Mobile App

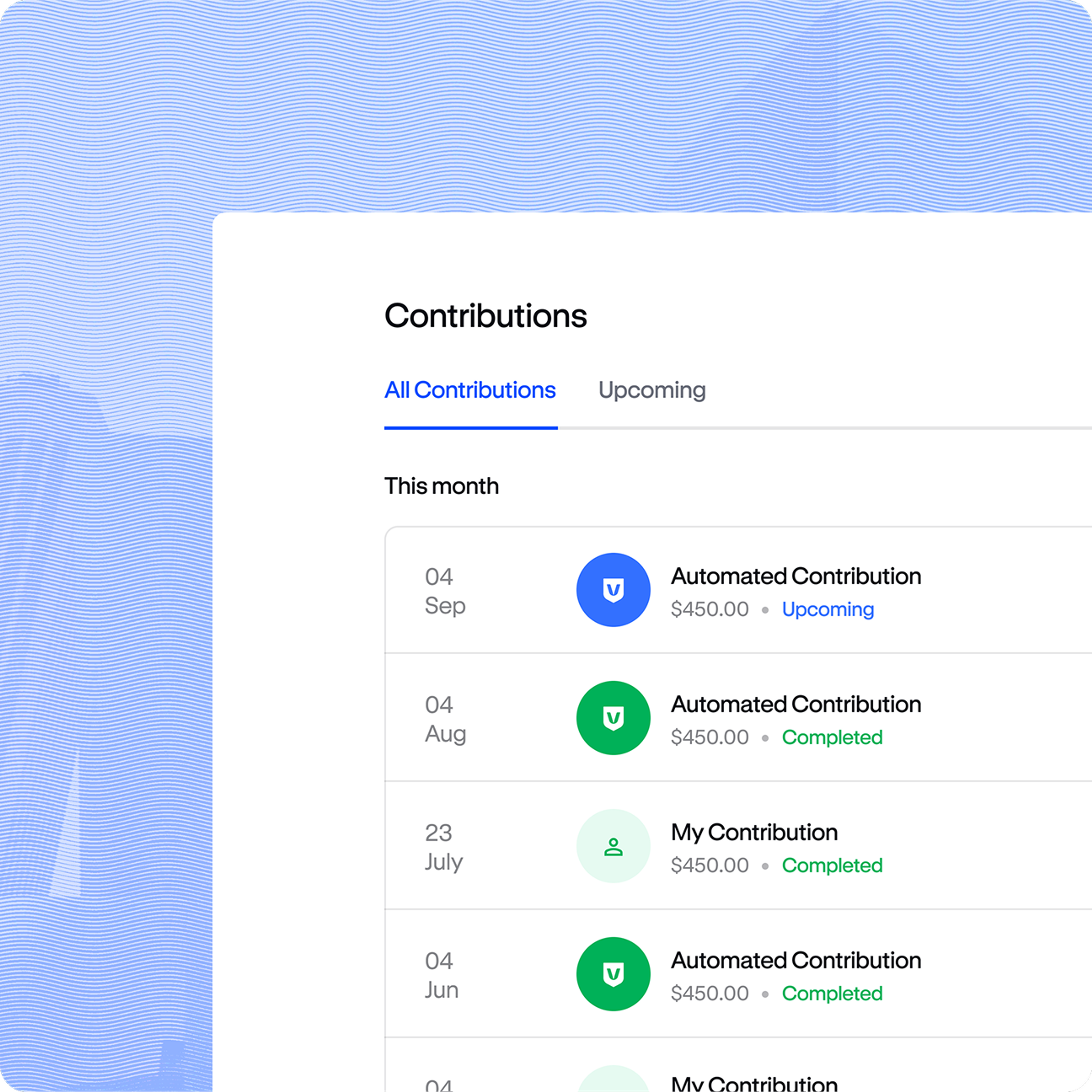

Employees can manage their account and savings on the go with the Vestwell mobile app. They can set contributions, adjust account details, and track progress anytime, anywhere.

Download on the App Store

Offer sole proprietors a streamlined, high-contribution retirement plan that’s flexible, compliant, and easy to administer.

Vestwell’s Solo(k) offers tax benefits and a built-in path to scale so you can meet the evolving needs of your self-employed clients.

With combined employee and employer contributions, your clients can maximize their savings. Offer Roth or traditional deferral options to align with their goals.

Solo(k) employer contributions are tax-deductible business expenses, offering a compelling incentive for self-employed clients to reduce taxable income while investing in their future.

Unlike SEP or SIMPLE IRAs, Vestwell’s Solo(k) can be seamlessly amended into a traditional 401(k) plan as your client hires employees, allowing you to retain and serve them as their business scales.

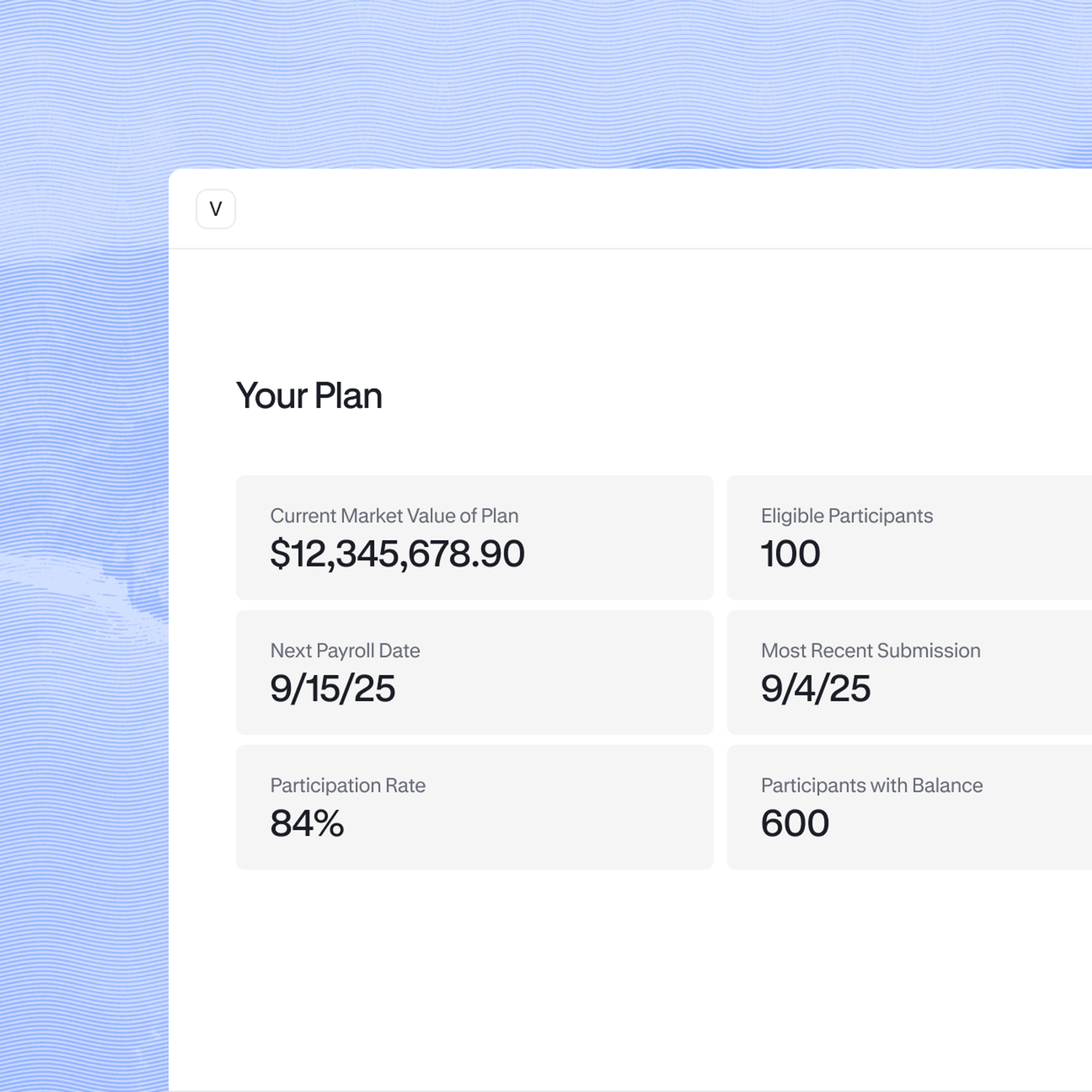

Vestwell provides integrated recordkeeping, 3(16) fiduciary services, contribution tracking, and optional payroll sync to reduce administrative burden—for both you and your clients.

Employees can manage their account and savings on the go with the Vestwell mobile app. They can set contributions, adjust account details, and track progress anytime, anywhere.

Download on the App StoreA tool that provides a more personalized asset allocation into portfolios based on retirement and investment goals. Funds can be selected by a third-party investment fiduciary or the plan’s advisor acting as 3(38) or 3(21) fiduciary.

Learn moreA flexible option for employers to share company success by making additional contributions toward retirement accounts after the plan year ends.

Read the case studyA benefit to pay back student debt while saving for retirement, with employer matching contributions of student loan payments towards employee retirement accounts.

Learn moreA complimentary, integrated library of financial wellness resources and interactive learning modules on foundational topics, from budgeting to saving for a home to planning for milestones.

An investment option that offers guaranteed monthly payments during retirement via lifetime annuities, providing a layer of income protection.

Learn more

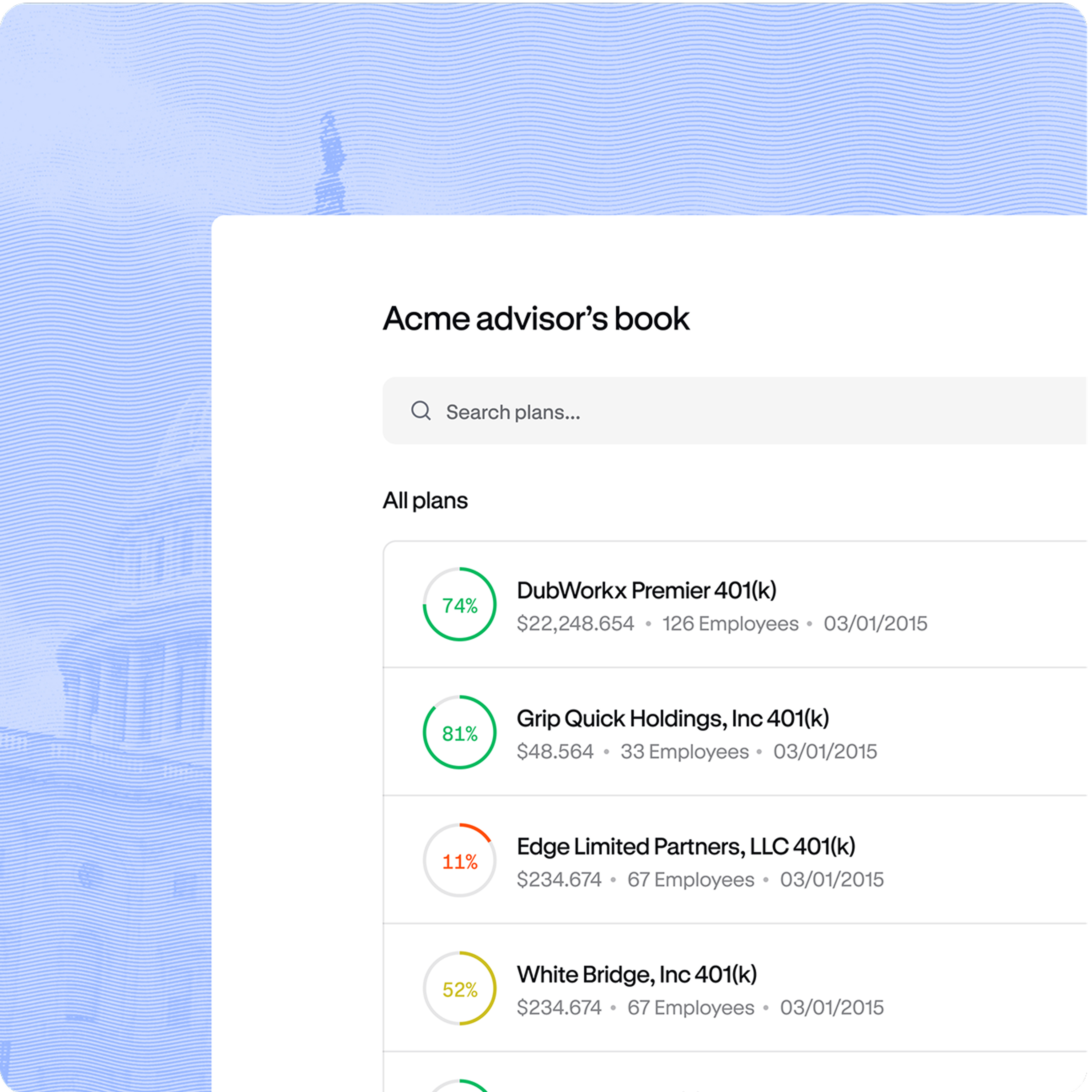

Our 401(k) solutions are built to work the way you do—offering plan transparency, an intuitive advisor dashboard, and the flexibility to take on as much or as little as you choose.

“When we were evaluating our options, we interviewed multiple fintech solutions. Without a doubt, Vestwell was the most advisor-friendly in the marketplace.”

With the recent passing of Secure Act 2.0, new tax credits may be available to your clients, making a 401(k) plan with Vestwell even more affordable. Use our calculator to show potential savings and strengthen your value proposition.¹

If you start a qualified retirement plan with auto-enrollment, you may qualify to earn more than $150,000 in tax credits over a three-year period.

Serve self-employed clients with a digital-first, high-contribution plan that grows with their business.

Self-employed individuals with no full-time employees other than a spouse who operate a sole proprietorship, LLC, partnership, or corporation.

Yes. Vestwell supports both traditional and Roth contributions.

Yes, Vestwell offers optional plan features including participant loans, hardship, and in-service withdrawals.

The plan can be converted into a traditional 401(k), allowing for seamless scaling and continued service.

Employee contributions must typically be made by December 31 while employer contributions are due by the business’s tax-filing deadline, including extensions.

The tax credit calculator is meant to be an estimate and it is provided for informational purposes only. It is based on credits that may be available to your business based on the current version of the Internal Revenue Code in effect and does not take into account potential changes to the tax credits that may be available to you that are currently under consideration. This calculator also does not take into account any other aspect of your business that may entitle your business to greater or fewer tax credits from starting or offering a new or existing retirement plan nor does it reflect any other fees or expenses associated with your plan. The tax credits that the Internal Revenue Service determines are available to your business could be materially different from the output of the tax credit calculator.