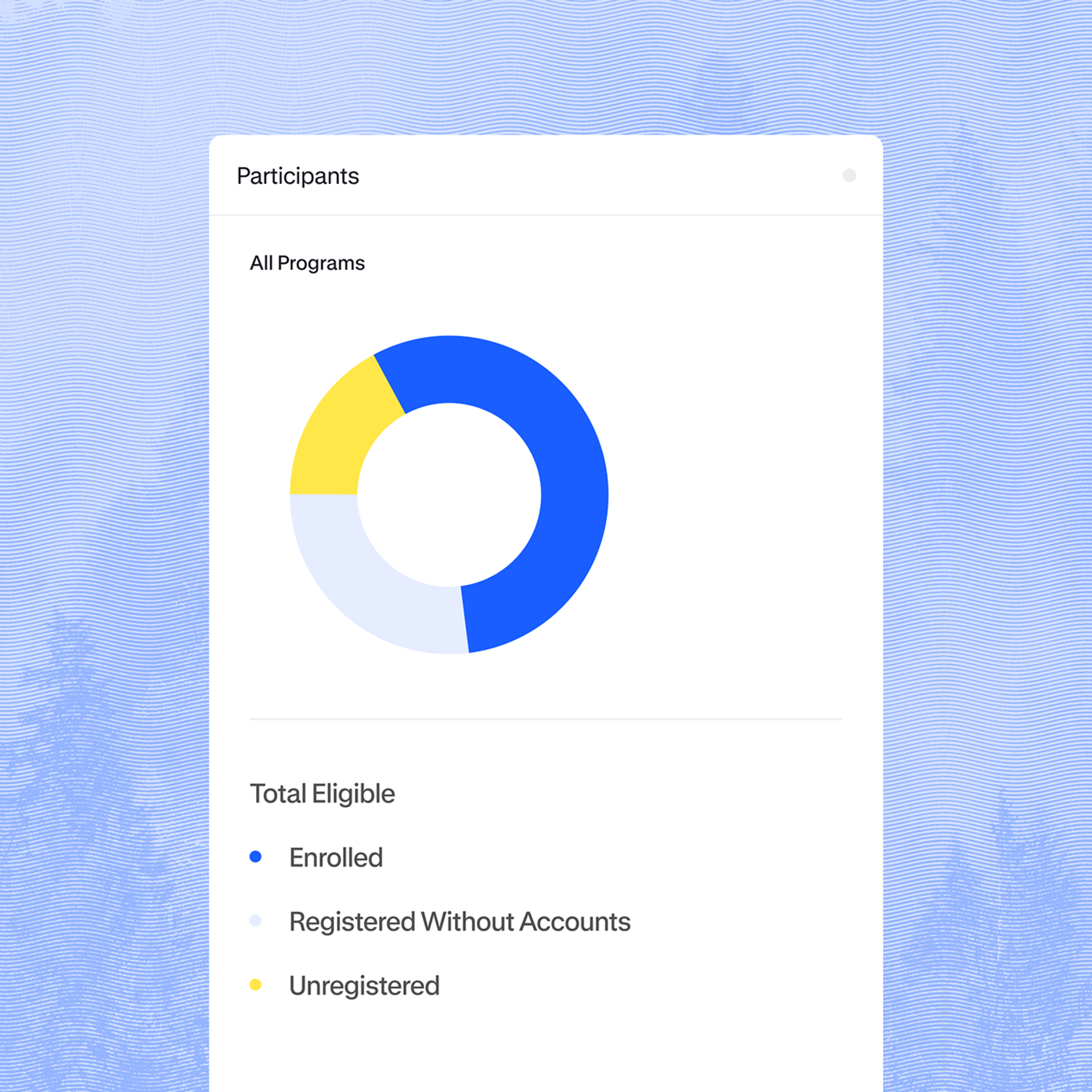

From large tech and financial services firms, to smaller doctors’ offices and legal practices, we’re enabling businesses to address the most pressing financial stressors in their workforce.

Our suite of savings solutions equips businesses to address employees’ long-term and short-term financial wellness goals — all on one, unified platform.

We are one of the originators of student loan repayment solutions. Since 2014, we’ve continued to be a leader in the mission towards a student debt-free future.

Student Loan PayDown provides a contribution from your organization to help employees pay down their student loans. Employees also have access to tools and resources to help them learn how to reduce student loan debt today—and increase savings for tomorrow.

Remove student debt as a barrier to retirement savings by matching employees’ student loan payments with contributions towards their retirement account.

Employees are able to receive up to $5,250 in employer student loan contributions per year tax-free. State income tax treatment may vary by state. If you have additional questions about this, please consult your human resources department.

Student loan refinancing is only available to employees who reside in certain states.