Vestwell Savings Report: The Evolution of Workplace Retirement Plans From Perk to Prerequisite

Workplace retirement benefits are no longer just a nice-to-have addition to a job offer—they have become a fundamental aspect of employee recruitment and retention.

Vestwell, a modern savings platform building a comprehensive suite of solutions across retirement, health, and education, surveyed 1,200 savers across the United States for our annual “Vestwell Savings Industry Report.” We learned that employer-sponsored retirement plans are a priority for employees—they’ve evolved from a bonus perk to a non-negotiable requirement.

In this article, we’ll explore how workers are turning to their employers for help amid current economic challenges and highlight the opportunities businesses have to strengthen their competitive edge while providing meaningful solutions for employees. Let's dive in.

Current Economic Conditions

In the years following the pandemic, the economy has presented challenges to workers across the nation. From the sharp rises in inflation to high interest rates, individuals are no doubt feeling financial pressure. This reality is becoming increasingly hard to ignore, with everyday expenses steadily climbing and the value of hard-earned wages struggling to keep pace.

Our survey revealed that 76% of savers are stressed about their financial situation. Whether it’s struggling to pay rent, making student loan payments on time, or keeping up with the increasing cost of essentials, employees across the board find themselves facing economic strain.

76% of savers are stressed about their financial situation.

On top of that, 79% of survey respondents reported that inflation has impacted their ability to save. Employees are finding themselves in a position where saving is a challenge—be it for a down payment on a first home, building up their emergency savings, or setting aside money for retirement.

Employees Are Prioritizing Retirement Savings Despite Economic Challenges

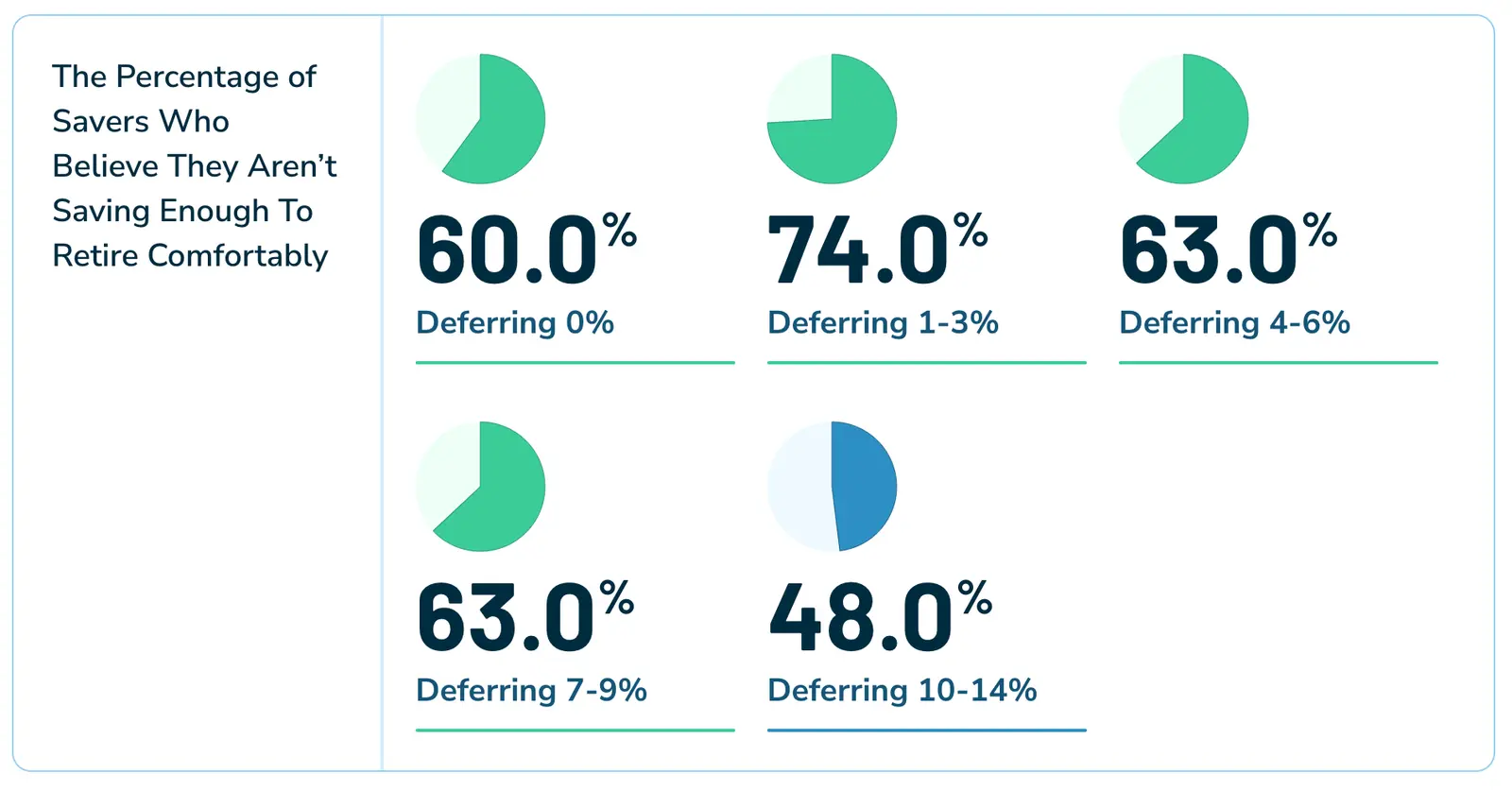

In spite of these challenges, workers are still prioritizing their retirement savings. In fact, they wish they could be saving more. The results of our survey reveal a clear gap between savers’ current deferral rates and their perceived ideal savings rates. Among Vestwell 401(k) and 403(b) account holders, the average deferral rate in 2023 was 6.4%. While 62% of savers believe they should defer 10% or more of their salary to retire comfortably, only 34% of savers actually contribute to that degree.

This discrepancy points to a broader issue: contributing to retirement savings, among other living expenses, continues to be a challenge for many. In fact, 40% of respondents reported their biggest concern when it comes to saving for retirement is that they cannot afford to save enough. A higher salary and employer match were identified as key motivators for respondents to increase their retirement savings.

Generational Saving Trends

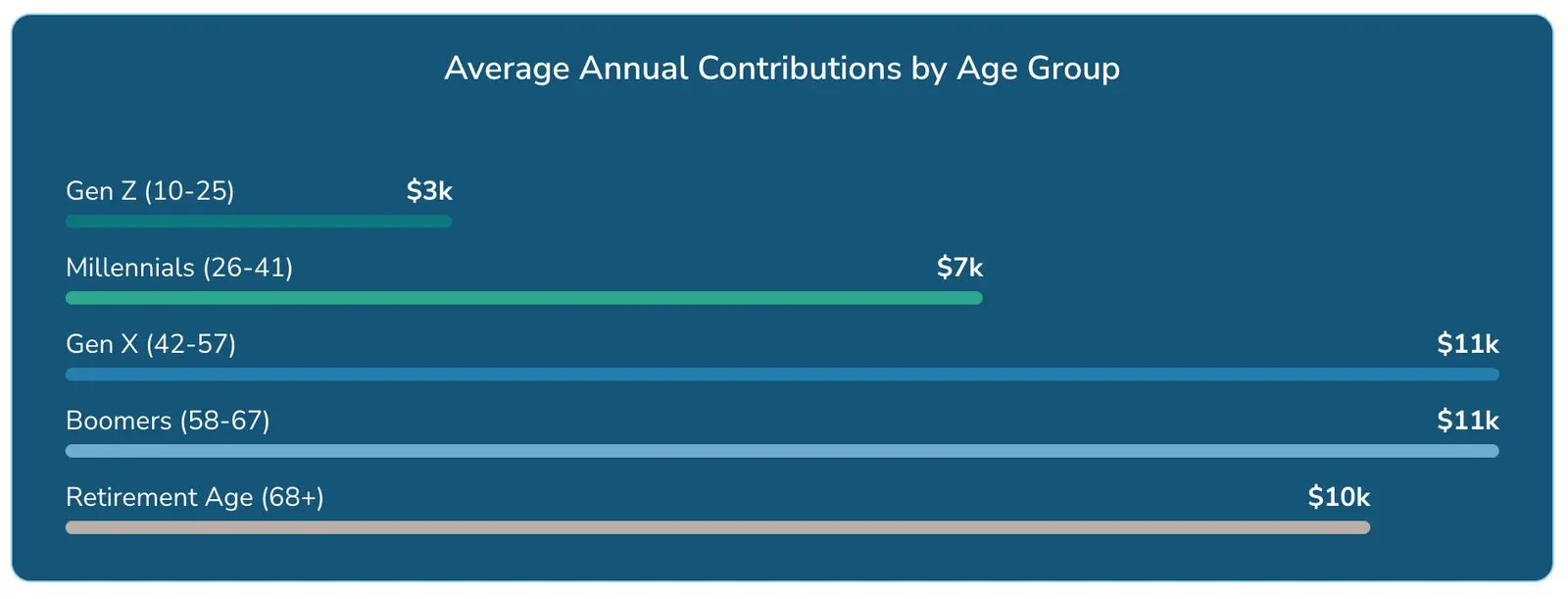

Vestwell's 401(k) and 403(b) saver data provide deeper insight into retirement saving trends across generations. The average annual contribution amount for each generation on our platform has shown resilience despite economic challenges, with figures staying within $2,000 of the levels in recent years.

This data underscores the continued commitment to retirement savings across all age groups, further emphasizing the essential role of workplace retirement plans.

Savers Are Turning to Employers for Help

Amid this increased financial stress and economic uncertainty, savers are turning to their employers for support with their retirement savings. And they’re not just asking for help, they’re expecting it.

Employees increasingly view company-sponsored retirement plans as essential, not optional. 85% of Vestwell’s survey respondents expect their employer to offer retirement benefits, a notable increase from the 72% of respondents who responded similarly in the prior year. It’s clear that employee demand for workplace financial benefits is growing quickly, and employers will need to adapt to remain competitive.

85% of respondents expect their employer to offer retirement benefits.

Employers Can Benefit From Offering a Plan

The good news for employers in all this? There are key opportunities and advantages for businesses—such as improved employee performance, increased recruiting and retention capabilities, and the potential for certain tax advantages—when they expand their benefits package to include a retirement plan.

Improve Employee Performance

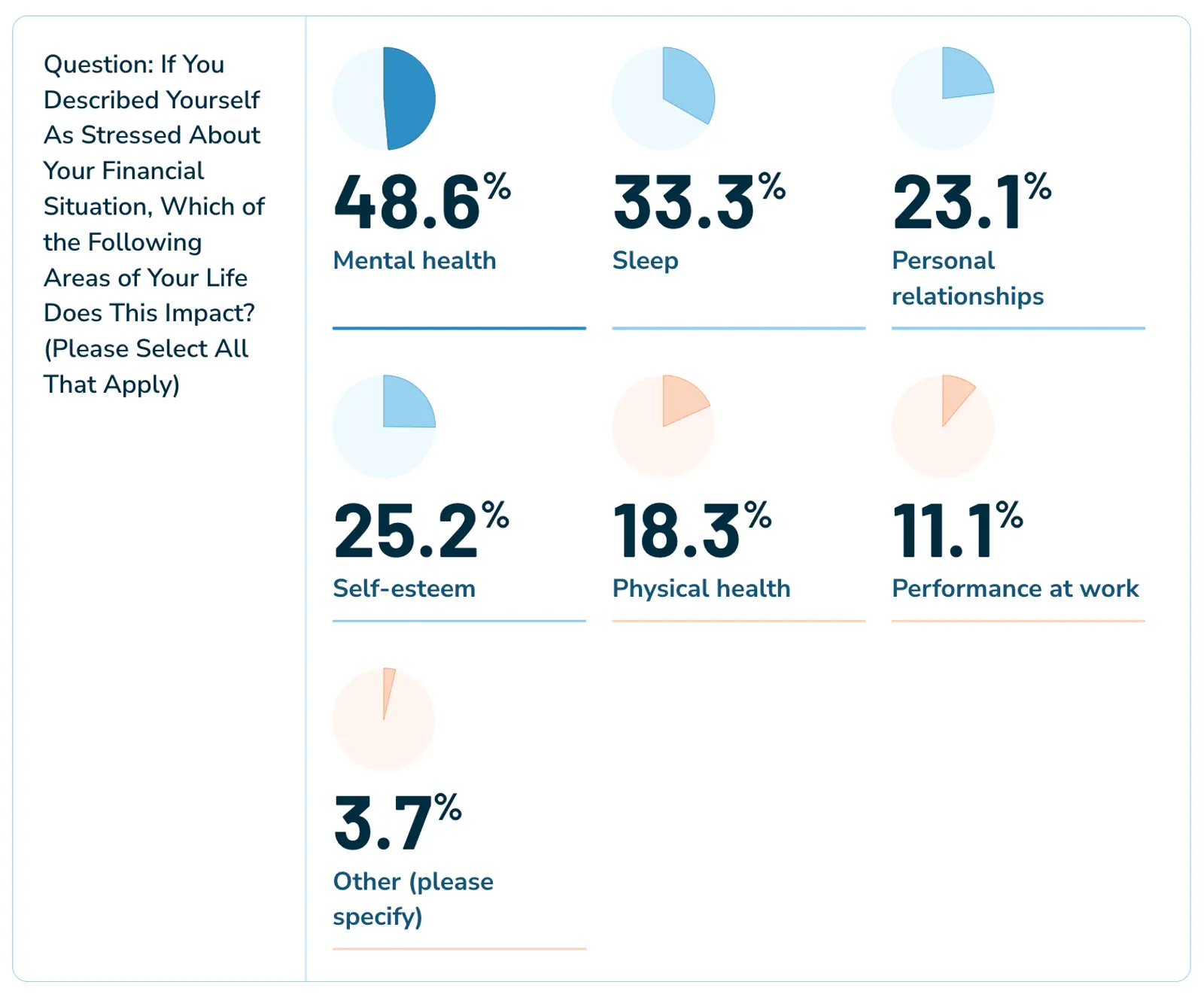

Many employees say that their financial stress has hindered their overall health and ability to work. In fact, among employees who report they are stressed about their finances, over 48% say it has impacted their mental health, 33% note their sleep has suffered, and 11% indicate their work performance has been adversely affected. By offering a retirement plan, employers can not only illustrate a commitment to their employees but also, in the long run, have workers who may be more focused at work.

Recruit & Retain Top Talent

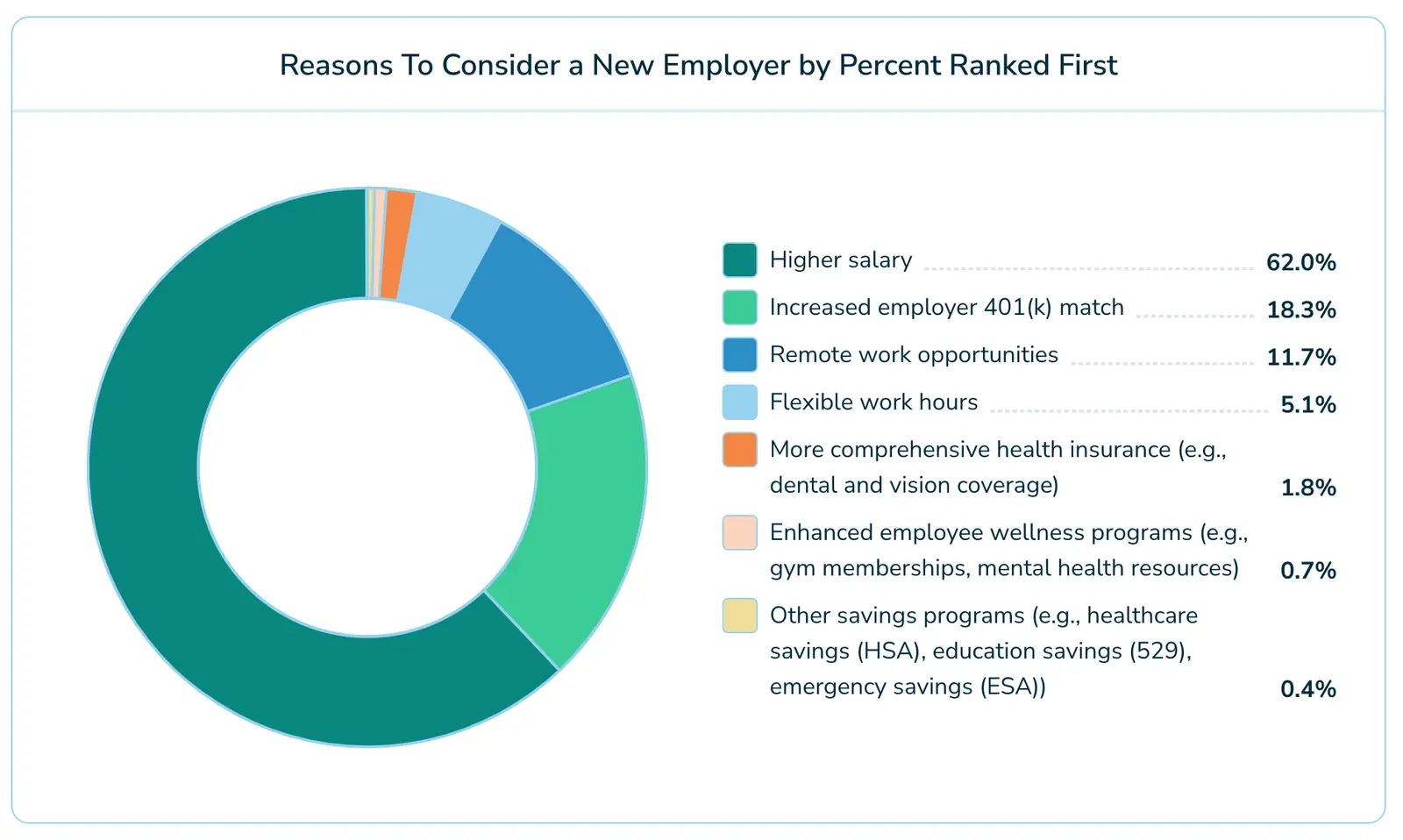

In addition to reducing stress and improving employee well-being, company-sponsored retirement plans are a powerful recruiting and retention tool. Retirement plans are a must-have for employees when selecting an employer in today’s competitive job market. Despite a challenging economy, employees are making it clear that saving for their later years is still a major priority. Vestwell survey respondents also indicated an increased employer 401(k) match as a top reason to consider a new employer, second only to a higher salary. To attract and retain top talent, businesses must align their benefits package with the changing demands of employees.

On top of that, our survey revealed that 89% of employees would be more likely to continue working for an employer that offered a retirement benefit. These data indicate that workplace retirement plans are more than just a perk; they are a fundamental aspect of employee satisfaction and retention.

Conclusion: The Future of Workplace Financial Wellness

As retirement savings continue to be a top priority for American workers, employers are poised to play a pivotal role in shaping more robust and accessible retirement savings solutions. By adding a retirement plan to their company’s benefits package, employers can attract talent, improve employee retention and satisfaction, and demonstrate a lasting commitment to the financial health of their team.

With improvements in technology and additional tax credits for employers introduced in the SECURE Act 2.0, it is now more affordable for businesses to offer retirement plans and employer matches.

Click here to view the full “Vestwell Savings Industry Report” and learn more about the saving trends that are shaping workplace financial wellness.