Mobile App

Employees can manage their account and savings on the go with the Vestwell mobile app. They can set contributions, adjust account details, and track progress anytime, anywhere.

Download on the App Store

Help businesses launch their first retirement plan with a streamlined and affordable 401(k).

Vestwell’s Starter 401(k) is built for businesses ready to offer a retirement plan for the first time, helping you meet them at the first step in offering workplace savings.

Starter 401(k)s are available only to employers who haven’t offered a retirement plan before, opening doors to businesses that are ready for a trusted advisor to lead the way.

With preset features and exemption from annual nondiscrimination and top-heavy testing, Starter 401(k)s make it easy to launch and manage a compliant plan without added complexity.

As more states require employers to offer retirement benefits, Starter 401(k)s give you a high-quality, compliant option that helps businesses avoid penalties while building long-term savings habits.

When a client is ready for more flexibility—like employer match or profit sharing—their Starter 401(k) can be converted to a traditional 401(k) without starting over, keeping you at the center of their growth.

Since employers are not required to make contributions and there is no need for nondiscrimination testing, Starter 401(k) plans are a cost-effective option for businesses.

Employees can manage their account and savings on the go with the Vestwell mobile app. They can set contributions, adjust account details, and track progress anytime, anywhere.

Download on the App StoreA tool that provides a more personalized asset allocation into portfolios based on retirement and investment goals. Funds can be selected by a third-party investment fiduciary or the plan’s advisor acting as 3(38) or 3(21) fiduciary.

Learn moreA complimentary, integrated library of financial wellness resources and interactive learning modules on foundational topics, from budgeting to saving for a home to planning for milestones.

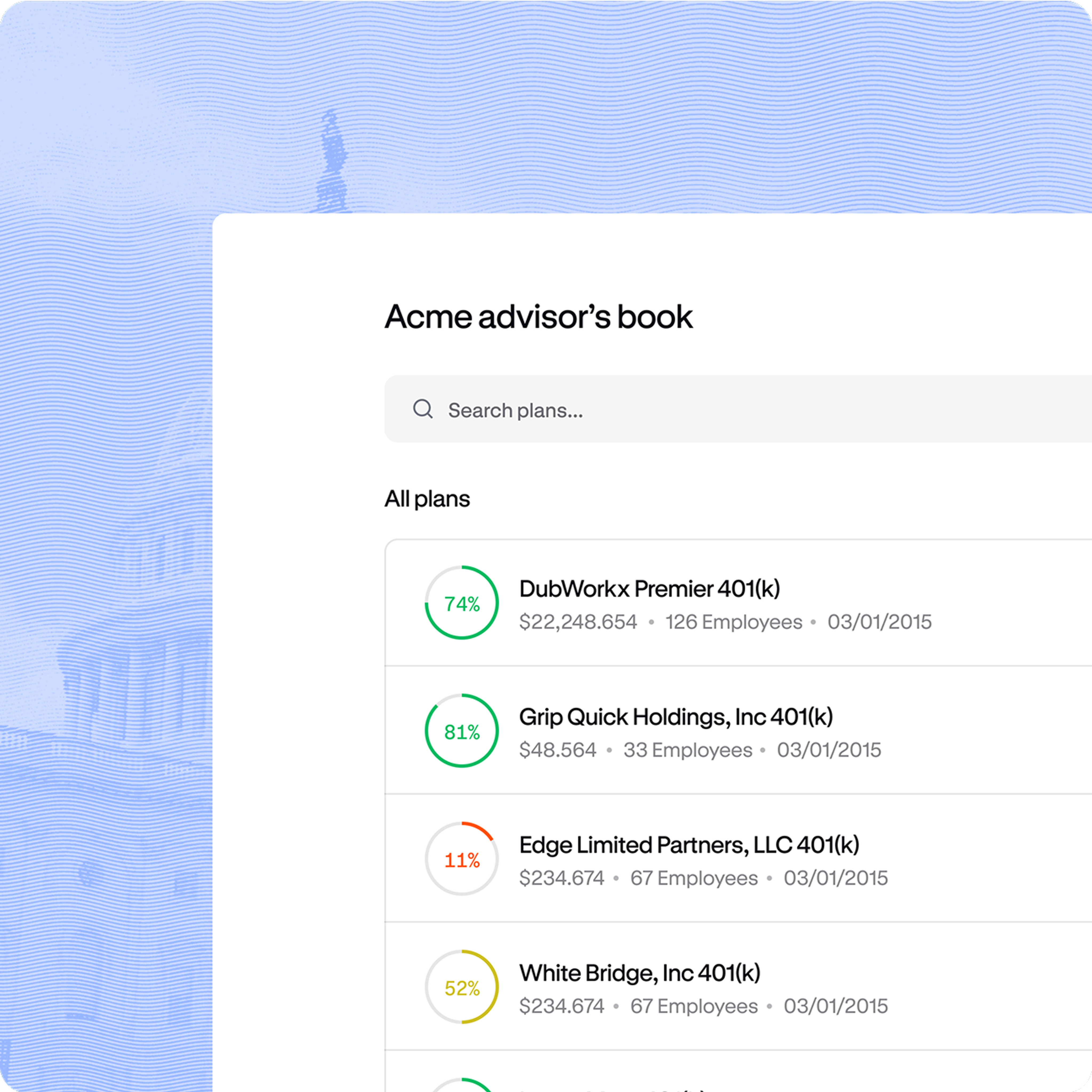

Our 401(k) solutions are built to work the way you do—offering plan transparency, an intuitive advisor dashboard, and the flexibility to take on as much or as little as you choose.

“When we were evaluating our options, we interviewed multiple fintech solutions. Without a doubt, Vestwell was the most advisor-friendly in the marketplace.”

With the recent passing of Secure Act 2.0, new tax credits may be available to your clients, making a 401(k) plan with Vestwell even more affordable. Use our calculator to show potential savings and strengthen your value proposition.¹

If you start a qualified retirement plan with auto-enrollment, you may qualify to earn more than $150,000 in tax credits over a three-year period.

Grow your book with 401(k) plans that save you time, simplify administration, and give you the tools to deliver better client outcomes.

Any business not currently offering a workplace retirement plan is eligible.

No, Starter 401(k) plans do not permit employer contributions, which keeps costs predictable for plan sponsors.

Yes. Employers must automatically enroll eligible employees between 3% and 15% of pay, with opt-out available.

Yes. Clients can convert to a traditional 401(k) at any time to add features like employer match, profit sharing, or custom plan design.

Contribution limits are set annually by the IRS and are lower than traditional 401(k) limits. Check the current IRS guidelines for up-to-date amounts.

The tax credit calculator is meant to be an estimate and it is provided for informational purposes only. It is based on credits that may be available to your business based on the current version of the Internal Revenue Code in effect and does not take into account potential changes to the tax credits that may be available to you that are currently under consideration. This calculator also does not take into account any other aspect of your business that may entitle your business to greater or fewer tax credits from starting or offering a new or existing retirement plan nor does it reflect any other fees or expenses associated with your plan. The tax credits that the Internal Revenue Service determines are available to your business could be materially different from the output of the tax credit calculator.