Learning Center

A complimentary, integrated library of financial wellness resources and interactive learning modules on foundational topics, from budgeting to saving for a home to planning for milestones.

Explore

Expand your offering and meet the diverse needs of your clients for both long-term and short-term financial goals by adding Vestwell’s emergency savings account (ESA) to your benefits portfolio.

Vestwell’s ESA equips employees to save for the unexpected with competitive interest rates,¹ optional employer contributions, and penalty-free access to ESA funds. It’s a powerful addition to your holistic benefits package—and available alongside a Vestwell retirement plan and other workplace savings solutions on one seamless platform.

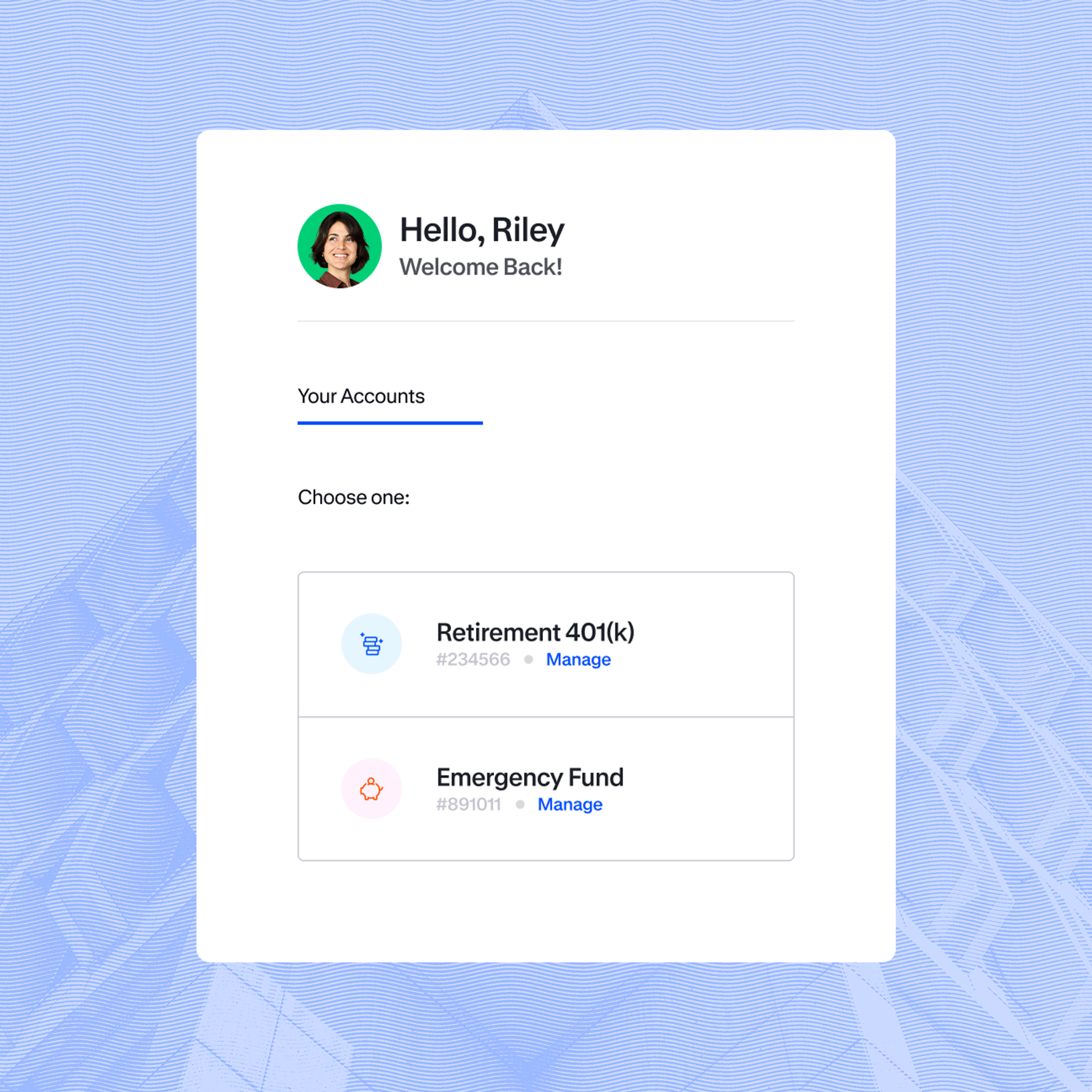

Vestwell’s platform is built to integrate an ESA alongside retirement, education, and other benefits—in one place, on one unified portal, presenting you with a seamless cross-sell opportunity.

Drive deeper client relationships and expand your financial wellness toolkit to reach new business with a comprehensive benefits strategy. From setup to ongoing service, Vestwell handles all the administration and operations—you just need to start the client conversation.

Vestwell’s ESA reduces the need for retirement loans and withdrawals and keeps more assets within the plan—meaning more funds towards investments that earn advisory fees. Boost retirement plan health and encourage smart savings habits, reflecting positively on your advisory impact.

A complimentary, integrated library of financial wellness resources and interactive learning modules on foundational topics, from budgeting to saving for a home to planning for milestones.

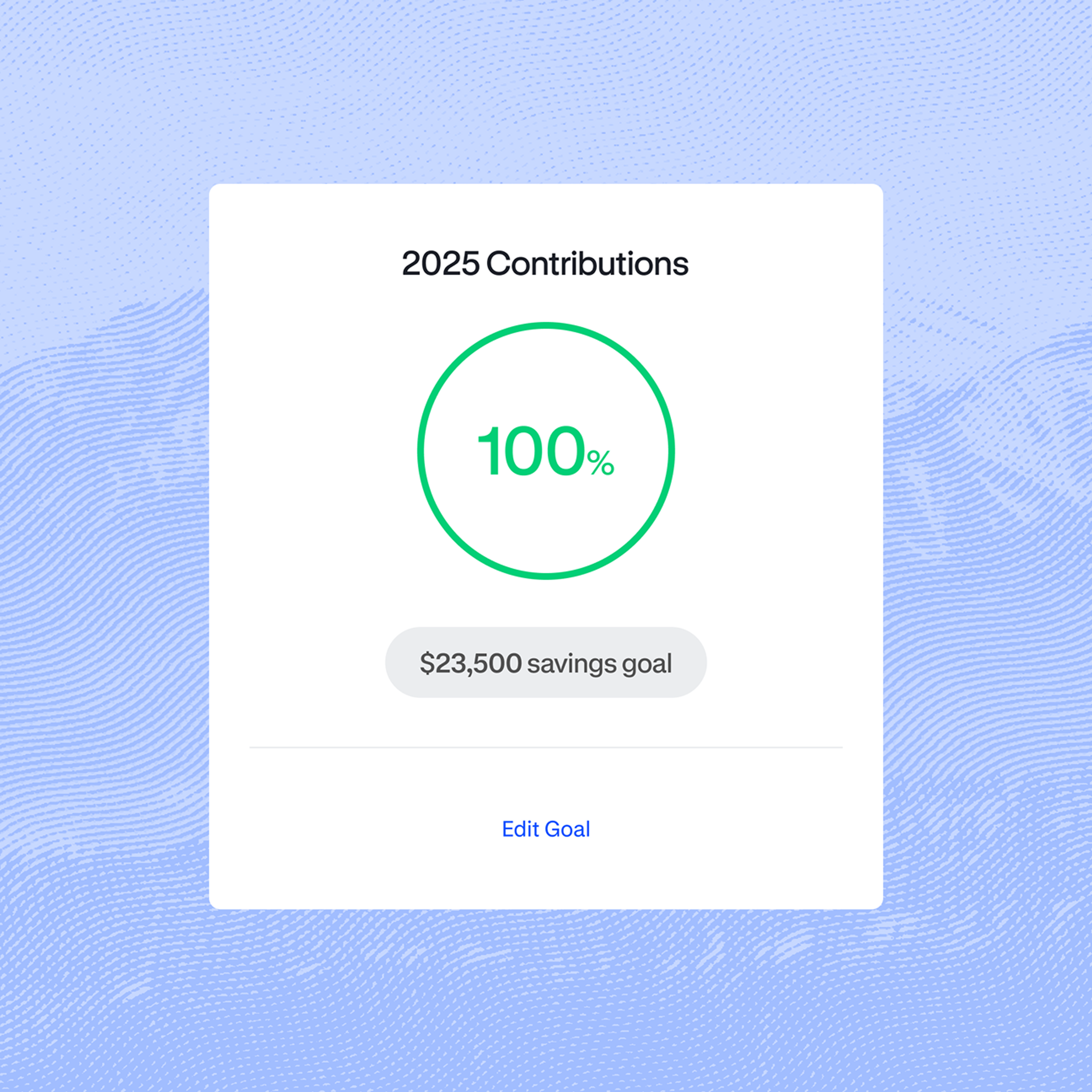

ExploreEmployees can manage their account and savings on the go with the Vestwell mobile app. They can set contributions, adjust account details, and track progress anytime, anywhere.

Download on the App Store

With 38% of Americans unable to cover a $1,000 emergency², clients and their employees seek benefits that build financial security for today and tomorrow. Vestwell’s ESA can help you meet rising demand for holistic benefits and expand your book of business to clients at all stages of their financial journey.

Vestwell makes it easy to embed ESAs into your offering—helping clients meet today’s needs while supporting long-term outcomes.

Yes! Vestwell’s ESA is available to clients who offer retirement plans on our platform and integrates seamlessly with existing Vestwell benefits, or as a standalone savings solution.

Employees can contribute automatically via payroll deduction or by linking a personal bank account.

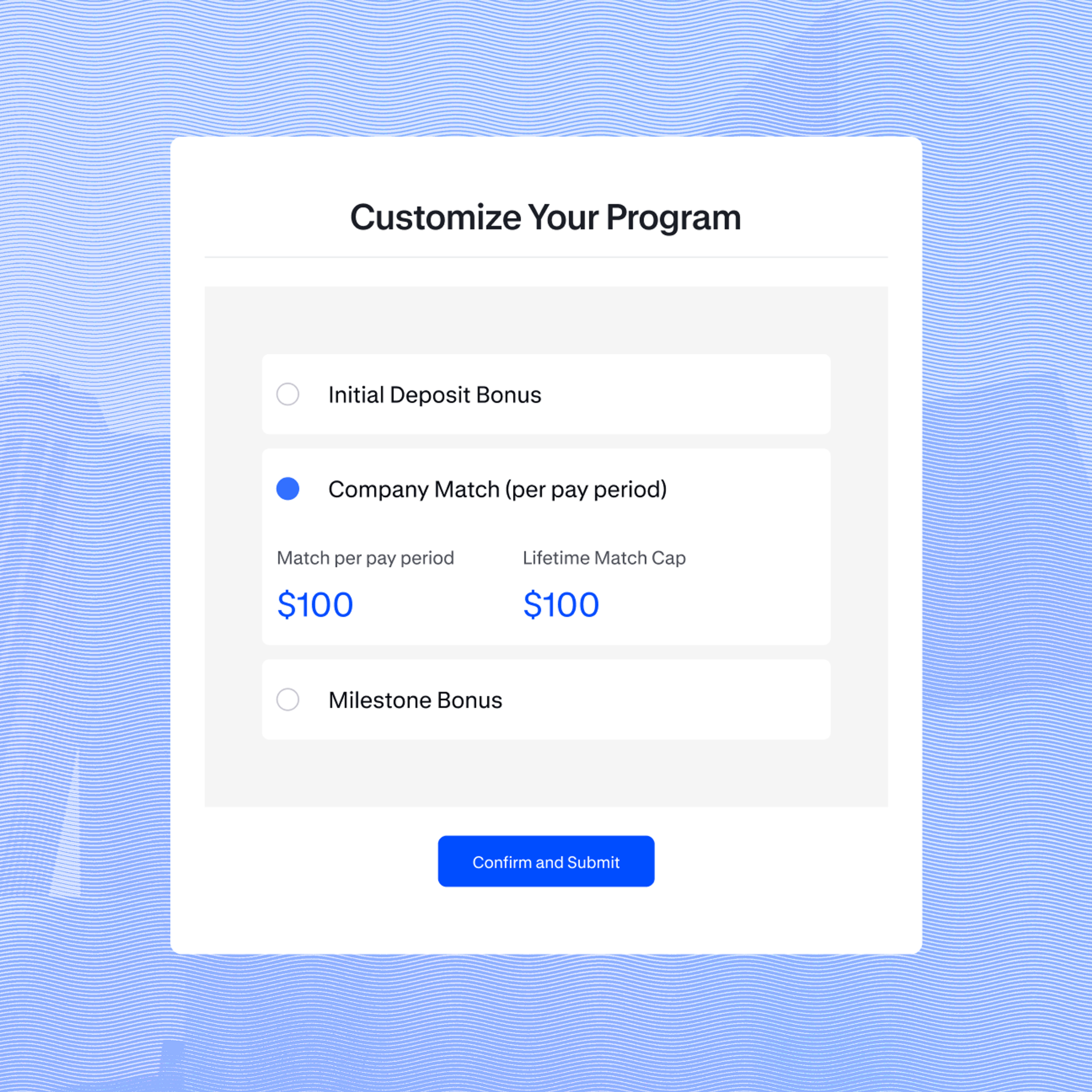

Absolutely. Employer contributions and participation incentives are optional and customizable, including sign-up bonuses, matching contributions, and savings milestone rewards.

No. Vestwell handles implementation, employee education, and ongoing support, so you can focus on building lasting relationships and scaling your book of business.

Yes, Vestwell’s ESA can be offered as a standalone benefit or alongside a Vestwell-managed retirement plan or other savings account. However, bundling typically offers the best value for both you and your clients.

The interest rate on Vestwell's ESA fluctuates. The exact rate will always be available in the ESA account portal, but it is generally higher than interest rates at traditional financial institutions