What’s the Difference Between Pre-Tax and Roth 401(k) Contributions?

Workplace retirement plans are among the most common investment vehicles Americans use to save for retirement. As of December 31, 2022, just over $26 trillion was held in employer-sponsored retirement plans, including traditional pension, profit sharing, and 401(k) plans.

It’s critical to understand your 401(k) plan as you map out your savings journey into retirement. In this article, we’ll explore the differences between pre-tax and Roth 401(k) contributions, helping you better understand your retirement plan contribution options.

The Basics: Contributing to Your 401(k) Plan

A 401(k) plan is an employer-sponsored retirement plan that allows employees to save for retirement in a tax-favored way. When you sign up for a 401(k) plan, you agree to have a percentage of your salary allocated to the plan’s investment accounts.

You can contribute up to $24,500 in 2026, up from $23,500 in 2025. Individuals aged 50 or over at the end of the calendar year can make annual catch-up contributions, up to $8,000 in 2026. Individuals ages 60 to 63 have a higher catch-up contributions limit, up to $11,250 in 2026.

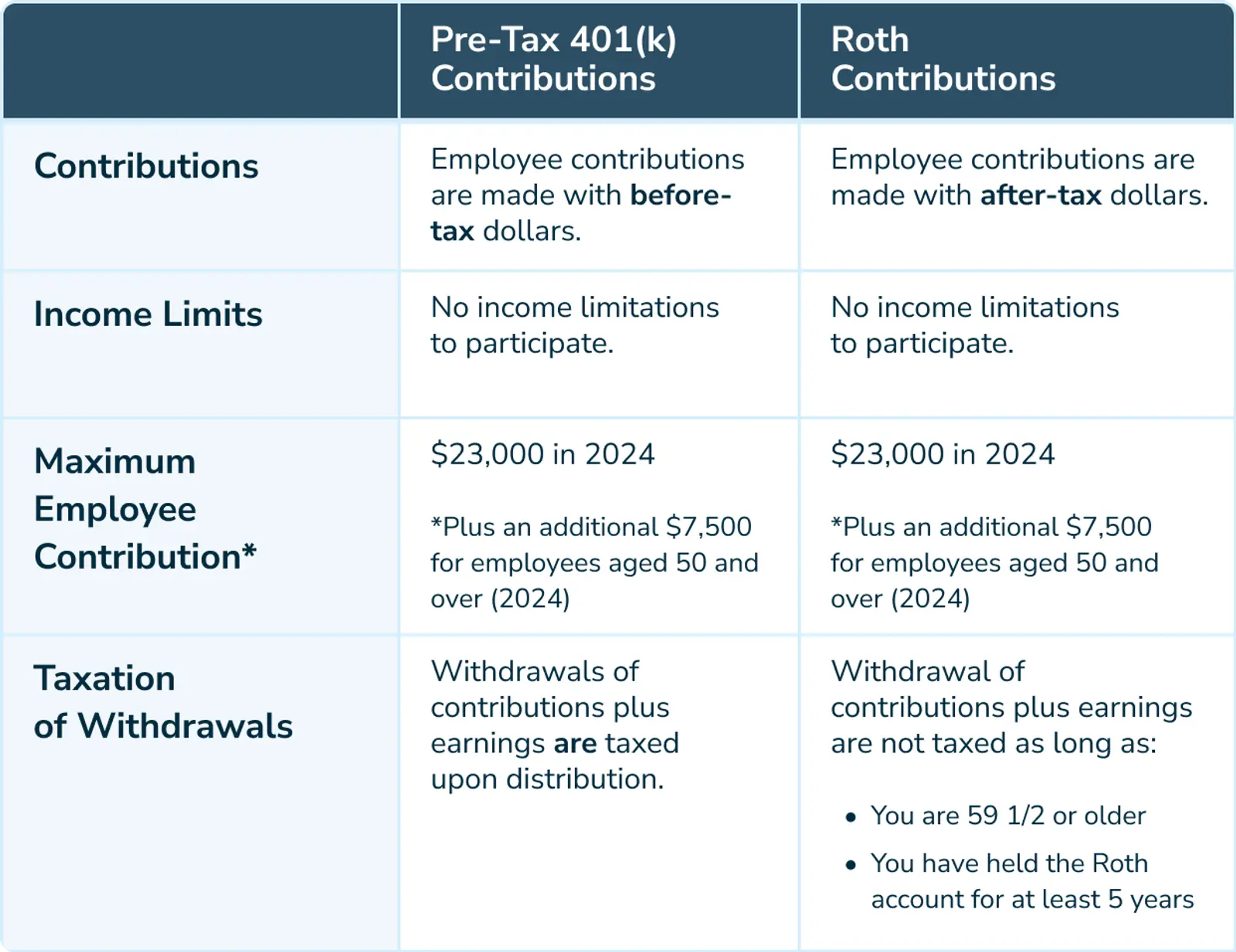

When choosing how to contribute to your 401(k) plan, you can typically choose between:

- A pre-tax contribution, which contributes a portion of your compensation to your retirement plan account before applying state, federal, or local taxes and withholdings, or

- A Roth contribution, which contributes a portion of your compensation to your retirement plan account after applying state, federal, and local taxes.

Not all 401(k) plans offer a Roth feature; you’ll need to check your employer’s plan to see if they are permitted. However, with 90% of 401(k) plans now offering Roth options, employees need to understand the difference—and the impact—of each.

The Difference: Pre-Tax vs. Roth 401(k) Contributions

What Is a Pre-Tax 401(k) Contribution?

Pre-tax 401(k) contributions are contributions made before taxes are deducted from your paycheck—so you receive the tax advantage for the year you contribute.

Here’s an example that illustrates this:

Pat’s monthly taxable income is $5,000. Assume that Pat’s tax rate is 22%. Also, assume that Pat would like to contribute 10% of her pre-tax income to her pre-tax 401(k) account.

This would be the result:

- $5,000 x .10 = $500 (pre-tax 401(k) contribution)

- $5,000 - $500 = $4,500 (remaining income pre-tax)

- $4,500 x .22 = $990 (tax owed)

Not only is Pat able to contribute $500 pre-tax to her 401(k) account, but the deferrals she makes also lower her taxable income for the year.

What Is a Roth Contribution?

Roth contributions are contributions made from your income after federal, state, and local taxes have already been withheld. Because of this, you don’t receive tax advantages for the year you contribute, like you do a pre-tax contribution.

Let’s look at an example using the same facts as we did above with the Roth contribution:

Pat’s monthly taxable income is $5,000. Assume that Pat’s tax rate is 22%. Also, assume that Pat would like to contribute 10% of her after-tax income to her Roth 401(k) account.

This would be the result:

- $5,000 x .22 = $1,100 (tax owed)

- $5,000 x .10 = $500 (Roth 401(k) contribution)

- $5,000 - $1,100 - $500 = $3,400 (income after taxes and contribution)

Although these examples are basic, you can still see the tax differences at the time of contribution. Notice that the tax owed on the Roth example is $1,100 while the tax owed in the pre-tax example is $990—a $110 difference.

The Roth tax benefit comes during retirement when you withdraw from your Roth 401(k) account. Because you already paid taxes on this money at the contribution stage, you can make withdrawals from your Roth 401(k) account tax-free, including any earnings you’ve received as your retirement accounts have grown. In other words, your earnings grow tax-free, no matter how significant they may be.

Additionally, because you’ve already paid taxes on your Roth contributions, you can withdraw them at any time as long as you meet the following requirements:

- You are 59½ or older; and

- You have held the Roth account for at least five years.

The exception to this rule is if you become permanently disabled or pass away. In that case, you or your beneficiary can access your Roth 401(k) account without penalties or taxes.

However, you may have an “early” withdrawal if you take Roth contributions out before you turn 59½ or have held the Roth account for at least five years. In this case, you may have to pay a 10% penalty on some or all of the amount you withdraw in addition to regular federal and state income taxes.

When determining which is better for you, you can’t stop the analysis here, especially since the Roth’s tax favorability doesn’t kick in until you take a distribution of your retirement funds. Which contribution type to use (or a combination of both) is an individual decision based on your current financial situation and retirement goals. Working with a financial advisor can help you determine the ideal course of action for you and your family.

Pre-Tax vs. Roth 401(k) Contributions

Conclusion

Each type of 401(k) contribution has its pros and cons. We recommend consulting with your financial advisor or tax expert when navigating the choice between pre-tax 401(k) or Roth contributions. However, staying in the know on your 401(k) plan will help you maximize your financial returns, minimize your taxes, and create a sound plan for your future. No matter which option you select, starting early and saving consistently for retirement should be your primary goal.

Want to learn more about your 401(k) plan features? Click here to get started.

Need to sign up for your Vestwell retirement account? You can register here.

*This maximum limit is an aggregate limit. In other words, you can split your contributions across Roth contributions and pre-tax contributions. However, the total amount of your employee contributions cannot exceed these maximum amounts.