Translating Access: Expanding Savings in Agriculture & Farming Through Language

Agriculture and farming workers are the backbone of American life. This industry not only puts food on our tables but also fuels the US economy, accounting for roughly 10% of total employment, or more than 22 million jobs nationwide.

However, employees in this industry are some of the least likely to have access to workplace savings benefits.

In this industry spotlight, we’ll discuss how multilingual benefits can expand access to savings, strengthen workforce retention, and enable agricultural businesses to better support their employees’ financial well-being.

Workforce Overview: Language, Access, and Opportunity

Demographics of the Agricultural and Farming Industry

The U.S. agricultural workforce consists of two groups of workers: self-employed farm operator families and hired workers. The decrease in self-employed family labor has led to an increase in hired workers over time. With the increase in hired workers, these employees are statistically more likely to be from a minority background, non-English speaking at home, and younger than those in other industries.

| Category | Agriculture Industry Workforce Overview |

|---|---|

| Age | Nearly 17% of agricultural and farming hired workers are under 25, and 59% are younger than 44, giving these workers ample opportunity to save long-term. When it comes to farm operators, one-third are over 65 years old, making them one of the oldest workforces in the country. |

| Born Outside of the US | About one-third of all agriculture operators and workers were born outside the U.S., with about 60% of hired workers born in Mexico alone. These numbers show how much the industry relies on immigrant and first-generation workers. |

| Minority Status | Over 50% of farming employees identify as members of racial or ethnic minority groups, compared to just 40% of the total U.S. labor force. |

| Ethnicity | Hispanic workers are more highly represented in the agricultural industry than in the overall U.S. workforce, with 47% identifying as Hispanic compared to the national average of just 19%. |

| Location | Over three-quarters of hired farmworkers are considered settled or live in one place and work at a single location within 75 miles of their home. |

| Education | One-third of all agriculture and farm workers have not finished high school. For hired workers, the average level of completed education is ninth grade and 35% have completed less than sixth grade. Farm operators, however, are more likely to have higher education levels, with around 30% of the operators of million-dollar farms having obtained college degrees. |

The State of Financial Wellness for Agriculture and Farming Employees

The agriculture and farming industry adds $1.53 trillion to the U.S. economy’s yearly total and is essential for feeding the nation. Despite the industry’s scale and impact, many of its workers face real financial challenges and often lack access to the workplace savings tools that could help them build long-term stability.

Lower Pay and Irregular Work for Hired Workers

A combination of lower wages and limited access to benefits has historically made it difficult for workers in this industry to build financial security. Agriculture and farming jobs for hired workers are some of the lowest-paid in the country, with a median annual wage of $35,980, compared to nearly $49,500 across all industries. In addition, 70% of farmworkers interviewed in a recent study averaged 16 weeks without employment in the previous year.

Because of such irregular work, their median personal income the previous year was below $24,999, and 11% of workers earned less than $10,000. As a result, about one-fifth of these farmworkers had family incomes below the poverty level. In addition, the manual labor they perform can lead to physical injuries that make it difficult to work as they age, and potentially increase medical costs later in life.

Lack of Access to Workplace Retirement Savings Plans

It‘s challenging to fully understand the extent of the savings gap for workers in this industry because organizations like the U.S. Bureau of Labor Statistics often exclude agricultural workers from surveys on compensation. However, we do know that only 40% farm operators participate in some type of retirement account for themselves, and the average farmer has over 50% of their equity in farm assets.

Because farm operators are relying on business assets for their financial future, very few seek retirement savings or offer a retirement plan to their workers. This gap leaves many employees in the industry with no access to retirement savings through the workplace and no business assets to rely on.

Plan Participation and Language Differences for Hired Workers

Language barriers also make participating in the few retirement plans that are offered difficult. Almost two-thirds of hired farm and agriculture workers speak Spanish as their primary language. Only one-third of workers report they can speak English well, and nearly one in four workers do not speak English at all.

In an industry where such a large portion of the workforce is not comfortable with English, many employees struggle to access or fully understand the benefits and savings options available to them.

The Opportunity Ahead

Finding and Keeping Good Employees Starts With Retirement Savings

With such a competitive job market, offering a retirement plan provides a competitive advantage. Businesses that offer workplace savings may see more skilled hires, increased employee retention, and lower turnover.

Over 3 million Americans leave their jobs each month, making it critical to recruit and retain workers. Replacing and retraining employees is not only time-consuming, but it also cuts into profit.

Because of recruiting, training, and onboarding, the cost of replacing an employee is typically one-fifth of their salary. For a farm and agricultural hired worker with an average yearly earnings of $35,980, that makes the replacement cost over $7,100 for each worker.

Offering access to retirement benefits can be a great and easy first step. Finding a provider that supports multilingual workplace savings opportunities can help agricultural and farm employers:

- Increase employee engagement with benefits they can rely on and fully understand in their primary language.

- Encourage a more loyal, productive workforce with lower turnover by providing the resources they need in the language they know best.

- Stay competitive in the marketplace, holding steady with larger operations that offer robust benefits.

- Support employee financial wellness, increasing stability, and reducing overall stress.

- Help close the savings gap and empower workers in one of the core industries in the American economy.

How Vestwell Empowers the Farming Industry

Vestwell recently partnered with Wayne-Sanderson Farms, the nation’s third-largest poultry producer. Farmers working with Wayne-Sanderson Farms can now participate in a Group of Plans (GoP) retirement program, which simplifies retirement plan management, reduces expenses, and provides a seamless experience for employers and employees alike.

“Our partnership with Vestwell has allowed us to create an opportunity for our farmers to be able to plan for their future. We are proud to support their ability to save for retirement with confidence and peace of mind.”

For operators and managers in the agricultural industry, offering retirement benefits can feel like a nice-to-have and not a vital business initiative. Vestwell’s platform puts these essential offerings within reach without adding extra administrative burden:

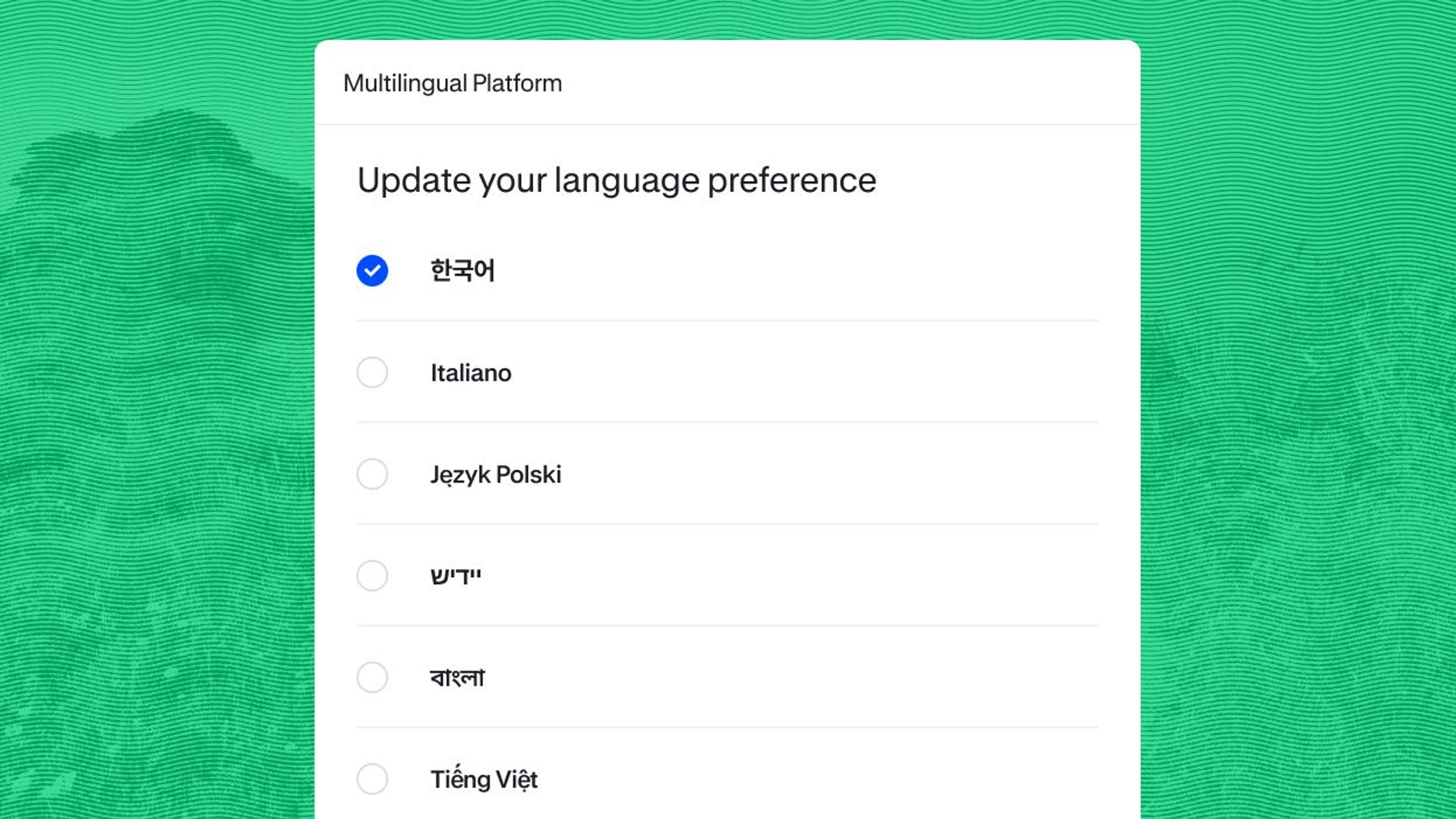

- 18+ Platform Languages and Support in 240+ Languages – Vestwell’s multilingual platform supports 18 languages and counting, overcoming one of the biggest barriers to participation. Workers can enroll and save confidently in the language they prefer and get the support they need in 240+ languages.

- Seamless Payroll Integrations – Spend more time focusing on your business when you can run employee contributions automatically with Vestwell’s seamless integrations. We have partnered with over 190 payroll providers to enable accurate and automated contributions. It’s never been easier to offer accessible, multilingual workplace savings benefits to your entire company.

- Mobile On-the-Go Access – Agricultural and farming employees work long and hard days, fulfilling a wide range of duties at the farm, in the field, or wherever they’re needed. Their savings tools need to meet them where they are. Vestwell’s mobile-friendly platform gives employees the ability to view balances, adjust contributions, and manage their accounts anytime, anywhere.

- Low Administrative Lift – Designed for operations of all sizes with unique needs and no benefits experience, Vestwell’s platform keeps things simple. Streamlined onboarding and minimal ongoing management deliver the highest impact with the lowest lift.

Creating a Stronger Financial Future for Agricultural Workers

With industry-leading technology, multilingual savings tools, and mobile-first access, Vestwell helps farmers and agricultural operations of all sizes attract and retain talent, improve their bottom line, and start their employees on a path to long-term financial stability.

When employees feel less stressed over basic financial needs, they’re more engaged. Supporting their financial stability can increase productivity and foster loyalty. For farming and agriculture, this means decreased turnover and lower hiring costs, a happier workforce, and a competitive edge in finding and retaining talented workers.

Maintain your edge in the market and retain the employees you rely on with innovative workplace savings benefits. Join the 350+ thousand businesses already powered by Vestwell to build a stronger financial future for your team.