Learning Center

A complimentary, integrated library of financial wellness resources and interactive learning modules on foundational topics, from budgeting to saving for a home to planning for milestones.

Prepare for the unexpected expenses of today and plan for a more financially secure tomorrow with Vestwell’s Emergency Savings Account (ESA).

Life happens—a flat tire, a lost job, a sports injury in your local league. By setting money aside in your ESA, you’re in control, no matter what life throws your way.

Build your emergency fund faster with help from high-paying interest rates¹ and potential employer contributions, money your company may provide towards your ESA when you sign up and save.

Get as fast as next-day access to your emergency funds without fees or withdrawal penalties. Plus, with the Vestwell mobile app and multilingual support, your emergency savings are always within reach when you need them most.

Fund your account without lifting a finger via automatic paycheck deductions or recurring bank account transfers, depending on your company program. You can also make one-time bank deposits for an extra boost whenever you need.

A complimentary, integrated library of financial wellness resources and interactive learning modules on foundational topics, from budgeting to saving for a home to planning for milestones.

Manage plans and savings on the go with the Vestwell mobile app. Set contributions, adjust investments, and track progress anytime, anywhere.

Download on the App Store

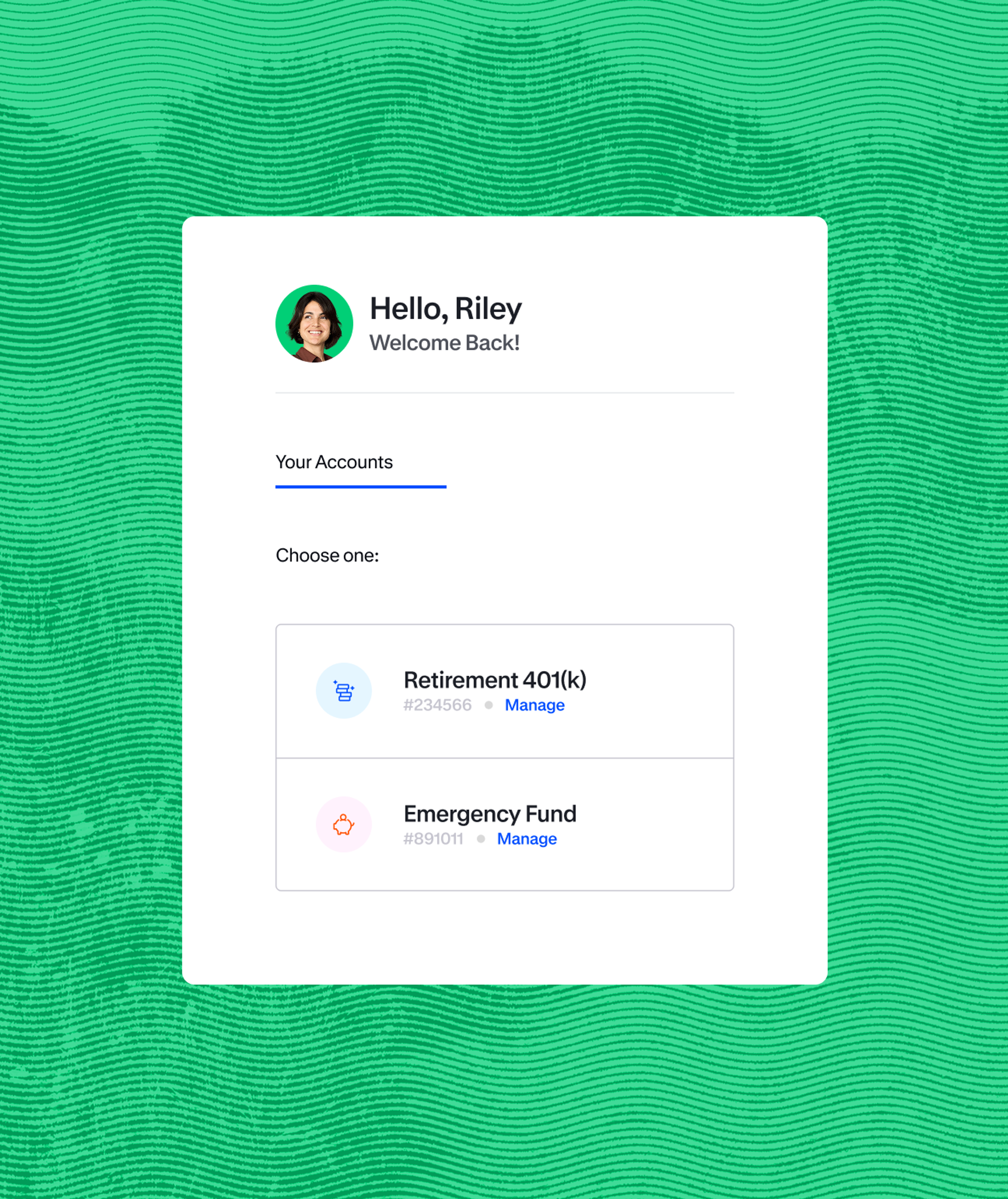

From your Vestwell portal, you can track your savings, adjust your contributions, and monitor progress across your short-term and long-term savings accounts—from retirement to emergencies, education, and more. Your ESA helps you stay prepared for immediate expenses without the penalties of dipping into long-term savings or turning to costly debt, keeping your retirement funds safe for the future.

Set up your ESA and start saving in less than 5 minutes, or log in to manage your emergency funds and take the next step towards your savings goals.

If your employer offers an ESA, you’ll receive an email with instructions to log in and activate your account, or you can click the link here to register.

No. There is no limit on the amount of money you can withdraw from your ESA, as long as the funds are available in your account. However, maintaining a healthy account balance for your financial situation can help you be secure in the face of unexpected challenges.

Yes, you can submit a request to withdraw funds in minutes from your ESA dashboard with no fees or penalties. You’ll receive your funds as fast as the next day.

Some employers offer matching or incentive contributions. Check with your HR team or view your company’s ESA policy within your Vestwell ESA dashboard for details.

With many employer-sponsored ESA plans including Vestwell’s, your money is deposited into an interest-bearing account, such as an interest-bearing savings account. An interest-bearing savings account is a type of bank account where the bank pays you interest or money based on a percentage of your account balance, just for holding your money in the account. With Vestwell’s ESA, the amount of interest you earn is calculated as an “annual percentage yield” or APY. This means that the percentage of your account balance that you earn as interest is expressed on an annual basis. The current APY on the Vestwell ESA is 3.00%, which means your account earns 3% per year. This rate may fluctuate in the future based on prevailing market interest rates set by the United States Federal Reserve.

Yes! Your Vestwell ESA is FDIC-insured for up to $250,000.

The interest rate on Vestwell's ESA fluctuates. The exact rate will always be available in your ESA account portal, but it is generally higher than interest rates at traditional financial institutions.