Mobile App

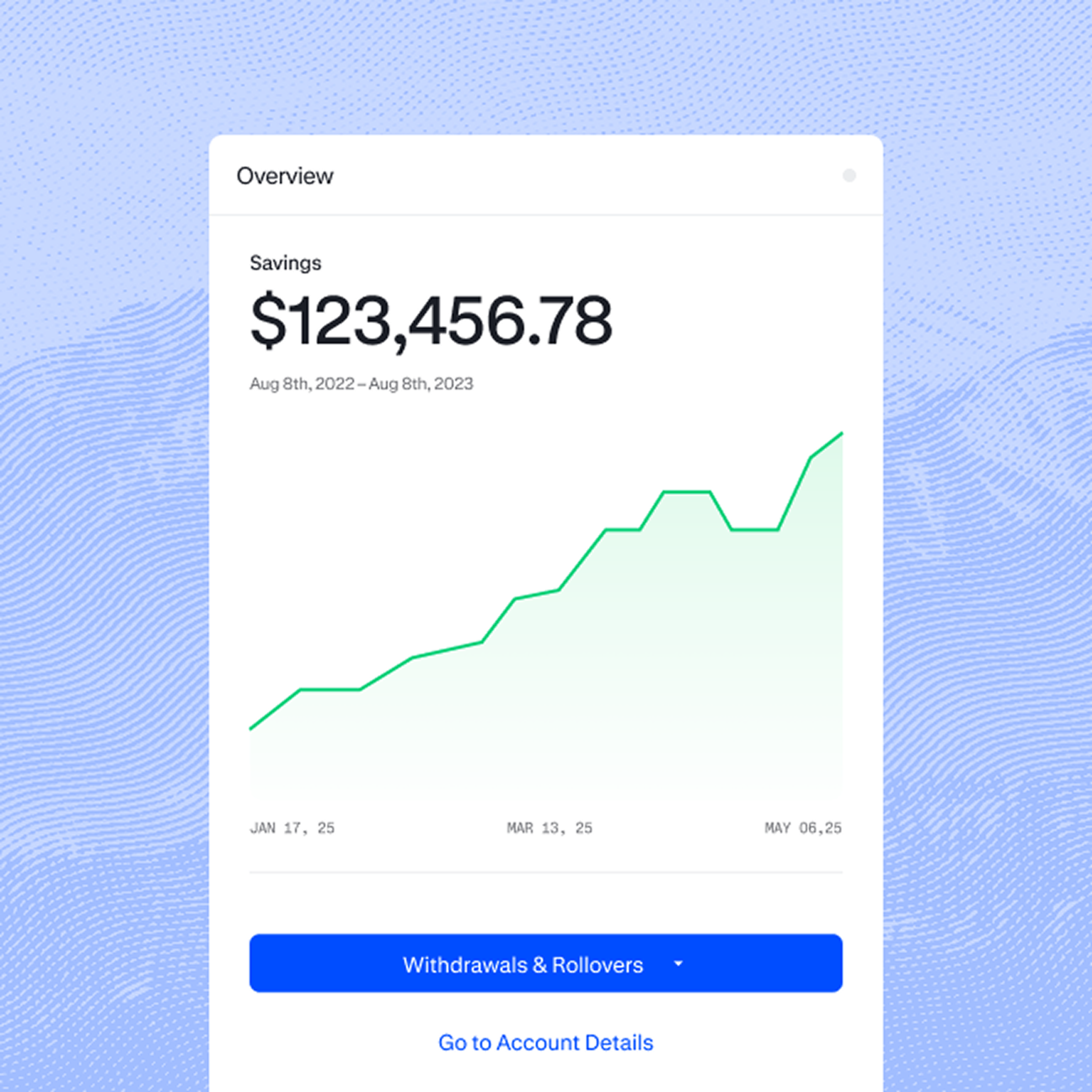

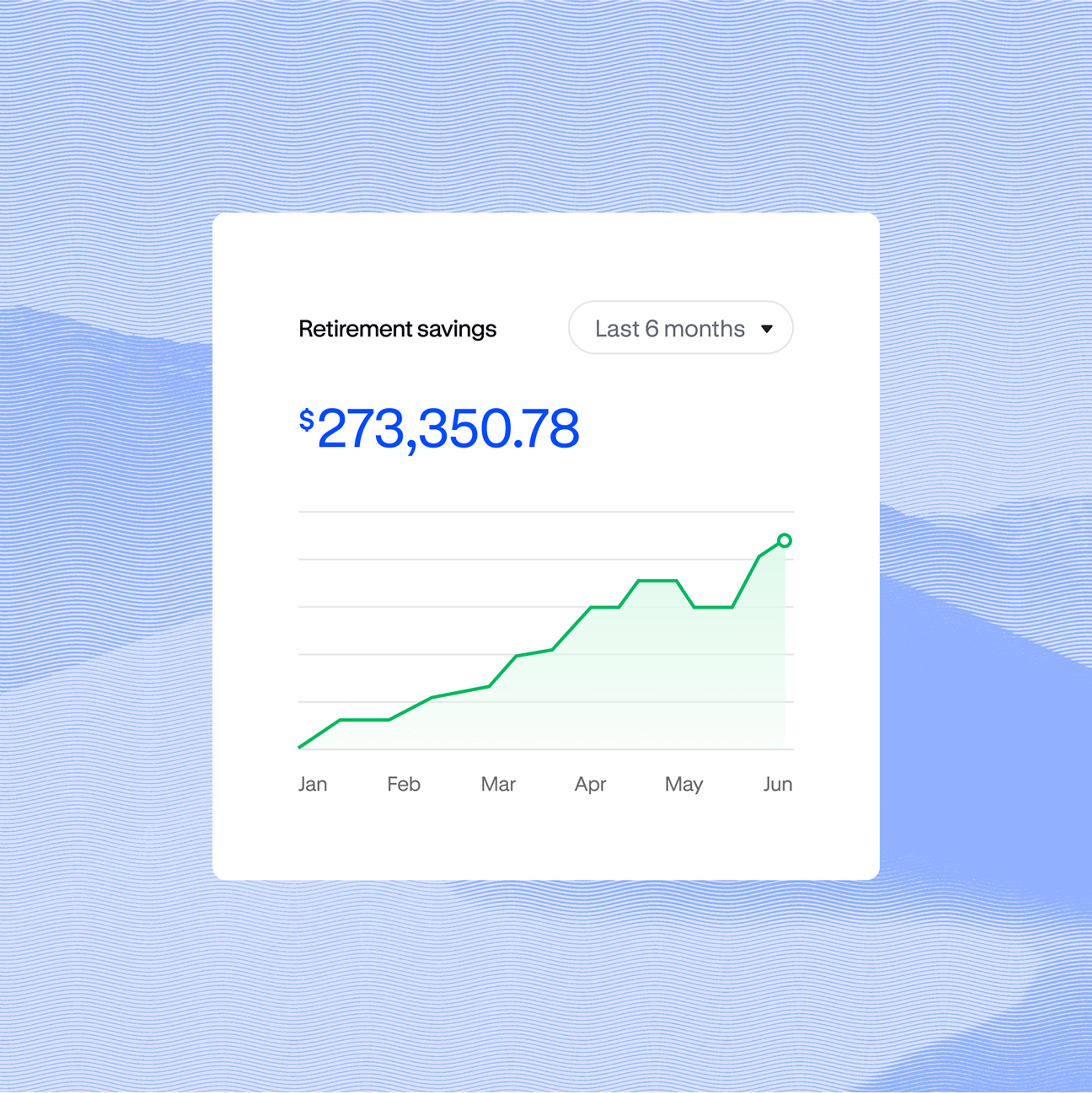

Manage plans and savings on the go with the Vestwell mobile app. Set contributions, adjust investments, and track progress anytime, anywhere.

Download on the App Store

A state-sponsored retirement program for employees without a workplace plan.

Take control of your retirement savings with Individual Retirement Accounts (IRA) facilitated by your state and powered by Vestwell.

Your employer adds you to the program so you’ll be signed up automatically for contributions from your paycheck. You can also open your own account if you do not have an employer who is participating or are self-employed.

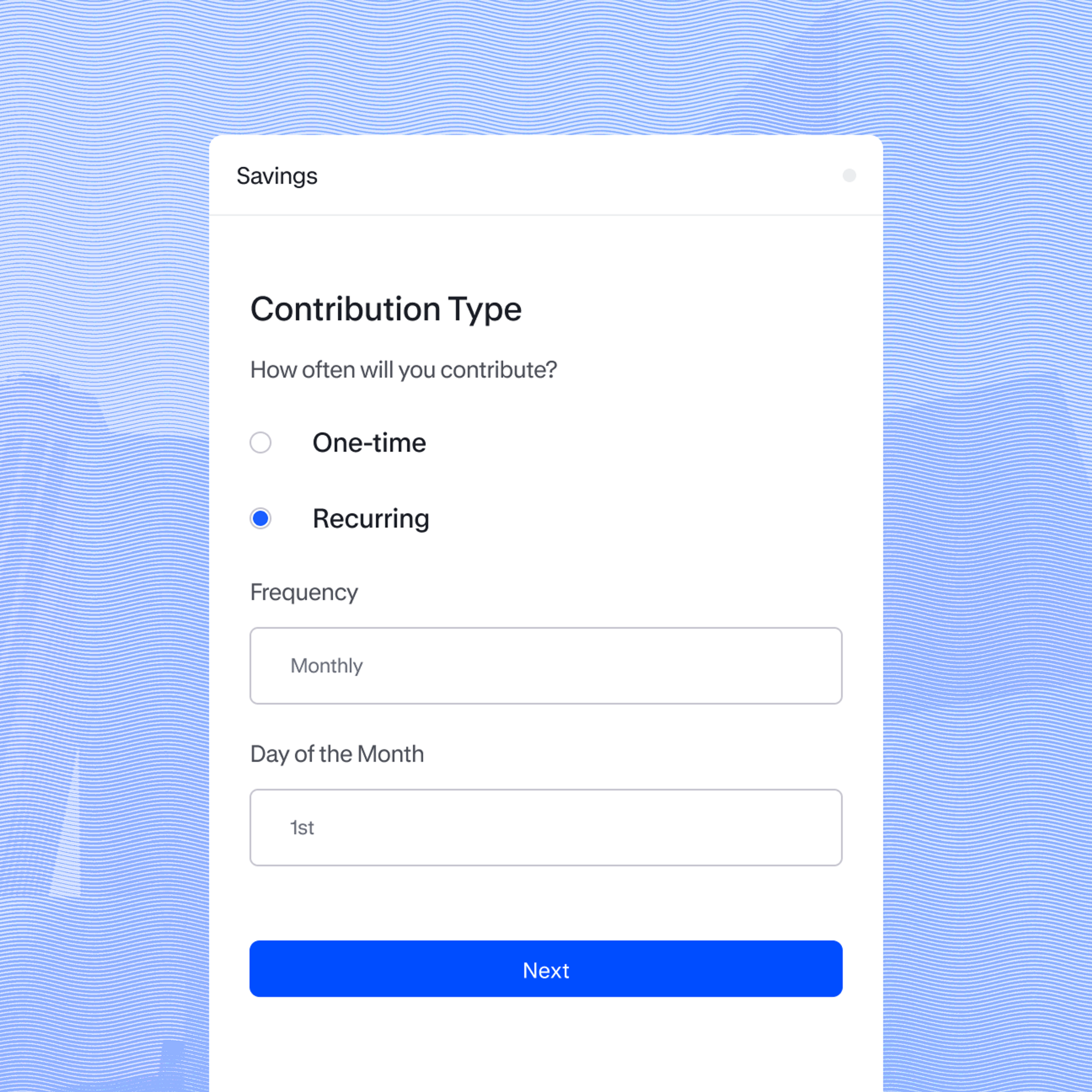

You decide how much to save. Customize your savings rate, make automatic increases to boost your savings each year, or opt out if you’re not ready to participate.

The funds saved in your account are yours. You take them and your account with you, even if you change jobs—all without the need for rollovers.

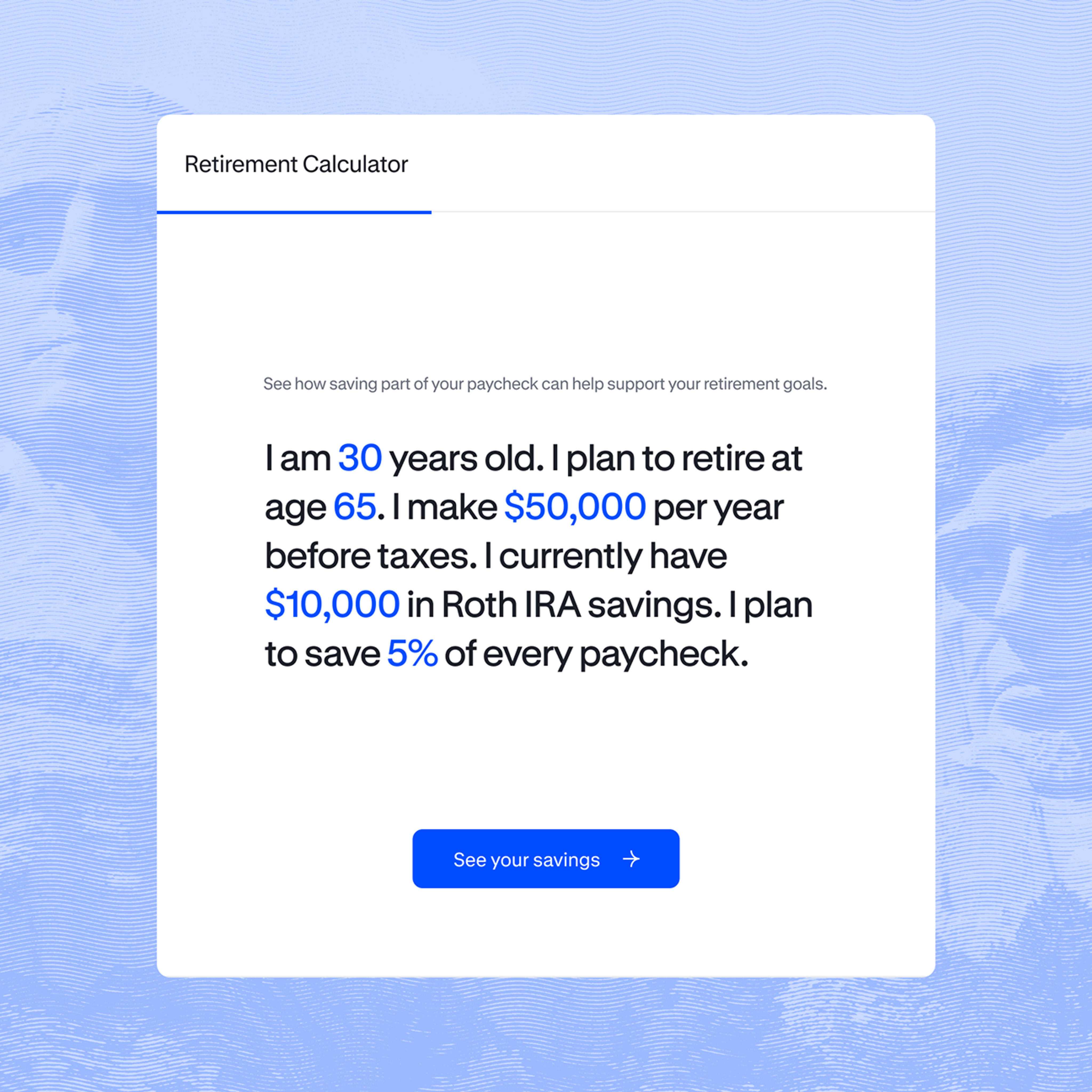

Find useful tools like our retirement savings calculator to help you understand what you might need in retirement and make the most of your account.

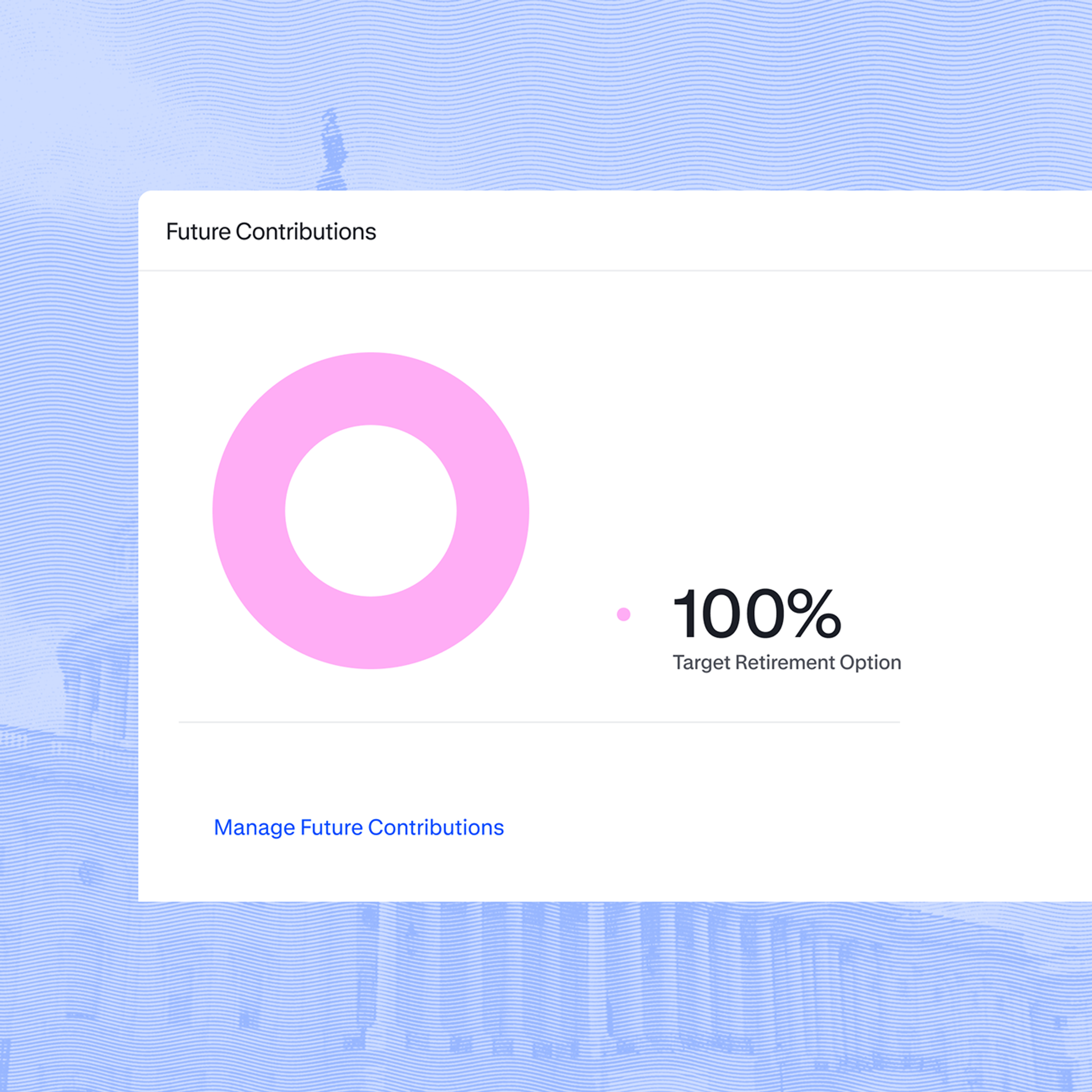

Choose the investment options that meet your savings goals, with portfolios ranging from aggressive to conservative as well as funds based on your target year of retirement.

Manage plans and savings on the go with the Vestwell mobile app. Set contributions, adjust investments, and track progress anytime, anywhere.

Download on the App Store

If your employer has added you to the program and you don’t want to change your default savings options, you don’t need to do anything. If you want to customize your account, you can use your Access Code or provide some personal information to get started.

“With stylists, usually they don’t retire. OregonSaves makes me feel like I actually have a career.”

Yes. If you meet the minimum age requirement, have earned income, are employed in the state of the program you’d like to join, and are eligible to contribute to an IRA, you can sign up online. You can set up automatic contributions through your bank account or contribute by check using a mail-in paper form after the account has been set up.

If you’re self-employed or don’t work for an employer registered with a government-facilitated program, you can contribute directly to your own IRA account.

It’s easy and takes only a few minutes to get started:

You may be able to take advantage of the Saver's Credit if you meet the eligibility requirements. The Saver's Credit is a federal tax credit you can get for making contributions to your retirement plan. You may want to consult with a tax expert or financial advisor for more information.

Vestwell does not provide financial or investment advice to individuals.

Your Roth IRA belongs to you. If you continue to work for an employer that facilitates the program, you can continue to participate and continue payroll contributions. If a new employer doesn’t facilitate the program, you can make contributions directly from your bank account. You can also roll over or transfer your savings from your account to an IRA at another investment provider, if that IRA accepts rollovers or transfers.

There is a small annual asset-based fee paid as a percentage of the money in your account. There may also be an annual account fee. These fees pay for the administration of the program, and the operating expenses charged by the underlying investment funds in which the program’s portfolios are invested.