Vestwell Savings Report: Embracing Personalized Financial Wellness Solutions in the Workplace

From coffee orders customized to the shot of espresso to curated recommendations about what to watch next on your favorite streaming services, personalization is fast becoming the expectation. Why should our finances be any different?

Vestwell surveyed 1,200 savers across the United States for our annual “Vestwell Savings Industry Report.” Our findings revealed a trend among savers: a growing preference for personalized financial guidance via digital tools, managed accounts, and financial advisors.

Employees have unique preferences and requirements. Some thrive on tech solutions, while others prefer a human connection. Financial wellness is not one-size-fits-all, and looking forward, savers appear to be searching for more tailored approaches to managing their finances.

In this article, we discuss the opportunities employers have to stand out by providing the personalized support their employees are looking for. Let’s dive in.

The Digital Transformation of Workplace Savings

As part of the trend toward personalization, savers are increasingly interested in leveraging digital tools for managing their personal finances. 65% of respondents indicated that an online savings platform that enables you to check your balance in real time would be helpful. This finding reflects a broader shift toward immediacy and transparency in financial management.

| Online platform with real-time balance checking | 65% |

|---|---|

| Mobile applications | 42% |

| Retirement calculators and projections | 39% |

| Digital educational resources and webinars | 21% |

| Push notifications, SMS text, or alerts about account activity | 16% |

| Automatic rebalancing tools to maintain your desired asset allocation | 16% |

The Advantages of Managed Accounts

Managed accounts are a feature that helps tailor investment portfolios to individuals’ specific situations. They use information such as age, account balance, salary, savings rate, outside accounts, and risk tolerance, to suggest personalized investment portfolios.

94% of survey respondents say that a tool that offers digital personalized investment suggestions would be valuable.

Managed accounts stand out because they offer personalization at a relatively low cost, making it more accessible to a broader audience. By analyzing a wide range of factors, the technology can dynamically adjust to suggest an optimal portfolio, taking into account the saver’s life changes and shifts in financial goals. This approach not only helps create a more personalized and engaging saving experience but also empowers savers to take control of their financial future with confidence.

A Growing Preference for Customized Financial Guidance

As savers seek tailored guidance that aligns with their unique financial goals and situations, they’re turning to a variety of sources, including friends and family, internet research, and financial advisors.

| Friends or family | 32% |

|---|---|

| Internet research | 28% |

| Financial Advisor | 24% |

| Publications or books | 6% |

| Other (please specify) | 6% |

| Social media | 4% |

While savers are increasingly leveraging digital tools when managing their finances, they also seem to value human expertise. Technology offers convenience and immediacy, but the complex nature of financial planning often requires professional guidance that only a financial advisor can provide.

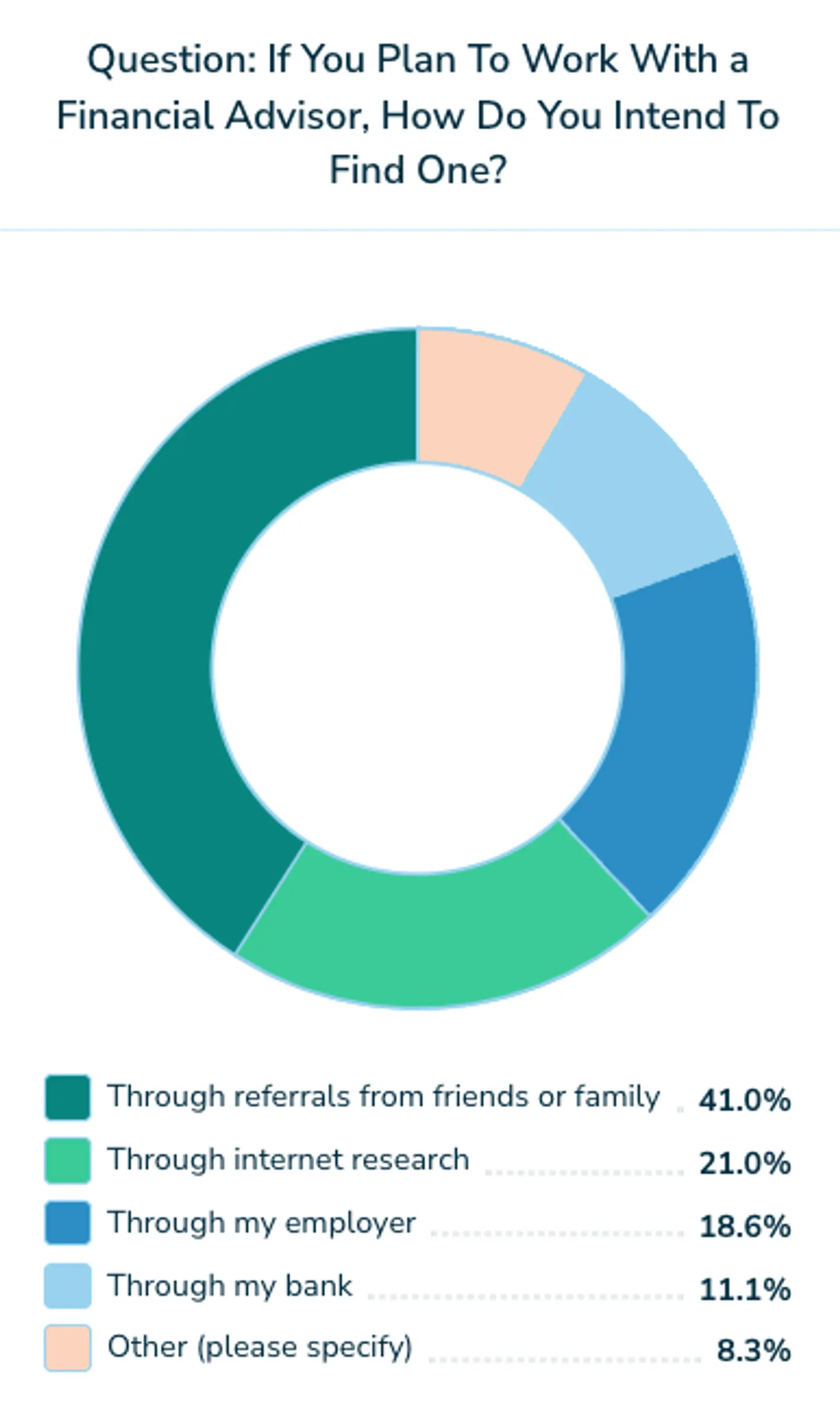

A notable 41% of savers surveyed by Vestwell do not currently work with a financial advisor but plan to in the future. Among those who plan to work with an advisor, 41% intend to find one through referrals from friends or family, 21% through internet research, and 19% through their employer.

Savers are not just looking for information; they are seeking out trustworthy advice that is specifically tailored to their individual circumstances, goals, and challenges. Employers can elevate their benefit offerings by providing access to a financial advisor and helping their workforce get the personalized and professional guidance they’re looking for.

Personalization at Scale

Savers are seeking more informed and efficient ways to navigate their finances. A combination of user-friendly digital tools and professional advice has become central to effective financial planning and wealth management.

This trend presents an opportunity for employers to redefine their benefits package. A commitment to personalized financial wellness underscores an employer's dedication to their team's long-term success and stability, establishing a culture of care and support that extends beyond the workplace. By adopting a holistic, scalable approach to financial wellness that includes access to digital tools, managed accounts, and financial advisors, businesses can improve employee satisfaction—and retention.

Conclusion: The Future of Workplace Financial Wellness

To remain competitive, employers can adapt their financial wellness programs to offer a blend of digital tools and access to professional advisory services that allow for personalization at scale. The future of workplace financial wellness lies in customization and flexibility, empowering employees to choose the paths that best suit their financial situations and aspirations.

Click here to view the full “Vestwell Savings Industry Report” and learn more about the saving trends that are shaping workplace financial wellness.