Safe Harbor 401(k)

A streamlined 401(k) plan with simplified compliance and maximized contributions

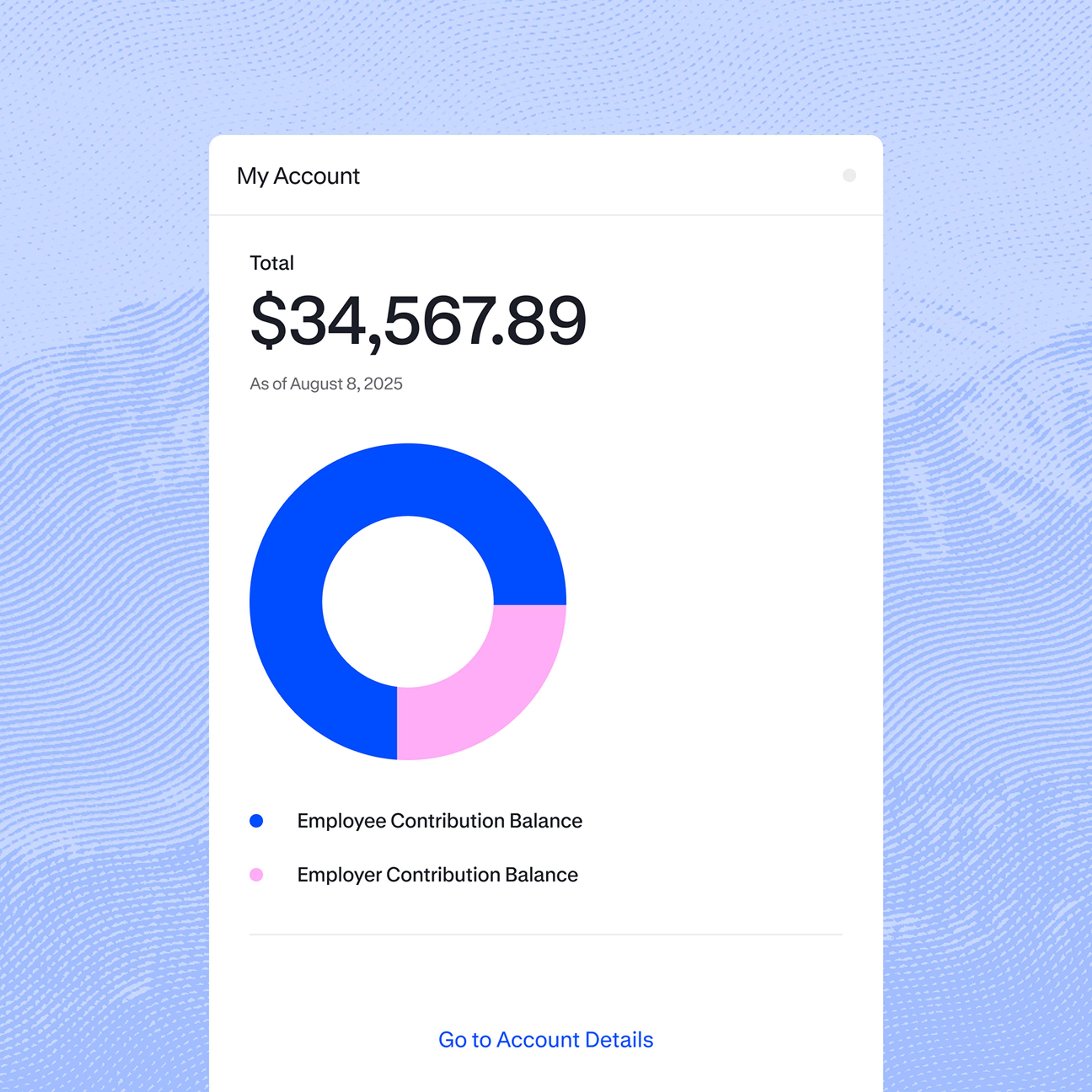

From retirement to emergency savings and more, we help you offer workplace savings plans that fit your team, your budget, and your time.

Finally, a savings solution that works as hard as you do.

A streamlined 401(k) plan with simplified compliance and maximized contributions

A flexible 401(k) plan with various employer contribution options

A streamlined, tax-advantaged plan designed for self-employed professionals.

A simplified, low-cost option for new plans--with no employer match

A retirement plan for schools, nonprofits, and certain public organizations

A state-sponsored retirement program for employees without a workplace plan

We handle the heavy lifting.

Small businesses like yours need benefits that work with your schedule—not against it. Vestwell helps you launch and manage savings plans with less time, less hassle, and more support.

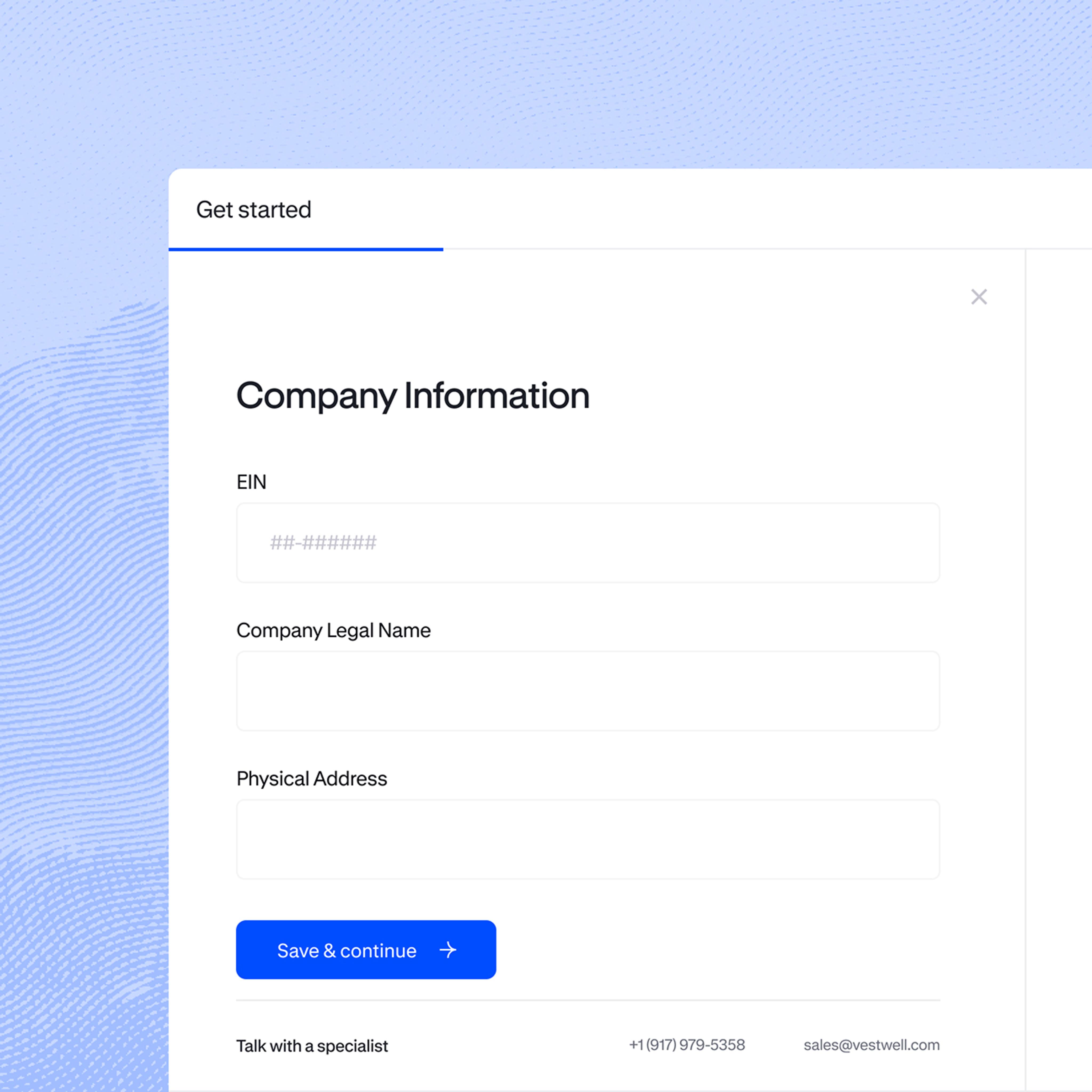

Get started fast with step-by-step digital setup and help from a dedicated team who knows what small businesses need. No confusing forms or piles of paperwork.

Take advantage of retirement plan tax credits that can cover most or all of your plan costs. Help your business and your employees save more—with less out of pocket.

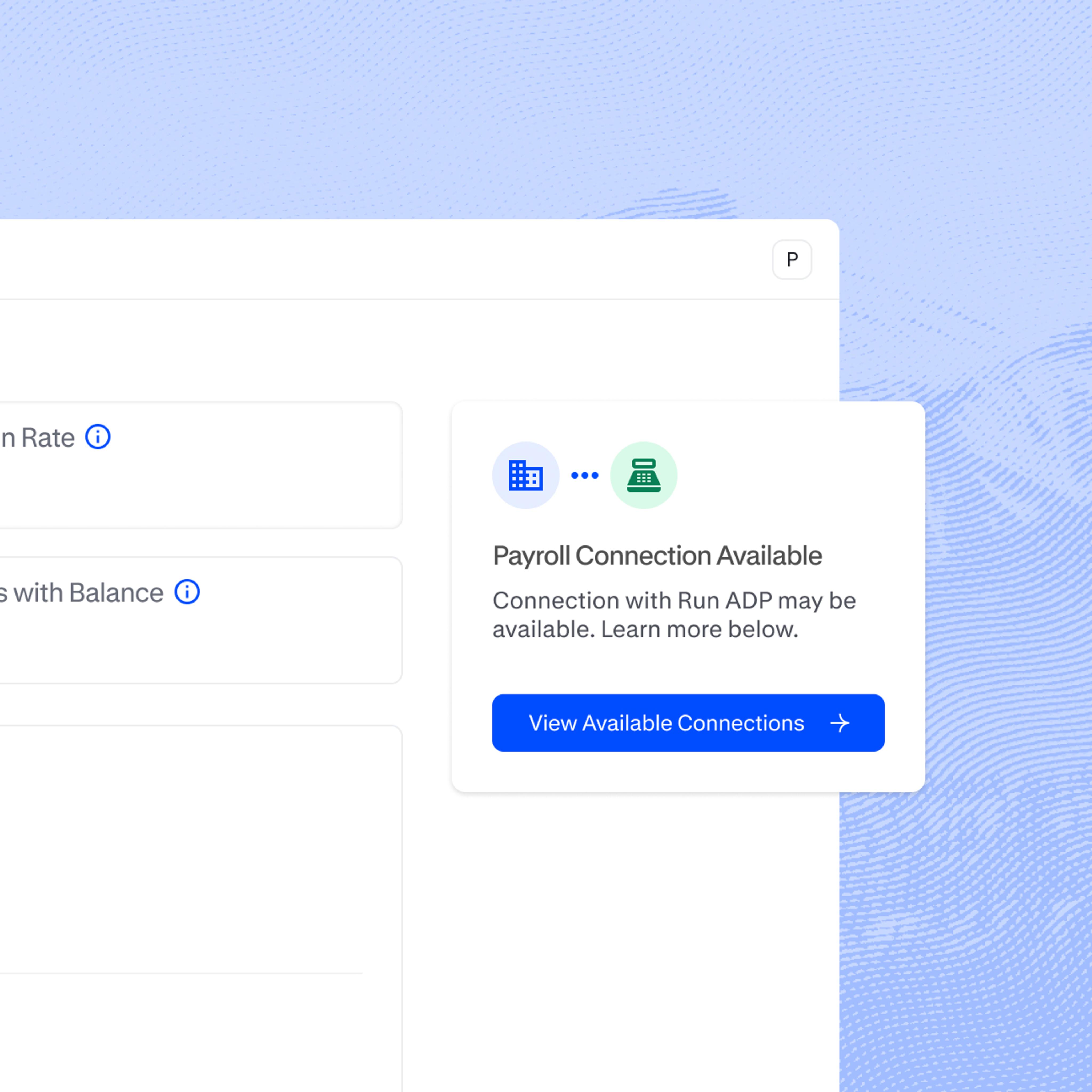

Automate contributions, eligibility, and savings rate changes with our ability to integrate with 190+ leading payroll providers—making plan management hands-off.

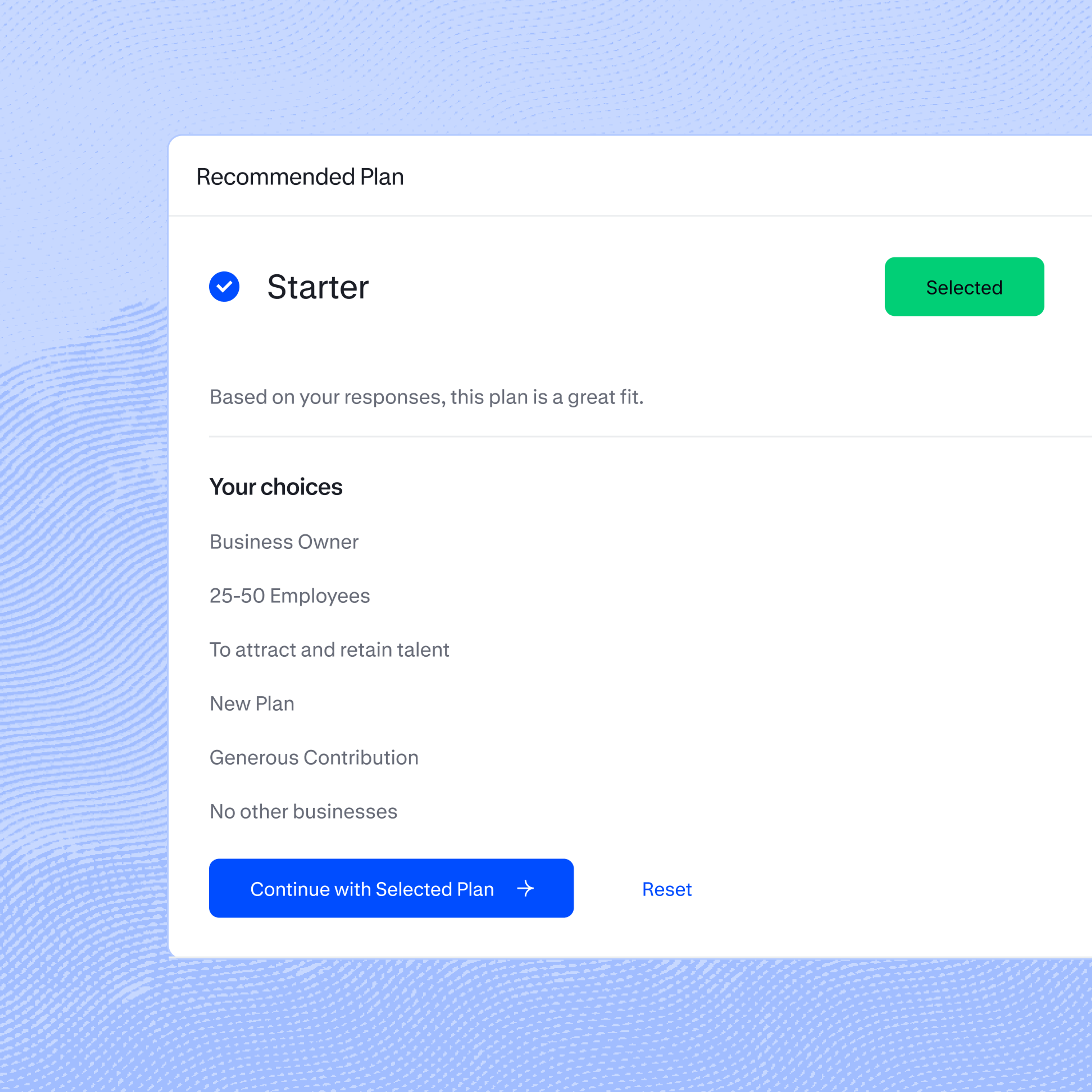

Whether you’re a one-person business or a 20-person team, choose a plan that fits your goals, including low-cost Starter(k) or Solo 401(k) options.

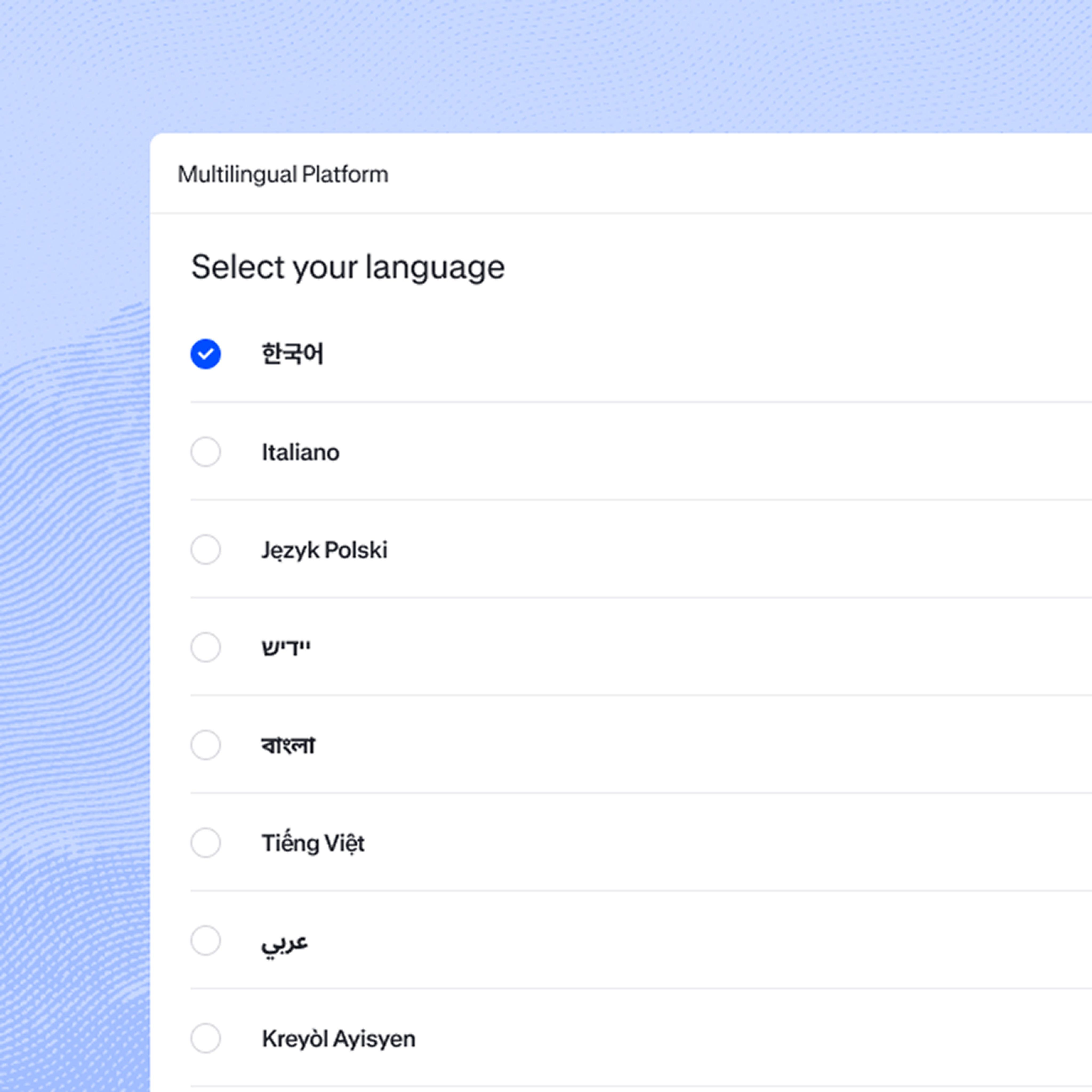

Get real help from real people—with live multilingual support and a mobile app that makes it easy to manage your plan on the go.

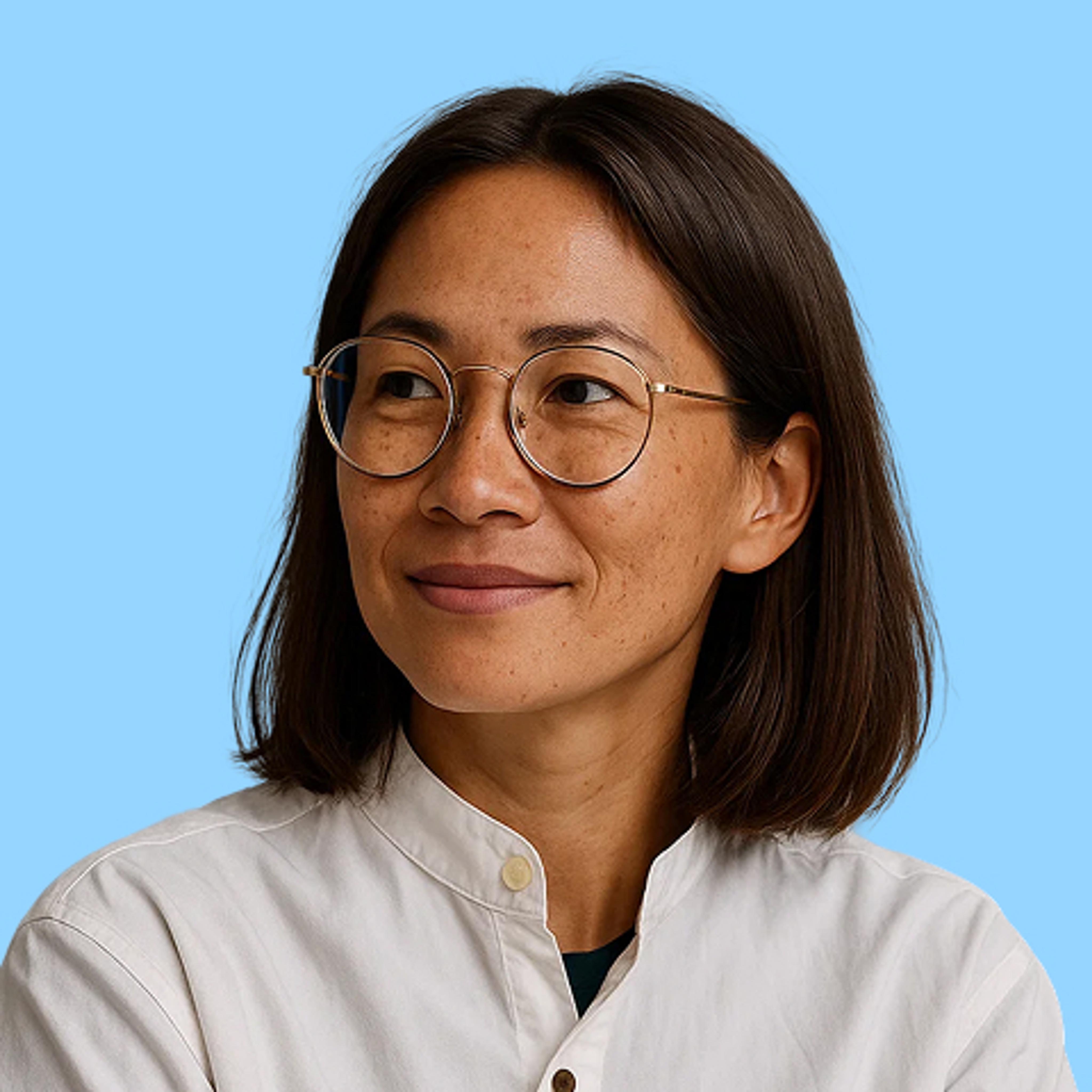

How DeHenzel Training Systems simplifies savings with Vestwell.

Sophie DeHenzel thought that offering a retirement plan would be “out of reach” for her small personal training business—until she found Vestwell. With seamless payroll integration and flexible plan options, Sophie was able to support her team without taking time away from her business. Small businesses like DeHenzel Training Systems use Vestwell to automate contributions, simplify compliance, and stay focused on what matters most.

Let’s make saving easy—for you and your team.

From tax credits to turnkey setup, Vestwell takes care of the hard stuff so you can focus on your business.

FAQ

Not at all. Whether you're a solo entrepreneur or a team of 40, Vestwell has affordable plans—like Solo and Starter 401(k)s—built for small businesses.

Most plans can be up and running in under 30 minutes. Your dedicated onboarding team will guide you every step of the way.

Yes! Many small businesses qualify for federal tax credits of $16,500 or more over three years when starting a new retirement plan—and that’s before factoring in deductions for employer contributions.

Yes, Vestwell has the ability to integrate with 100+ leading payroll providers, making it easy to automate contributions and minimize manual work.

Yes. Vestwell combines retirement, emergency savings, education benefits, and more on a single platform—giving you a true financial wellness solution for your team.