Vestwell Savings Report: Expanding the Scope of Workplace Wellness Benefits

Worker expectations for employee benefits are shifting. As employees increasingly prioritize long-term financial security and well-being—and look to their employer for support—financial wellness benefits are becoming an important part of the modern workplace benefits package.

Vestwell, a modern savings platform building a comprehensive suite of solutions across retirement, health, and education, surveyed 1,200 savers across the United States for our annual “Vestwell Savings Industry Report.” The survey revealed that employee demand is rising for comprehensive benefits that address real-life challenges—from healthcare expenses to emergency savings and more.

In this article, we’ll explore sought-after financial benefits such as Emergency Savings Accounts (ESAs), Health Savings Accounts (HSAs), and Achieving a Better Life Experience (ABLE) Savings Accounts. We’ll also share how employers can distinguish themselves by expanding their benefits package to meet evolving employee needs and demands.

The Call for Comprehensive Financial Wellness at Work

Workplace financial benefits have been 400 years in the making, starting with the first pension plan in 1636. Since then, employees have increasingly valued employer-sponsored perks that support their health, wellness, and financial stability.

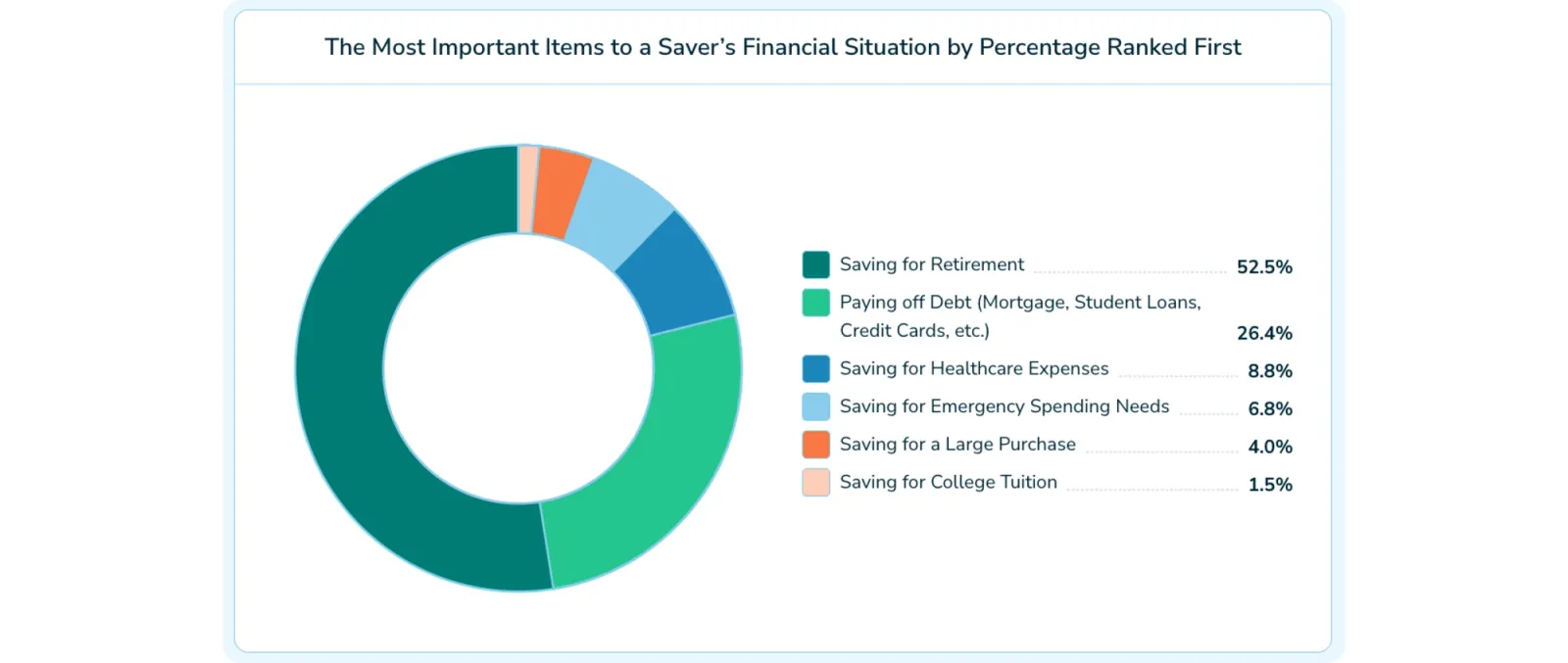

While retirement plans have evolved to become an expectation for employees, the results of our survey also indicated increasing demand for other workplace financial benefits, such as solutions for emergency and health savings. 76% of employees feel stressed about their financial situation, so it’s not surprising that they are searching for additional support from their employer.

Workplace benefits are continually evolving to meet employee demands and capture talent in a competitive job market. Below, we’ll explore the top emerging financial benefits that employees seek and the driving factors behind this growing demand.

Emergency Savings Accounts (ESAs)

What Are ESAs?

An ESA, or Emergency Savings Account, is an emergency fund used to build savings for unplanned expenses or financial emergencies. ESAs offer an opportunity to save for short-term emergency expenses without the penalties of dipping into long-term savings or turning to long-lasting debt. ESAs can take many forms, and adding an ESA to a company benefits package is one of their valuable use cases. When integrated with payroll, employees can contribute automatically to their emergency savings account with funds from their paychecks.

Employee Demand for ESAs

Our survey results indicate strong employee demand for employer-sponsored ESAs—or ESAs offered via an employer: 69% of respondents expressed willingness to participate in such a program. Furthermore, half (50%) of savers surveyed agree that the availability of an ESA would increase their likelihood of remaining with their current employer.

What Prompted Demand for ESAs?

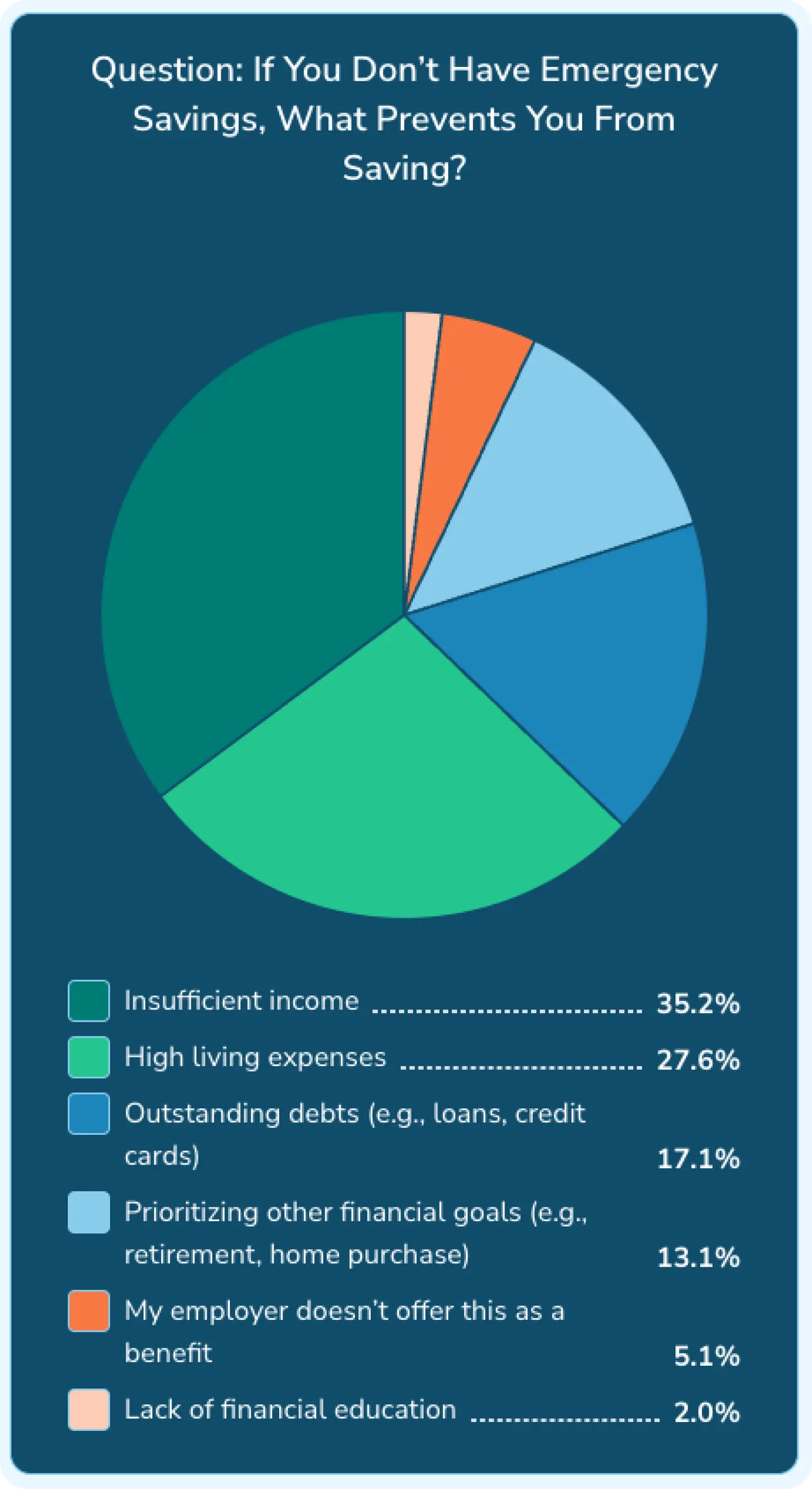

The pressing need for emergency savings is the primary driver behind the surge in demand for ESAs among employees. When it comes to a rainy day fund, the results of our survey reveal a significant shortfall: 38% of respondents have less than $1,000 in emergency savings, and 29% report having no emergency savings at all. However, the Consumer Financial Protection Bureau (CFPB) states that the median amount of money people report they and their family need in savings for emergencies is $10,000.

Even among those who have managed to set aside some funds, 65% acknowledge that their savings would not be sufficient to cover six months of expenses, a commonly recommended benchmark for financial security.

How Businesses Can Support Employees

By offering an ESA program, businesses can equip their workforce to prepare for unexpected expenses today and plan for future costs tomorrow. In addition, employers can enhance their ESA program by contributing directly to their employees' emergency savings accounts. By adding an ESA to their company benefits package, businesses can help alleviate financial stress and promote financial wellness among their workforce.

50% of savers agree that the availability of an ESA would increase their likelihood of remaining with their current employer.

Health Savings Accounts (HSAs)

What Are HSAs?

HSAs, or Health Savings Accounts, are tax-advantaged savings accounts that allow savers to contribute money on a pre-tax basis to cover qualified medical expenses. These accounts are paired with high-deductible health plans (HDHPs) and offer significant tax benefits, including tax-deductible contributions, tax-free growth of funds, and tax-free withdrawals for qualified medical expenses. Employers may offer HSAs to employees and can choose to make contributions to their accounts.

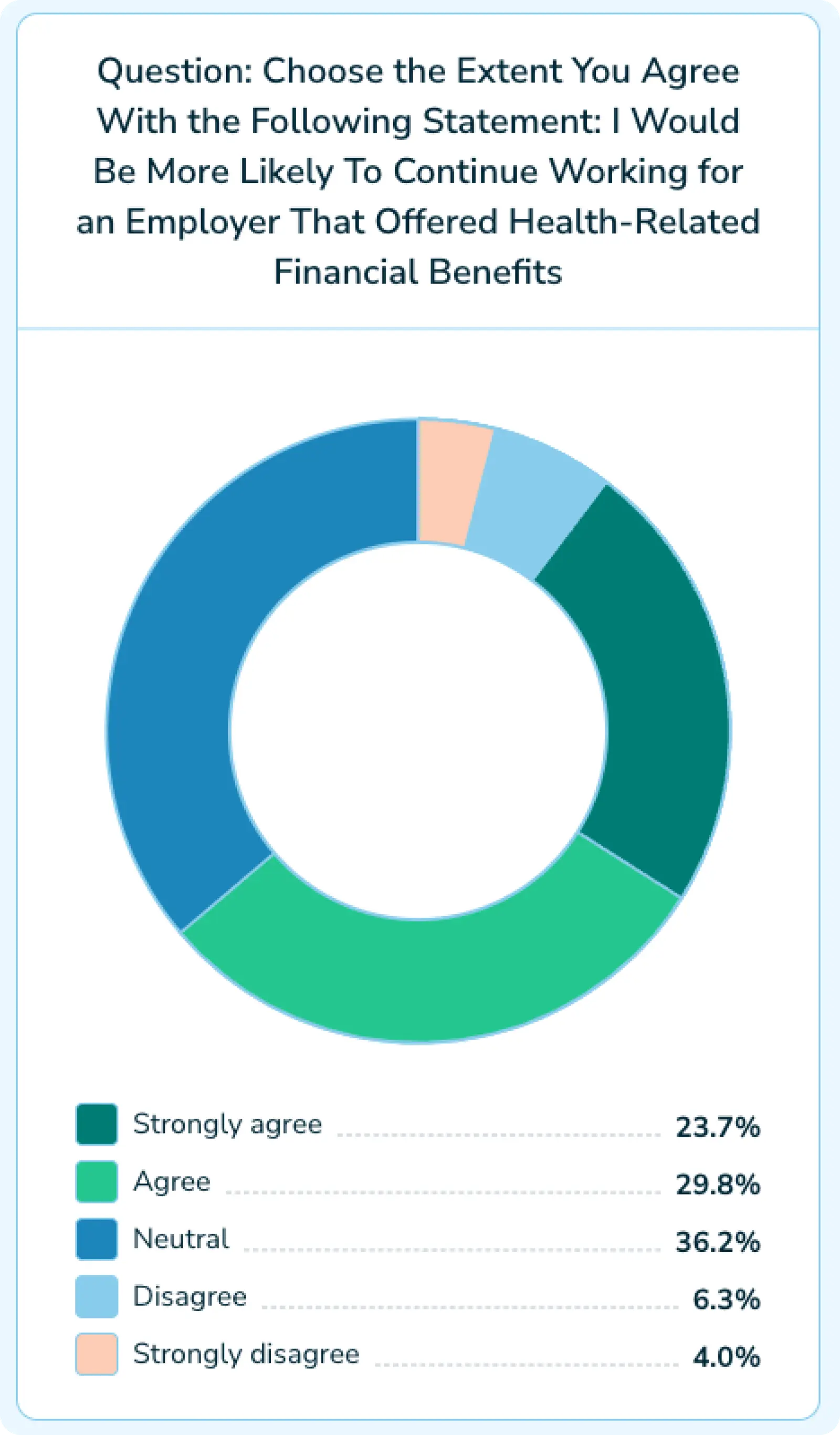

Employee Demand for HSAs

The desire for HSAs is strong—87% of employees placed some level of importance on having access to an HSA in the workplace. In addition, 54% of respondents would be more inclined to continue working for an employer that provides access to an HSA. Despite this interest, only 27% of savers reported having an HSA. This indicates a significant gap between employee demand and current availability.

What Prompted Demand for HSAs?

Over the last 50 years, spending on healthcare has increased by nearly 6,000%. In addition to increased spending, a report by KFF reveals that unexpected medical bills and the cost of healthcare services are at the top of the list when it comes to respondents’ financial worries. Rising costs, coupled with the stress workers feel about medical-related expenses, are potential drivers behind the strong demand for HSAs in the workplace.

How Businesses Can Support Employees

Employers have an opportunity to address this growing demand by incorporating HSAs into their benefits package. By offering these savings vehicles, businesses can provide employees with a valuable tool for managing healthcare expenses and saving for future medical needs. Additionally, providing access to HSAs can enhance employee satisfaction and retention, as many employees place importance on having access to these accounts in the workplace.

54% of respondents would be more inclined to continue working for an employer that provides access to an HSA.

ABLE Accounts

What Are ABLE Accounts?

ABLE (Achieving a Better Life Experience) Savings Accounts are state-facilitated programs designed to help Americans with disabilities build savings. These accounts provide a tax-advantaged way for these individuals and their families to save for qualified disability expenses, such as education, housing, transportation, healthcare, and more.

Notably, the first $100,000 saved in an ABLE account is not counted against Supplemental Security Income’s (SSI) $2,000 asset limit. This allows individuals and their families to accumulate substantial savings without affecting their SSI benefit eligibility.

Employee Demand for ABLE Accounts

Among respondents who have an immediate family member with a disability, 77% say that having an ABLE Savings Account is somewhat important, or more, to their financial situation. This highlights the potential demand for ABLE accounts among individuals directly connected to someone with a disability.

What Prompted Demand for ABLE Accounts?

Millions of Americans with disabilities depend on various public benefits for income, health care, food, and housing. However, historically, individuals could not hold more than $2,000 in assets to be deemed eligible for many of these benefits, including Medicaid and SSI. This previously limited the savings opportunities for those with disabilities.

Since the launch of ABLE in 2014, Americans with disabilities have been able to grow their savings without jeopardizing their eligibility for public benefit programs. As employees realize the advantages of ABLE accounts, they are quickly gaining popularity and demand.

How Businesses Can Support Employees

As more individuals have become familiar with ABLE accounts and look to expand the scope of their financial workplace perks, businesses are beginning to fit ABLE accounts into their suite of benefits.

While a newer objective, ABLE accounts are beginning to gain traction both inside and outside of the workplace. Employers may provide information to their employees about the ABLE program within their state. In addition, employees may set up a payroll direct deposit account for themselves, and businesses may make contributions to this account. This movement represents an opportunity for employers to educate employees about the availability and benefits of ABLE Savings Accounts.

Among respondents who have an immediate family member with a disability, 77% say that having an ABLE Savings Account is at least somewhat important to their financial situation.

Unlocking Business Success With Expanded Workplace Benefits

Expanding your company’s benefits package is a strategic decision that can have a number of positive effects on your business. Businesses can leverage growing employee demand for expanded benefits to attract and retain top talent in the job market. In addition, such workplace environments with comprehensive financial wellness benefits demonstrate a commitment to the overall well-being and long-term success of employees.

Conclusion: The Future of Workplace Financial Wellness

As workers’ expectations around workplace benefits shift to focus on financial wellness, businesses have an opportunity to support employees and help mitigate the challenges they face across multiple areas of life—from retirement to emergencies, healthcare, and disability expenses. Tax credits, state-facilitated savings programs, and employee demand have made now an opportune time for businesses to expand their benefits offerings.

Click here to view the full “Vestwell Savings Industry Report” and learn more about the saving trends that are shaping workplace financial wellness.