Does Offering A Retirement Benefit Actually Increase Retention?

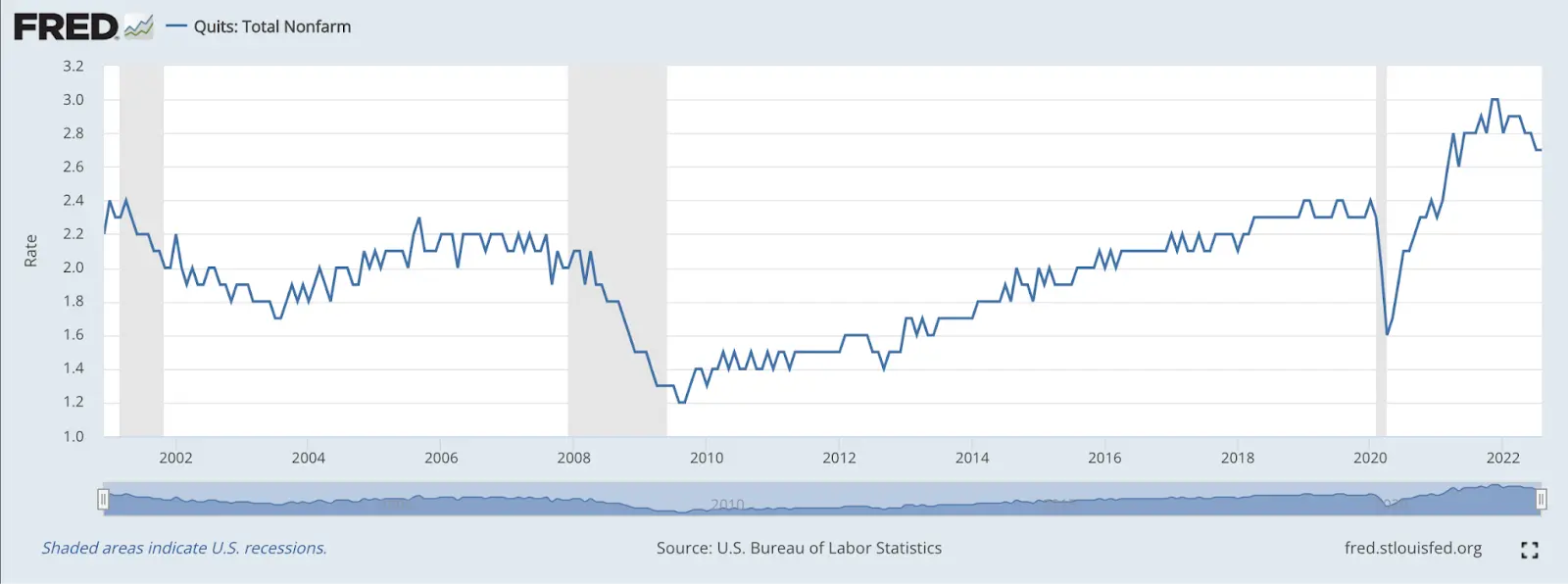

In November 2022, almost 4.2 million workers quit their jobs, and though the US quit rate has slightly declined from its December 2021 highs, that figure is still 35% higher than the 20-year historical average.

From young, entry-level employees to high-level executives, the data shows that more and more workers are putting in their two weeks notice. There are many reasons why workers are quitting their jobs, ranging from the purely personal, to the deeply structural. Regardless, many businesses are wondering what benefits they can offer to keep their employees around for the long haul.

In this article, we'll review what the research has to say about employee benefits, and which of them have been shown to meaningfully impact retention.

The Research Is In: Benefits That Actually Retain Employees

Employee benefits are a key part of any retention strategy. In order to keep the best workers from leaving, employees need to be offered a package that meets their needs and helps them see a future with the company.

While some might be looking for more paid time off (PTO), others might prefer extra health insurance coverage, and others still may be looking for a more secure retirement plan. However, there are certain benefits that are consistently cited as being important to workers across all industries.

WTW, the multi-national insurance advisor company formerly known as Willis Towers Watson, published their annual Global Benefits Attitudes Survey in June of this year. The survey asked over 9,600 American workers how they felt about their retirement plan and gauged their attitudes toward retirement saving as a whole. Their results have helped employers answer some of the following questions:

Does offering a retirement benefit help retain employees?

In WTW’s 2022 Global Benefits Attitudes Survey, nearly 60% of employees surveyed cited their employers' retirement benefits as an important reason they remain with their current employer, compared with 41% in 2010. These findings show that not only do a majority of employees see retirement benefits as important, but also that retirement benefits have grown increasingly important over time.

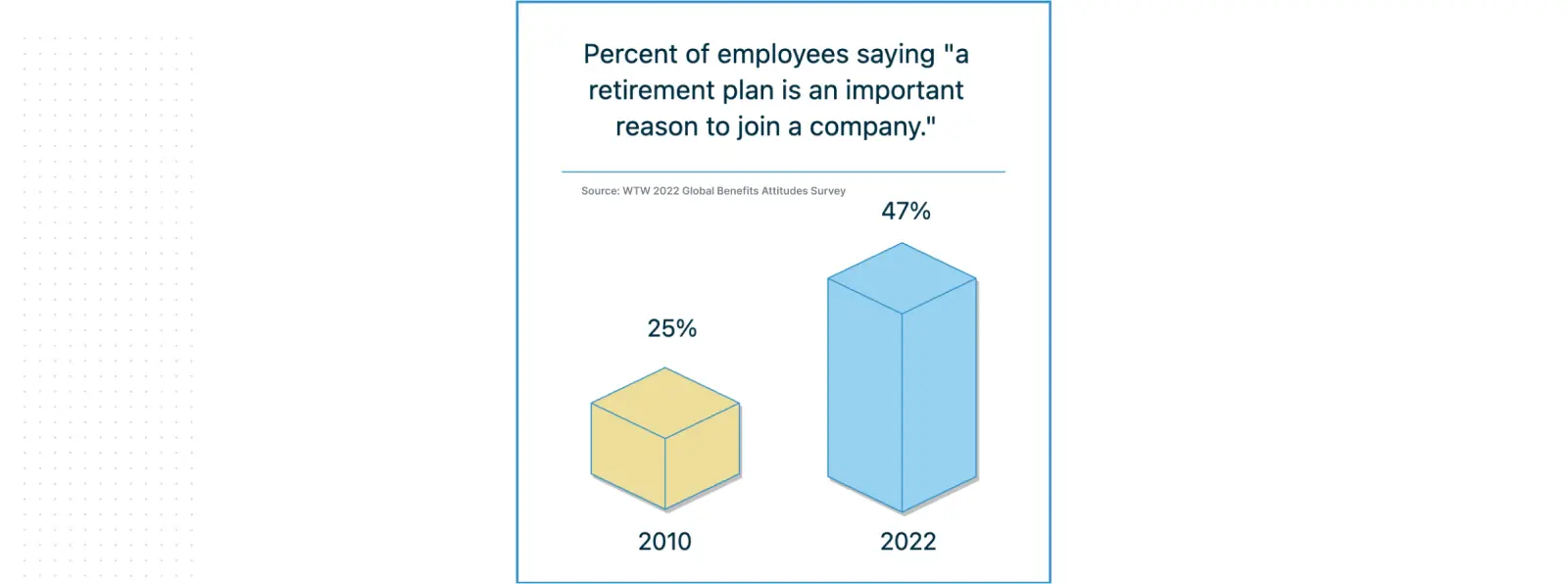

Does offering a retirement benefit help attract employees?

Just as retirement benefits have grown more important for retaining employees over time, they have also grown more important for attracting employees. In 2010, a mere 25% of surveyed workers said that a retirement benefit is an important reason to join a company. In 2022, the same survey found that 47% of workers believe a retirement plan is an important reason to join a company, almost doubling in importance over 12 years.

Which benefit do employees most want from their company?

WTW found that employees seek a range of benefits from their employer, but that some are more valued than others. The benefit seen as most valuable by employees was a retirement plan, with 44% of workers ranking it in their top three most desired benefits. This was closely followed by flexible work, with 39% of employees ranking it in their top three benefits, and healthcare, with 33% of employees ranking it in their top three benefits.

Are employees okay with businesses withholding from their paycheck for a retirement plan?

For many business owners, the idea of withholding money from an employee’s paycheck can seem uncomfortable, especially if their employees make less than the median income. However, WTW’s research shows that a large majority of employees are comfortable with this practice and would even support larger withholdings under the right circumstance. 59% of employees are willing to have a higher amount of their paycheck withheld if it meant a larger, more generous retirement. Similarly, 63% of employees would feel the same if it meant a guaranteed retirement benefit.

Why Do Some Benefits Increase Retention, While Others Do Not?

Not all benefits are created equal. Some, like health insurance and paid time off, are essential to attracting and retaining employees. Others, like a transportation allowance or a free gym membership, can be nice perks, but they may not be make-or-break factors for most workers.

In a study published by the International Journal of Education and Research, the authors conducted an overview of the literature on benefits and retention, then examined the relationship of benefits such as leave, loans, and retirement plans with employee retention. The researchers found that there are two main reasons why these benefits are more effective at retaining employees than others.

First, the benefits that were most effective at retaining employees were those that helped employees with long-term planning. Retirement benefits, for example, allow workers to plan for their future and feel more secure in their jobs. Given this context, many consider it an excellent long-term employee retention tool.

Second, the benefits that increased retention were those that could not be easily replaced by another employer. In other words, if another company offered the same benefit, employees were unlikely to be lured away from their current employer by the prospect of it. In contrast, benefits that did not increase retention were those that were seen as being common across all employers. Research indicates just 22% of small and medium-size businesses offer retirement benefits, making it an uncommon benefit in the small business space. Additionally, Vestwell’s 2023 Employer Trends Report found that 72% of responding employees said they “expect employers to offer a 401(k)/403(b),” in light of the tight labor market.

How Can Vestwell Help With Your Retirement Plan?

If you're a business owner, the prospect of offering a retirement benefit may seem daunting. After all, setting up and administering a plan can be complicated and time-consuming; fortunately, it no longer has to be.

Vestwell is a digital retirement platform that makes it easy for businesses of all sizes to offer retirement benefits to their employees. Vestwell helps businesses of all sizes set up and administer company-sponsored 401(k) and 403(b) plans to make the process simple, efficient, and less expensive.

As a 3(16) fiduciary, Vestwell is among the few platforms that can help businesses manage the day-to-day administrative work of a 401(k) plan using different features such as payroll integrations, security controls, and advisor-managed accounts.

Conclusion: Some Benefits Do More Than Just Retain Employees

If you're looking for a way to increase employee retention, offering a retirement benefit is a good place to start. Research shows that employees highly value retirement benefits, meaning they can be a potent tool in recruitment and retention efforts.

Even better, some benefits may also come with sizable tax credits for the businesses offering them. If you are an employer interested in setting up a 401(k) account for your business, you can contact Vestwell to determine if you are eligible to receive substantial tax credits, which can help cancel out administration costs. Interested? Learn more here.