Protecting financial futures

Automatic savings in an Individual Retirement Account (IRA) can help working individuals begin to save for retirement and avoid the need to rely on public benefits in the future.

Government-facilitated retirement savings programs help both employees and businesses grow and thrive.

Automatic savings in an Individual Retirement Account (IRA) can help working individuals begin to save for retirement and avoid the need to rely on public benefits in the future.

These programs help businesses support their employees and build a stronger work environment at no cost and with limited time investment.

Government-administered plans help employers stay competitive by offering retirement benefits and competing with larger operations for top talent.

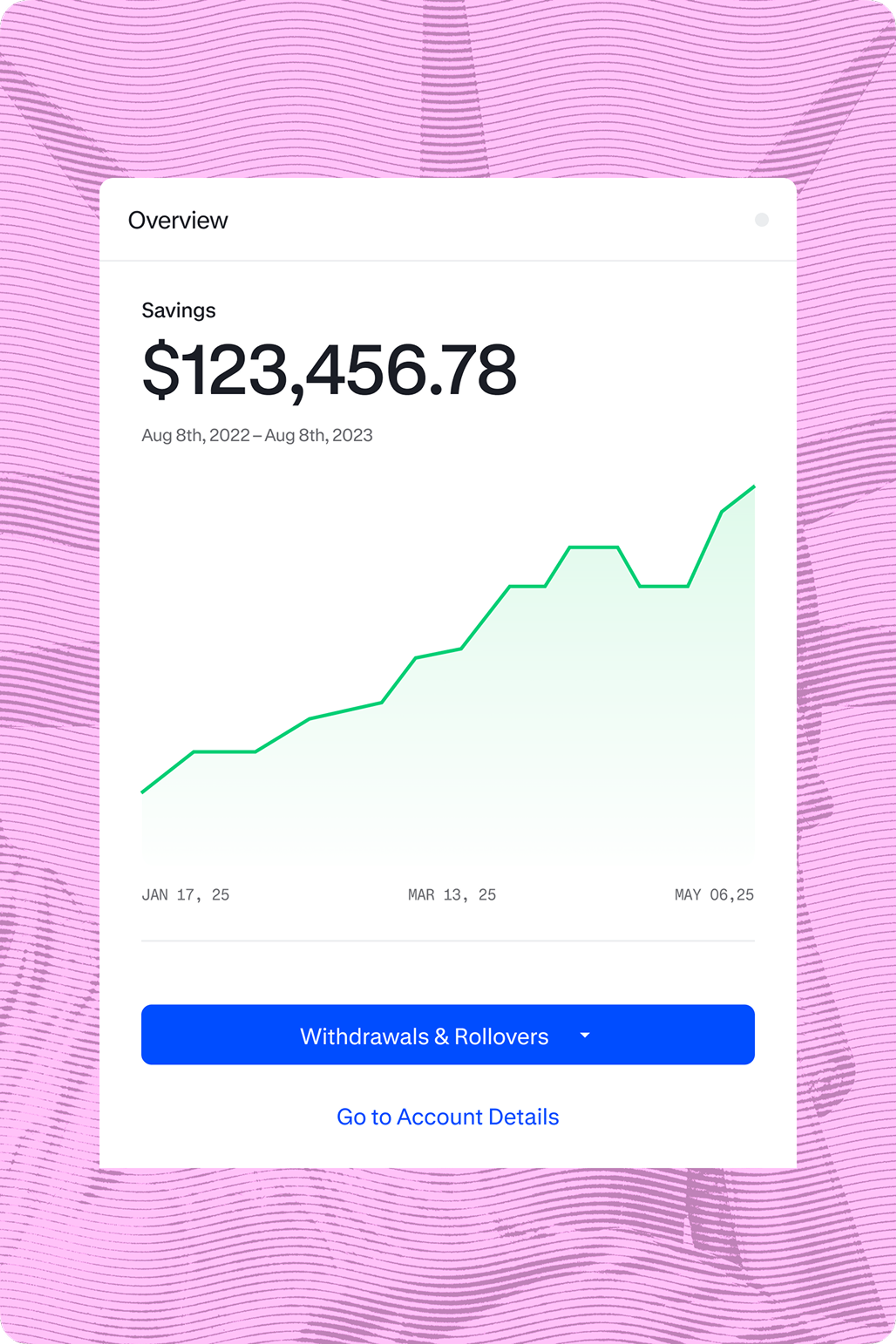

A variety of investment options and portfolios allow savers to customize their savings accounts, investing in a range of funds based on their goals

“OregonSaves is I think a very positive addition to my business and to any small business because now we are actually able to offer something we were not previously able to do. Now, I’m able to compete on a level playing field.”

A modern, white-labeled experience puts your name and brand front and center. Our partnership provides the easy-to-use portal that supports savers and their financial future.

We bring together a comprehensive suite of technology that delivers a holistic solution and makes participation easy for employers and saving automatic for employees.

Acting as exclusive servicing agent for the programs managed by Vestwell, Bank of New York, one of the largest custodians in the world, provides custody, fund accounting, recordkeeping and investment management services for the state plans we support.

Yes, Vestwell provides fully white-labeled solutions, allowing states to deliver a range of offerings under their own brand while Vestwell operates behind the scenes.

Vestwell combines enterprise-grade security, rigorous compliance standards, and deep policy fluency to protect client data and ensure ongoing regulatory alignment.