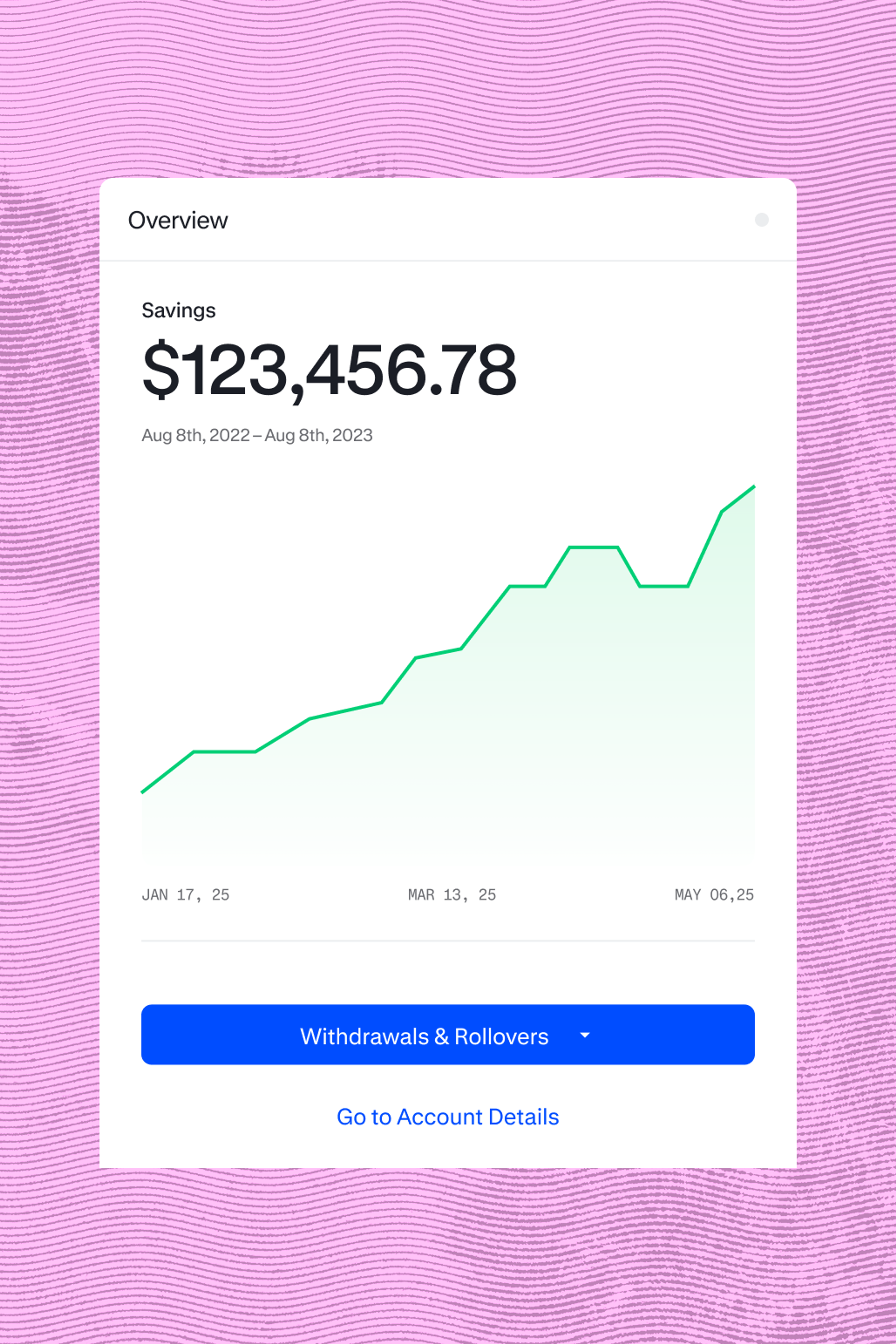

Automated savings

Savers can add money automatically with recurring contributions from the bank account of their choice, set up payroll direct deposit, and even use our Savings Boosters to add a little extra to their savings without extra effort.

Vestwell creates a user-friendly experience that empowers savers to achieve more financial security and makes education more accessible.

Savers can add money automatically with recurring contributions from the bank account of their choice, set up payroll direct deposit, and even use our Savings Boosters to add a little extra to their savings without extra effort.

Using their unique URL, savers can easily give friends and family a way to contribute to their savings—sharing on social media, by text, and more. Friends and family can even set up gifting profiles and recurring gifts to make it easier to help them reach their goals.

Our easy-to-use portal is available in 18 languages and boasts accessible features to make saving comfortable and intuitive. Plus, our mobile app makes it easy for savers to manage their account anytime, anywhere.

Education costs have risen by 158% over the last 20 years¹, making saving for education a top concern for many individuals today. Working with a trusted partner makes it easier to offer unique program benefits and make education and tax benefits more accessible for residents in your state. We support you every step of the way and provide a simple, white-labeled interface designed for seamless interactions and experiences across our portals. We even offer a mobile app and prepaid card that make account management and accessing funds easier for savers.

Vestwell offers powerful solutions that reduce employee stress and increase financial security. Savers have access to in-depth financial wellness resources so they can understand their options and make informed decisions. With College SaveUp, savers also gain plan benefits that can help them decrease the need for student loans and even shorten the time it takes to repay them.

A College SaveUp plan is an employee benefit that enables employers to help their employees save for college by making direct contributions to a 529 college savings plan held by the employee.

Currently, all direct-sold 529 plans are eligible plans. To receive contributions, you must have a 529 college savings plan approved by Gradifi. If you do not currently have an approved 529 plan, you may open a new direct-sold 529 plan account and then register it with Gradifi.

Vestwell combines enterprise-grade security, rigorous compliance standards, and deep policy fluency to protect client data and ensure ongoing regulatory alignment.